This article, written by Jennifer Tan (left, Director, Research & Products, Equities & Fixed Income, at the Singapore Exchange), originally was published in SGX's kopi-C: the Company brew series series on 13 November 2015. The article is republished with permission.

This article, written by Jennifer Tan (left, Director, Research & Products, Equities & Fixed Income, at the Singapore Exchange), originally was published in SGX's kopi-C: the Company brew series series on 13 November 2015. The article is republished with permission.

The name Douglas Foo is virtually synonymous with conveyor-belt sushi.

This spurred the 46-year-old entrepreneur, now Chairman of Sakae Holdings Ltd, to consider ways of taking this premium cuisine to the mass-market by building a global brand. |

Longevity and Prosperity

He wanted to build a brand that was easy and simple to remember – drink sake, eat sushi, so “Sakae Sushi” was born. The word “sakae” also means growth and development in Japanese.

In Mandarin, the brand is 荣寿司(rong shou si), which symbolises double blessings of longevity and prosperity.  The Group's headquarters at Tai Seng --- Sakae Building, houses its central kitchen, culinary training facility, automated self-retrieval system for freezers storage of frozen food, sake and other amenities. (Photo: Company)

The Group's headquarters at Tai Seng --- Sakae Building, houses its central kitchen, culinary training facility, automated self-retrieval system for freezers storage of frozen food, sake and other amenities. (Photo: Company)

To give the brand a soul and clear symbolism, Foo chose a frog. “The frog is a creature that likes clean environments, and we want to epitomise hygiene and cleanliness in our food preparation. Besides that, this animal appeals to all cultures.”

The frog’s head and tummy form the lucky figure 8, a symbol of prosperity. The bottom half of the logo is shaped like a rice bowl, the fundamental ingredient in Japanese food, and also resembles a gold ingot. Together, they signify abundance and a thriving business, he explained.

The amphibian’s colour signifies healthy dining, and personifies Sakae’s green efforts – recycling, the use of renewable energy, and sustainable initiatives.

Different parts of the frog also portray the coming together of all facets of the business. “How does the team want to move? By leaps and bounds, of course,” he added.

|

- Douglas Foo Sakae Holdings |

The company is not interested in just running a F&B business. “From day one, we have been on a global brand-building journey, and we want to ensure our brand has a soul – Sakae cares for the communities we serve,” Foo said.

With that in mind, Sakae Holdings decided not to remove Vitamin E from its cooked rice to cut costs during the economic downturn. It has been serving Vitamin E-infused rice since 1997.

“Some colleagues wanted to cut costs and suggested we stop adding Vitamin E to our rice. But I told them, ‘Let’s not lose our direction, because if we do, we can forget about building the brand’,” Foo said.

“I asked them, ‘If you were cooking this pot of rice for your family, would you add the Vitamin E?’ The answer was clear, so we kept the recipe, and senior management volunteered to take a pay cut instead.”

In recognition of his efforts, Foo was named Entrepreneur of the Year earlier this month at the 2015 Asia Corporate Excellence & Sustainability Awards (ACES). He was lauded for making high-end Japanese dining experiences accessible to middle-income consumers.

ACES is a two-year-old awards programme organised by the MORS Group, which champions revolutionary leadership and sustainability in companies operating in Asia.

| ♦ School of Hard Knocks | ||||||||||||||

|

The company, which ventured beyond its home market in 2000, has faced its share of challenges. Over the last 18 years, it has survived the fallout from the Asian financial crisis, as well as virus outbreaks, including the Severe Acute Respiratory Syndrome (SARS) and bird flu.

“We had actually secured a place earlier, but we held back because the location and timing were not right,” Foo said. |

||||||||||||||

Four Pivots

The company’s blueprint revolves around four pillars of growth. It will use mergers and acquisitions to step up its pace of expansion where appropriate.

Sakae’s first pillar centres on human capital. It has set up in-house training programs to allow staff to upgrade themselves, and scholarships with various educational institutions and statutory boards to harness talent, Foo said.

