|

Inflation is picking up and political risk is high, so it could be a good time to consider investing in gold. Do Schroders' fund managers agree? |

What's happened to the gold price recently?

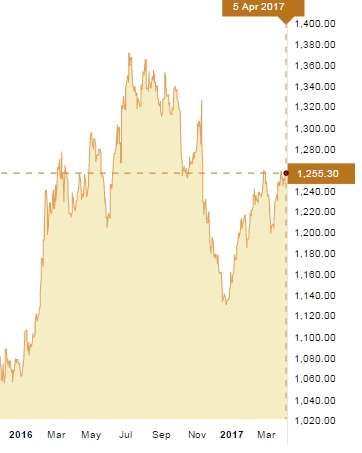

Chart: www.bullionstar.comIt had been a pleasant 2016 for gold investors until August. After a steep climb from around $1050 to $1360, the price of the precious metal started to fall and by December was back at around $1130.

Chart: www.bullionstar.comIt had been a pleasant 2016 for gold investors until August. After a steep climb from around $1050 to $1360, the price of the precious metal started to fall and by December was back at around $1130.

For gold bugs this was a chance to top up their holdings. Since then gold has been on the rise once again and at the time of writing is back at $1259 (source: Bloomberg, 27 March 2017).

So, what next for this most divisive of investments? We spoke to some Schroders investors to find out more and found that instead of just investing in gold itself, equities from gold mining companies are also finding favour.

James Luke, Fund Manager, Commodities:

"The primary reason for investing in commodities, and especially gold and silver, should always be as an inflation hedge. Given the printing of money by the world's central banks through quantitative easing, there is every reason to argue that higher inflation is coming in the future."

"Gold and silver investments in particular remain very under-owned. Some investors fear the prospect of an increasing base interest rate in the US is reason alone to avoid these types of investments. However, although past performance is not a reliable indicator of future results, the gold price has tended to rise from the beginning to the end of Federal Reserve (Fed) hiking cycles. In the last four instances when the Fed embarked on a hiking cycle, in three of the four instances gold saw +10% to +20% returns from beginning to end."

"The environment for gold investments remains positive. In the background, global record debt burdens have not magically vanished. These make global growth highly sensitive to any real increase in interest rates and the cost of servicing these debts. This is a key reason to expect that central banks will be highly weary of raising interest rates too quickly and that real interest rates (a key driver of gold prices) should continue to remain very low and have the possibility of being negative as inflation accelerates."

"Given investors' high exposure to the traditional asset classes, there is an urgent need to find uncorrelated and attractive alternative investments. Liquid and tangible portfolio diversification options are limited, making gold and gold related investments unique and of use to many investors."

"Although there will be some good tactical opportunities to invest in gold in the coming years, we think the best gold-related opportunities are in gold mining stocks. Valuations are very attractive and miners have also become more disciplined than in the past, with better management focusing on free cashflow and controlling costs."

Marcus Brookes, Head of Multi-Manager:

"We began to get more positive on gold-related equities in the third quarter to 2015, driven by the significant bear market that many of these companies had experienced from 2010 and what looked like an attractive entry point at the time. As a result we added to our position in a gold equity fund.

"We then added further to the position over the summer. This is because we believed that many investors had taken a significantly skewed position for a deflationary backdrop (where prices in an economy fall) as the "secular stagnation" argument, that we were entering a period of negligible or no economic growth, was so widespread. This meant they moved away from the more "value" (undervalued and economically sensitive) areas of markets such as gold equity. In our eyes, inflation expectations were too low and any signs of inflation were due to benefit the more value-orientated areas of markets.

"While there was something of a correction in gold in the latter part of this year, our view of it as a valuable asset to hold in an inflationary backdrop remained. Inflation expectations are now relatively well-established and whilst there are various factors to unravel over the course of 2017 (how the US dollar fares and the extent of Donald Trump's fiscal measures to name a couple), we expect it to remain an important part of our portfolios in what could prove to be a tricky year."