This article was recently published on Ernest Lim's (left) blog.

This article was recently published on Ernest Lim's (left) blog.

THE FIRST time I came into direct contact with Vallianz Holdings (“Vallianz”) was in early Aug 2014 when Mr Ling Yong Wah, Executive Director of Vallianz, did a presentation at CIMB Securities.

He went to great lengths to explain his company’s business and prospects. He was also candid and shared some investors’ concerns about his company. A week later, I met him for a 1-1 chat over coffee to understand more about the company.

Vallianz has fallen approximately 32% from its intraday high of $0.135 on 22 Aug 2014 to $0.092 on 13 Oct 2014. It is a good time to take a closer look at this stock.

Description

Vallianz is a provider of offshore support vessels (“OSV”) and integrated offshore marine solutions to the oil and gas industry. It owns a young fleet of over 29 vessels with an average age of 2.3 years.

The fleet comprises of 19 anchor handling tugs (“AHTs”), six platform supply vessels (“PSVs”), two towing tugs and two other vessels. They cover markets in Asia Pacific, the Middle East and Latin America. The company's headquarters is in Singapore.

Vallianz is listed on the SGX Catalist with a market capitalization of S$281m as of 13 Oct 2014.

Investment merits

Industry dynamics seem positive

Industry dynamics seem positive for Vallianz. Firstly, amid the delivery of new rigs in 2014 and 2015, the supply of rigs is expected to increase. This is likely to underpin demand for OSVs.

Industry dynamics seem positive for Vallianz. Firstly, amid the delivery of new rigs in 2014 and 2015, the supply of rigs is expected to increase. This is likely to underpin demand for OSVs.

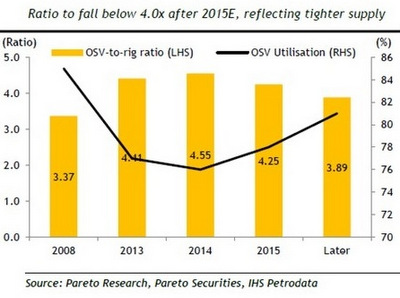

In Figure 1 on the right, the OSV – rig ratio is likely to decline to 4.25x in 2015 (lower than that of 2013) and may decline to below 4x beyond 2015.

Secondly, according to Tidewater and Gulfmark, customers are placing more emphasis on younger vessels with higher specifications such as dynamic positioning technology and better fuel efficiency.

Based on the chart below, more than 25% of the OSV fleet is more than 25 years old and likely to be less competitive. The average age of Vallianz’s fleet is about 2.3 years old.

This compares favourably with the global average of about 11 years for AHTS and 18 years for PSVs. Furthermore, according to Vallianz, 17 out of 19 of their AHTs and all their six PSVs have dynamic positioning technology, which is increasingly a pre-requisite for most offshore projects.

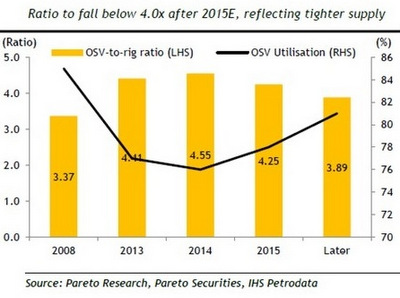

With reference to the chart above above and table below, although there was an overbuilding of OSVs prior to 2008 where the AHTs and PSVs order book to fleet soared above 30%, this ratio has dropped to an average 8% for AHTs and 27% for PSVs.

With reference to the chart above above and table below, although there was an overbuilding of OSVs prior to 2008 where the AHTs and PSVs order book to fleet soared above 30%, this ratio has dropped to an average 8% for AHTs and 27% for PSVs.

All of Vallianz’s vessels are below 7,999 BHP where the order book to fleet ratio is around 5%.

Vallianz’s order book of US$494m stretches to 2018, provides visibility

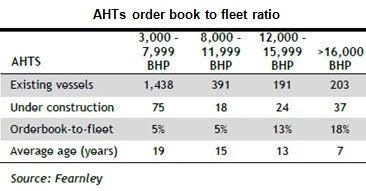

As of 30 Jun 2014, Vallianz has an order book of US$494m and is tendering for projects valued at around US$1.2b.

