|

Golden Energy - 4th largest in Indonesia but share price lags Geo Energy's by a mile! |

Key takeaways from the meetup

Bullish on FY17F

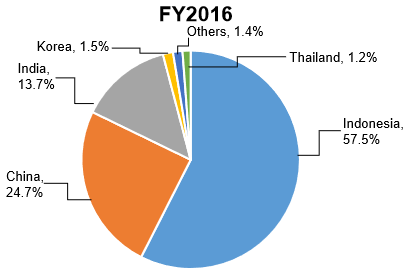

Management continues to be bullish about its outlook. Based on Chart 1 below, Indonesia, China and India contributed about 58%, 25% and 14% respectively. For example, Indonesian government under President Jokowi’s administration has implemented an electrification programme to add 35,000 megawatts (MW) in power generation capacity across the country by 2019.

Of that, almost 20,000 MW will come from coal-fired plants. Moreover, there is increasing budget allocated to infrastructure development which fuels demand for cement. Coal is used intensively in the cement manufacturing processing plant.

According to management, China’s coal imports, which has surged 64% to 24.91 MT in January this year, is also projected to increase further as a result of restrictions on local production and its recent ban on North Korean coal import. However, management does not see any negative spill over effects from China limiting imports of low-quality coal. (See next point)

Power generation in India, which is reliant on coal-fired power to meet soaring domestic energy demand, is expected to increase to around 1,750 TWh by 2020, with coal accounting for more than 1,230 TWh.

Southeast Asian countries, including Thailand, the Philippines and Vietnam are growth markets for thermal coal in the years out to 2020 as coal-fired electricity is used to fuel their fast-growing economies.

All in, the outlook for coal continues to be positive. Chart 1: Geographical split of GEAR’s revenue.

Chart 1: Geographical split of GEAR’s revenue.

Source: Company

GEAR unaffected by China clamping down on imports of low quality coal

Reuters this month reported that China is controlling imports of low-quality coal amid concerns on smog and overcapacity in the world’s top coal consumer. However, management does not see any negative spill over effects.

In fact, it is seeing robust demand for their coal which they attribute to its flexibility. This is because due to GEAR’s coal specifications (BIB 4,000 – 4,200 GAR) and large reserves, it can sell to power producers. Furthermore, as their coal has low ash and sulphur content, there is demand for their coal for blending with higher sulphur coal.

Confident of getting regulatory approval to raise BIB mine production from 7.5MT to 12MT

Management plans to ramp up coal production from 9.5MT in FY16 to 14.0MT in FY17F. This comes mainly from the BIB mine which is targeted to increase production from 7.5MT in FY16 to 12MT in FY17F, subject to regulatory approval. GEAR is confident of getting the regulatory approval.

Ramping up investor awareness

|

Golden Energy & Resources |

|

|

Share price: |

Target: 96 c |

For such a large company of S$1.2b market cap, GEAR is covered by only one brokerage house, KGI Securities. KGI ascribed a target price for GEAR at $0.960 with an estimated net profit attributable to shareholders amounting to US$100m, which is almost 5x that of FY16 net profit.

In view of the above, management is cognizant that it can do more to engage the investment community. It is doing a presentation to retail investors at SGX seminar on 30 Mar 2017. Furthermore, it is planning a site visit around the week of 20 Apr 2017 for analysts and media.

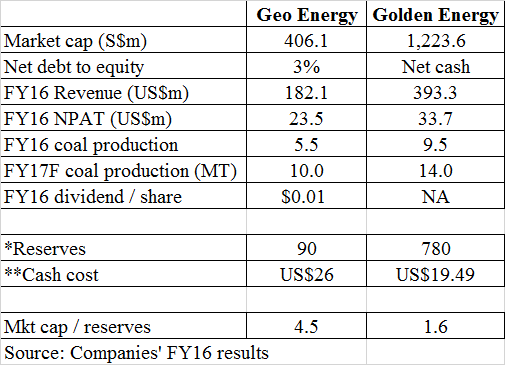

Comparison between Geo Energy and GEAR

As Geo Energy is the closest comparable listed on SGX bourse, I have made a simple comparison between the two. Based on Table 1, GEAR seems to be better than Geo Energy as it has a larger market capitalisation, net cash, larger reserves, lower cash cost and lower market capitalisation per ton of reserves.

