|

If you are rich enough to be paying income tax, we assume you would interested to pay as little as possible as well. Even in Singapore, where our income tax rate is known for being one of the lowest in the world, income tax can also be a significant chunk of your annual income, particularly if you are not careful in managing it. Aside from your regular monthly income, it is worth noting that income derived from bonuses, overtime pay and other income sources such as those from rental also form part of your total taxable income. How Much Do I Really Pay?Fresh Graduate Who Earns $3,500 Plus A 3-Month Bonus:Let’s assume you are a fresh graduate who earns a comfortable $3,500 for your first job at a MNC. You are also fortunate enough to receive a total of 3-month annual bonus throughout the year. In total, your annual income would be $52,500. At this amount, you will pay income tax of $1,425 if you do not have any tax-deductible claims. Middle Aged Person Who Earns $6,000 A Month With 3-Month Bonus:If you are at the peak of your career drawing a monthly salary of $6,000 with a 3-month annual bonus, your annual income would be $90,000. At this amount, your annual income tax would be $4,500 if you do not have any tax-deductible claims. |

Realistic Ways To Reduce My Income Tax

1. Top Up Your CPF Special Account

Providing a top up to your CPF Special Account is one of the most cost efficient ways to build up your own retirement portfolio without taking on any risk.

By doing so when you are young, it also allows the top up amount to earn interest over a prolonged period of time. For example, a top up of $7,000 today would become $22,704 after 30 years based on a 4% per annum interest. This strategy of building up a retirement portfolio is practically risk-free and requires zero knowledge to execute.

In addition, CPF members get a dollar-for-dollar tax relief up to $7,000 per annum for providing top up to their CPF Special Account.

For example, if our young graduate who earns $3,500 a month provides a CPF top up of $7,000, he can reduce his income tax from $1,425 to $935, or a saving of $490. It is like the government giving you extra money to encourage you to build up your own retirement portfolio.

Similar to donations, you would need to make your top up before the end of the year to qualify.

2. Donate To Approved Institutions

A donation made to an approved institution would allow the donor to claim tax relief of 250% of the amount donated. (For 2015, the tax relief is 300%).

For example, if our middle age person has a habit of donating 10% ($9,000) of his income to charitable causes, he would be able to claim a tax relief of $22,500. This would reduce his income tax from $4,500 to $2,475, a saving of about $2,025.

Do note that all donations must be made before the year end for you to claim your tax relief for 2015.

3. Cost Of Renting Out Your Property

As mentioned earlier in the article, rental income from your property is taxable. This could be income from a room you rent out or from the multiple properties that you own.

Here is the thing, while you are required to pay tax based on the income you derived from the rental of a property, you are also allowed to claim expenses you incur for renting it out.

Claimable expenses include the interest you paid for the housing loan you took, property tax, premiums paid on fire insurance, monthly management fee, repair cost, agent commission and Internet and utility charges.

If you a landlord who owns multiple properties, we are pretty sure we don’t need to tell you how costly some of these items can be. So do claim it Otherwise you will just be paying a higher income tax for no good reason!

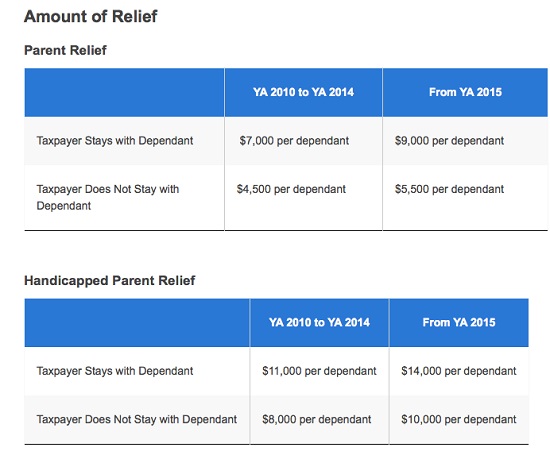

4. Parents Relief

If you have parents (or grandparents) whom you are supporting, you can also claim tax relief as well. The following table shows how much relief you can claim. Source: IRAS

Source: IRAS

Do note that you can’t just claim tax relief based on the fact that you have elderly parents (otherwise everyone would be claiming the heck out of it!). Rather, specific conditions must be met.

Based on our observation, the biggest condition is the fact that your dependant cannot have an income exceeding $4,000 per annum (or about $330 per month). These include tax-exempt income such as those from pension schemes, dividends or bank interest.

In other words, you must really be supporting your parent(s) who are reliant on your income for survival, and not simply parent(s) who happened to be retired but have access to income from somewhere else.

5. Course Fee

If you are currently furthering your studies while working, there is a great chance that you would be able to reduce your income tax by claiming the cost you incur for your studies against your taxable income. These costs include examination fee, course fee and tuition fee.

You may claim up to $5,500 per annum.

Claim Your Tax Relief And Save Some Money

Some of the ways we shared have to be executed before the end of the year for you to earn tax savings. Others can be claimed as long as you keep supporting proof of the costs you incurred. In any case, they all help you to save money while concurrently helping you to fulfil your responsibilities in life. Don’t miss out on them. Do note that there is a personal tax relief of 50% in conjunction with SG50 celebration (yes, this is one of the rare times when we are truly excited about SG50).

This article was originally published in DollarsAndSense.sg and is republished with permission.