According to the company, around 50% of the order book is likely to be recognized in 2HFY14F and FY15F. (See chart below)

Vallianz has executed several noteworthy initiatives in 2014

Firstly, Vallianz announced on 12 Apr 2014 that it has entered into a collaboration arrangement with a first class Chinese shipyard to build Vallianz – designed vessels. Vallianz has the right of refusal for up to 200 vessels. This is a strategic step to manage the asset base and fleet renewal.

Secondly, Vallianz announced on 22 Sep 2014 that it was acquiring Singapore incorporated Jetlee Shipbuilding and Engineering Pte Ltd to establish its own marine base for docking and maintenance operations. This should result in cost savings and enhance operational efficiencies.

The purchase of Jetlee would be settled by the issuance of 143.3m Vallianz shares at an issue price of $0.138 per share. The issue price was at a 24% premium to Vallianz’s volume weighted average price (“VWAP”) of $0.1116 per share. The owners of Jetlee Group are industry veterans and comprise of Mr Chan Kwan Bian (co-founder of Labroy Marine), Mr Teo Guo Ping (previously with Pan-United Corp) and Mr Ng Chee Keong (founder of Jetlee through a joint venture with Pan-United Marine Limited).

As the consideration will be entirely settled via Vallianz shares, priced at a significant premium to the current price (then), it is likely that the Jetlee owners are confident in Vallianz’s business and growth prospects.

Thirdly, Vallianz announced on 30 Sep 2014 that it is acquiring OER Holdings Pte Ltd, a provider of manpower services to the offshore industry for US$27.7m.

OER Holdings’ 2013 earnings before interest, tax, depreciation and amortization (“EBITDA”) was around US$5.6m. Thus, it was priced at approximately 5x 2013 EBITDA.

According to management, this acquisition not only brings an additional source of revenue and income but is likely to open doors to new customers and geographical markets, especially in Asia. This acquisition would also be settled solely by the issuance of 250m shares at an issue price of $0.140 per share. This is at a 27% premium to Vallianz VWAP of $0.1101 per share which underlines OER Holdings’ confidence in Vallianz.

All of the initiatives seem to be part of Vallianz strategic move to grow its business over the medium to long term.

As with any company, there are noteworthy points to consider:

|

Possibility of a delay in fleet expansion As of 30 Jun 2014, Vallianz plans to increase its fleet by 72% to 50 vessels by end 2016. The current vessels are built by third party shipyards. Any delay by the shipyards in delivering the vessels to Vallianz may have an adverse impact on Vallianz. Contracts cancellation is possible in dire circumstances Some investors fear that if the oil prices continue declining, charter contracts may be cancelled. Despite Vallianz’s long term charter contracts, customers are allowed to give one month's notice to Vallianz before cancelling. Order book replenishment Since the company’s announcement on 12 Apr 2014 that it was bidding for US$1.2b worth of contracts, only one Latin America contract worth US$82m has been announced (on 15 May 2014). I understand from management that the award for some of the contracts is typically done in 4Q. Significant gearing is a sticky point for most investors As of 30 Jun 2014, short term and long term totaled US$508m. This is significant vs. its total equity of US$169m. Vallianz’s loans are mainly USD denominated with floating rate obligations. This naturally brings up two issues especially with the strengthening of the USD and talk of rising interest rates. According to management, although its loans are mainly USD denominated, its assets are also USD denominated. Furthermore, both earnings and expenses are USD denominated hence there is a natural hedge to a certain extent. It reports results in USD terms too. Thus, an appreciating USD is likely to have an overall muted impact on Vallianz. |

Valliance chart: Bloomberg.

Valliance chart: Bloomberg.

Conclusion – This is just an introduction

Vallianz seems to be in the right industry with bright prospects and it has executed several initiatives in 2014. If executed well, they should pave the way for continual growth in the medium to long term.

However, contract replenishment, significant U.S. debt and finance costs, etc are some factors which readers should be aware of. If Vallianz continues to deliver on its earnings, contracts and their plans, it is likely that the stock may re-rate over time.

Readers who are interested should take a look at Vallianz's website for more information. You can also email me at