Table 1: Comparison between Geo Energy and Golden Energy

* Geo Energy reserves include the acquisition of TBR, to be completed in 1H17

* Geo Energy reserves include the acquisition of TBR, to be completed in 1H17

** I couldn’t find the cash cost in Geo Energy FY16 results and I used Philip Securities estimate for FY17F

** Golden Energy management believes that the cash cost should broadly stay around the above level in FY17F

Coal prices may have bottomed last year

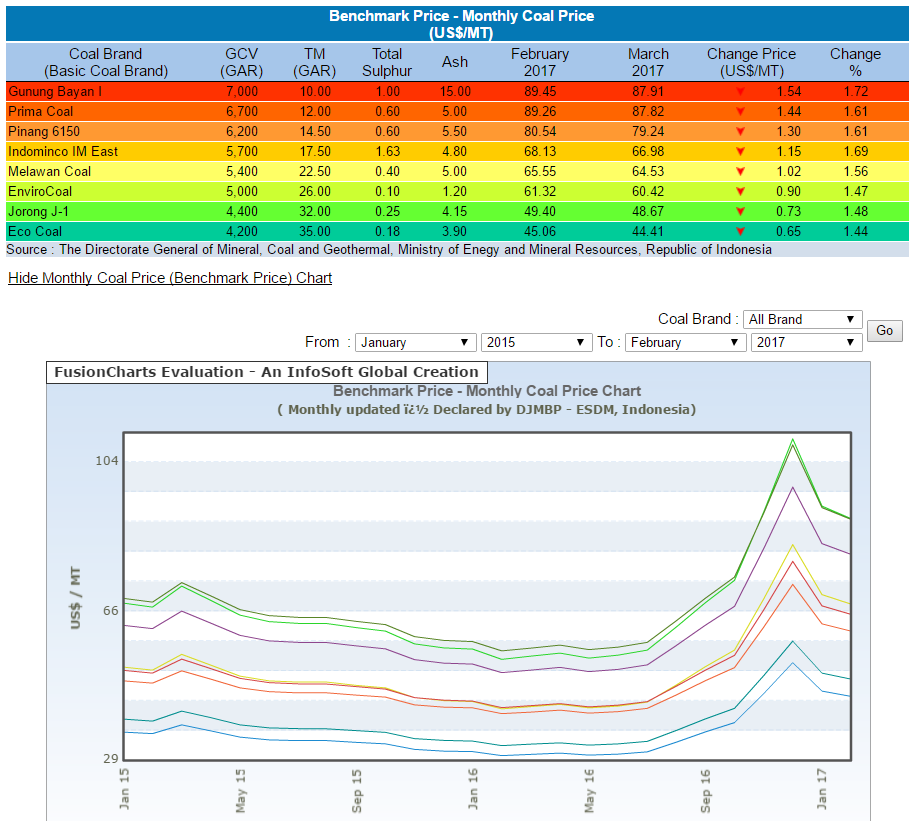

Based on Chart 2 below, although coal prices may have hit a near term peak in Dec 2016 and have slid 17% since then, there are a couple of noteworthy points.

Firstly, to put things in perspective, Ecocoal, at the Mar 2017 price of US$44.41, is still up approximately 45%, compared to one year ago. Secondly, the rate of monthly decline seems to be slowing. i.e there is a possibility that it may trade sideways in the next few months.

KGI’s report uses a long-term average selling price (“ASP”) of US$42 / tonne to derive a target price of S$0.960. As of now, coal prices are still trading above KGI’s long-term ASP assumption.

Chart 2: Monthly coal price chart by brands

Source: Coalspot.com (27 Mar 17)

Chart analysis

With reference to Chart 3 below, Golden Energy is testing the support area of around $0.510 - 0.520. After the sharp drop post its listing on 12 Dec 2016, there seems to be a short-to-medium term uptrend as depicted by the uptrend line. However, a break below $0.510 on strong volume and on a sustained basis is negative for the chart.

Near term supports: $0.515 / 0.510 / 0.500

Near term resistances: $ 0.525 / 0.535 – 0.545 / 0.565 – 0.570

Chart 3: Golden Energy testing the support at 0.510 - 0.515

Source: Chartnexus as of 27 Mar17

Source: Chartnexus as of 27 Mar17

Ernest Lim, CFA, CA SingaporeConclusion

Ernest Lim, CFA, CA SingaporeConclusion

GEAR lags behind Geo Energy in share price performance maybe due to the market's unfamiliarity with GEAR. Hopefully, this will be resolved to some extent by its continual delivery on its results (supported by a positive macro outlook), coupled with its investment seminars and site visit.

Readers are advised to refer to GEAR’s website (click HERE), the announcements on SGX, KGI research report and my previous write-up (click HERE) for more information.

Disclaimer

Please refer to the disclaimer HERE

Article is republished with permission from Ernest Lim's blog

Precisely. These are my exact thoughts too when I looked at GEAR vs Geo too.

Coal companies need to be aggressive and fast in monetizing their reserves when times are good, cos the nature of the industry is such that when times are good, it's really really good but when it's bad, it's really really bad. The operational costs stay roughly the same, while the revenue that can be attained (by doing the same thing) swings wildly when coal prices are high vs when they're low.

So monetization and efficacy, as well as management's ability to keep in touch with the industry cycle, are key factors to look at. Geo Energy is rapidly monetizing their coal and locking in take up agreements for their remaining reserves.

GEAR just seems much less attuned to the rapid price rises.

"GEAR seems to be better than Geo Energy as it has a larger market capitalisation....."

Also, I'm not exactly certain why a larger market cap is better.

Sure, more coal reserves, lower cash costs etc would be better. But a larger market cap doesn't help. In fact, for potential investors, a smaller market cap is even better.

Furthermore, a strong EPS today implies ability to pay dividends! Geo pays! Waiting for GEAR which is expected to do the same after it gets over its "accumulated losses" from RTO company. My target price for GEAR is 85 cents.