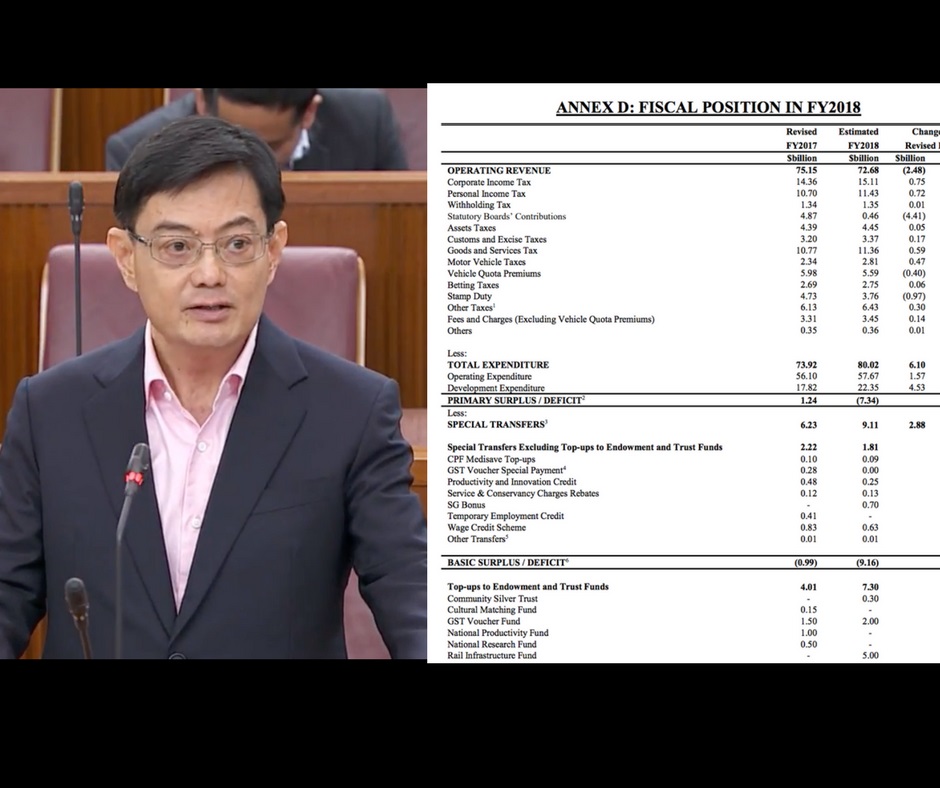

Finance Minister Mr Heng Swee Keat delivered the Singapore Budget 2018 on 19 February. Graphic: Dollars and Sense Finance Minister Mr Heng Swee Keat delivered the Singapore Budget 2018 on 19 February. Graphic: Dollars and Sense

By paying attention to details to the Singapore Budget and asking yourself some questions, you can learn a lot about Singapore. |

For the past three years, I have had the privilege of watching the Singapore Budget while it’s being presented. This comes as a perk/responsibility of writing at a finance website. And like all other writers covering the budget, I do my best to try to understand what is being presented, and how it impacts ordinary folks.

Read Also: Singapore Budget 2018: Here Are 6 Important Changes That May Impact Our Lives

At the same time, I also try my best to understand the challenges of managing a national budget, and to try to understand the reasons why policymakers sometimes make important, but unpopular decisions.

GST Hike – What’s The Impact?

The biggest headline for this year’s budget will be the future GST hike. Scheduled to be introduced anywhere from between 2021 to 2025, GST hike is generally the most unpopular thing a government can introduce because it impacts everyone, both the rich and the poor.

When GST hike was announced, the first questions that sprung to mind were 1) how much will it impact the average Singapore family and 2) how much difference would it actually make to Singapore’s tax revenue?

Impact On The Singapore Family

We observed from an old Singstats report that the lower-middle income group of Singapore families (between 21st to 40th percentile) spend about $3,536 per month. This includes the existing 7% GST.

In other words, a 2 percentage points increase in GST would cost, on average, these families an additional $66 per month, or about $793 each year.

The National Budget

On a national level, GST brings in about $11.4 billion a year (FY2018 estimates). Based on a simplified calculation, this means that the hike in GST will increase GST revenue to $14.6 billion a year. With all things being equal, this will increase expected operating revenue of the country by about 4.4%, from $72.7 billion to $75.9 billion.

The most simplistic way of looking at this is that with an increase of $3.2 billion per year, divided by our Singapore population of 4 million, each Singaporean receives, on average, about $800 (or more) in terms of benefit, assuming every dollar raised is given back to the people (or invested on their behalf).

This is significantly higher than the increase in contribution from a lower-middle income family, which is about $792 per family.

I will be the first to admit that this is a simplistic way of trying to understand how GST hike will impact people in Singapore. But it’s nevertheless, one way of looking at the situation.

Read Also: Guide To Understanding Taxes And Who Pays For Them

Net Investment Return Contribution (NIRC)

The Singapore Budget consists of a few key areas.

Government operating revenue consists of the many taxes collected (including GST) which raise about $72.7 billion (FY2018 estimates).

Expenditure, which includes both operating expenditure, development expenditure and special transfer (i.e. GST Vouchers, Wage Credit Scheme) adds up to about $81.8 billion (FY2018 estimates),

Based on these two numbers, our national budget should be incurring a significant deficit of about $9.1 billion. However, this is before the contribution of what is called the Net Investment Return Contributions (NIRC).

“The investment returns of Temasek, GIC, and MAS are now the largest tax contributor to our country’s revenue, to the tune of about $15.9 billion for FY2018.” |

NIRC consists of up to 50% of:

1) the investment returns on the net assets invested by GIC, MAS and Temasek

2) up to 50% of the net investment return derived from past reserves from the remaining assets.

What surprised me, and perhaps, some other Singaporeans as well, is that NIRC is now the largest tax contributor to our country’s revenue, to the tune of about $15.9 billion for FY2018. Without it, it’s certain that our national budget would incur a significant deficit, or that taxes will have to increase by a lot!

By using up to 50% of the expected returns, we are also able to balance between spending on our needs today, while still allowing our principal investment in the reserves to grow over time.

Think of NIRC in this way. If you have $10 million dollars invested today and receive a return of about 5% per annum, you can either 1) reinvest the entire sum of $500,000 to continue growing your investment, 2) spend the entire $500,000 and hope to achieve a similar return next year or 3) spend $250,000 this year and reinvest the remaining $250,000.

The right answer is completely subjective and I am not here to try to convince you which one is better. But the Singapore government is choosing option 3, at least for now.

This article is republished with permission from Dollars and Sense.