RECENTLY, the management of Terramin Australia was in Singapore on a non-deal roadshow to share their views on the zinc market and their huge zinc mine in Algeria.

See: TERRAMIN AUSTRALIA: A zinc play for a future with rising zinc prices

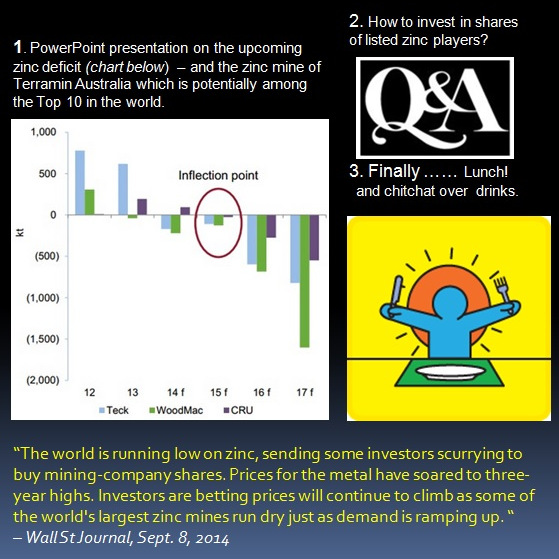

A supply deficit is looming.

See what an expert was quoted on in Wall Street Journal here --->

|

"Right now the interesting dynamic in the zinc space is that there are a number of very key mine shutdowns coming down the pipeline here in the next two to three years. Last year alone we saw the big Brunswick mine in New Brunswick, Canada, shut down.

"That alone was about 2% of world supply. And there are a whole bunch of others; the next big one that guys are really focused on is the Century mine in Australia. That's about 4% of world supply, and it's going to shut down sometime in 2015. When you add up all the mines shutting down, you're looking at about 10% to 12% of zinc supply coming off the market in the next two to three years.

"The flipside of that argument is when you look at what's out there to replace those lost mines, there really isn't much at all to fill the gap. More specifically, there aren't very many larger advanced-stage projects out there that can come online quickly to replace these mines facing reserve depletions, and so people are starting to look forward, anticipating a zinc price run in 2015 or so..."

|

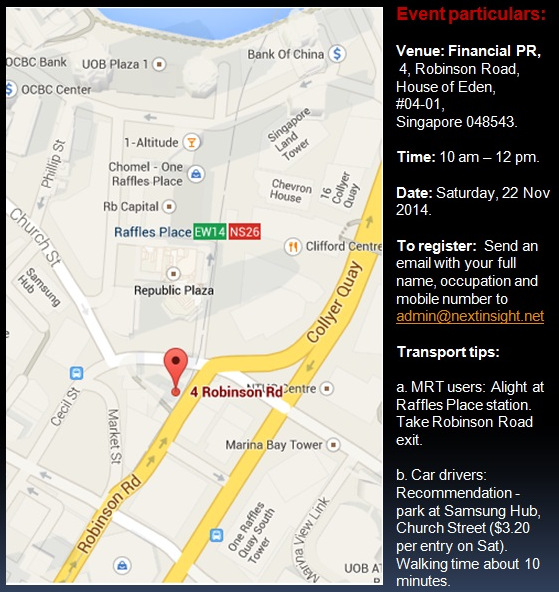

If you want to know more about the zinc deficit and the business of ASX-listed Terramin Australia, come to a presentation on Sat, Nov 22. The programme is as follows:

For your background reading:

Zinc Deficiency Gives Investors a Jolt - WSJ

The Zinc Deficit Has Arrived — Here’s What You Need to Know