The second involves managing its global resources and choosing strategic partners to ensure quality and reliable supply of ingredients, including fish.

Its network currently spans suppliers in South America, New Zealand, South Africa, Europe and Asia Pacific. It is also working with various research groups and universities on sustainable fish farming practices and methods to naturally boost yields.

“As we are a small enterprise, we need to be very creative. We have an open-door policy – customers and suppliers can come and audit our facilities,” he added. “There may also be an option to build the aquaculture unit into a separate business later on.”

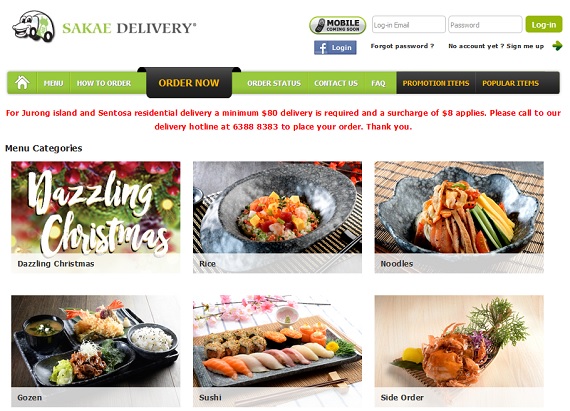

Sakae's mobile delivery platform. (Picture: Company website)

Sakae's mobile delivery platform. (Picture: Company website)

The company’s third pivot is real estate investment and management.

“Property costs in Singapore and other markets are constantly rising, and this will eat into our margins. So we need to have a hedge – we buy and invest in those properties, and where relevant, rent them out,” Foo said.

The final prong is Sakae Corporate Advisory, which was established in January to help local businesses grow, brand and add value.

Foo was inspired by General Electric’s business model, which has a capital-raising arm that generates cash flow for other units in the organisation and enables them to achieve their goals.

This unit will provide an income stream that could help fund Sakae’s expansion in F&B, as businesses in this sector tend to have long gestation periods, he noted.

“When our dream of 30,000 outlets materialises, it would mean that for every piece of sushi eaten in the world, equity would flow back to the Singapore economy,” Foo said.

“That allows me to do my small part for Singapore, which has given me the resources to be who I am today.”

Financial results

| Year ended 31 Dec (S$ 000) |

FY2015 | FY2014 | FY2013 |

| Revenue | 96,165 | 97,693 | 98,962 |

| Operating profit before tax | -2,180 | 5,080 | 8,352 |

| Profit/loss before tax | -4,854 | 4,046 | 6,763 |

| Loss/profit attributable to shareholders | -4,631 | 2,091 | 5,365 |

| 9 months ended 30 Sep (S$ 000) | 9M2016 | 9M2015 | % Change |

| Revenue | 63,810 | 72,526 | -12.0 |

| Gross profit | 40,957 | 48,769 | -16.0 |

| Profit / loss before tax | -7,327 | -26 | N.M. |

| Loss / profit attributable to shareholders | -7,323 | 71 | N.M. |

| Outlook & Risks | ||

|

||

Sakae Holdings

Sakae Holdings is a food and beverage company that operates restaurants, kiosks, and cafes in Singapore, China, India, Indonesia, Malaysia, the Philippines, Thailand, Vietnam, the United States, and Japan. The company has over 200 outlets worldwide, under brands including Sakae Sushi, Sakae Teppanyaki, Sakae Delivery, Sakae Junior Club, Hei Sushi, Hei Delivery, Senjyu, Kyo by Sakae, Crepes & Cream, Sakae Express, Sachi, Sakae Shoppe, and Nouvelle Events. It is also involved in trading and sushi processing activities, catering and franchising, as well as food and beverage consultancy and management services.

The company website is: www.sakaeholdings.com

Click here for the company's StockFacts page.

For its results for the 9 months ended 30 Sep 2016, click here.

If you look at all

If you look at all