This article was recently published on Ernest Lim's (left) blog and is republished with permission.

This article was recently published on Ernest Lim's (left) blog and is republished with permission.

MOST INVESTORS would shun the stock, given that it has skyrocketed 800% from $0.035 on 18 Feb 14 to $0.315 on 1 Oct 14.

This is notwithstanding a series of shares placement which Giken has done since Feb.

What piques my interest?

Giken is a potential onshore Indonesia oil play. After doing some research and armed with queries, I decided to connect with Giken’s management to understand more about the company and prospects. Mr Sydney Yeung, CEO of Giken (“Management”), promptly agreed to meet me for a chat over coffee.  Giken has skyrocketed 800% from 3.5 cents on 18 Feb this year to 31.5 cents on 1 Oct this year. Giken now has a market cap of S$151 million.

Giken has skyrocketed 800% from 3.5 cents on 18 Feb this year to 31.5 cents on 1 Oct this year. Giken now has a market cap of S$151 million.

Chart: Bloomberg.

Sydney Yeung, the newly-appointed CEO of Giken Sakata. NextInsight file photo

Sydney Yeung, the newly-appointed CEO of Giken Sakata. NextInsight file photo

Key takeaways from the 1-1 meeting

Interesting business model – old wells programme

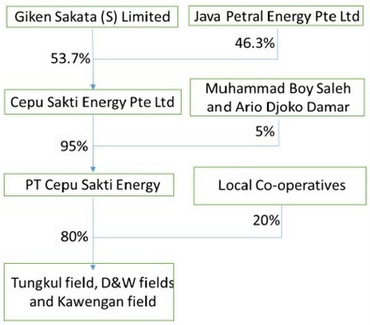

For the onshore oil production business, Giken, through PT Cepu, operates in the following manner:

a) Pertamina, Indonesia’s state-owned oil and gas company, signs a Mother Agreement with local co-operatives (e.g. KUD / BUMD);

b) The local co-operatives sign a Cooperative Agreement with PT Cepu (i.e. Giken) to produce oil. The revenue split for this cooperative arrangement is typically 20% (local co-operatives) and 80% (PT Cepu).

According to management, Giken is the only player in this old wells programme in the whole of Indonesia. They believe that the above arrangement is beneficial to all three parties.

♦ Firstly, oil produced from the old wells must be sold to Pertamina at approximately 70% of Indonesian crude price (“ICP”). Without this arrangement, Pertamina would have to source oil from other parties, which is likely to be at less favourable prices.

♦ Secondly, the local co-operatives which are the local governments stand to benefit from the arrangement. Their villagers would be able to enjoy a higher standard of living, as some would be employed by Giken. The local governments enjoy 20% of the revenue obtained from the sale of oil to Pertamina.

♦ Thirdly, for Giken, it has nothing to lose. The production cost is about US$20 / barrel of oil, thus the profit margin is still considerable, despite the revenue split between local co-operatives and Giken and the discounted selling price of the oil to Pertamina. In addition, Giken has less business risk as it has a guaranteed buyer i.e. Pertamina.

Extremely limited exploration risk

Giken utilizes a “twinning” strategy where it drills new wells beside the old wells. These new wells are sturdier, more operation-friendly and can be deeper than the old wells to increase the yield on each well. As the new wells are drilled beside the old wells which were previously producing, exploration risk is minimal.

Short payback period, cash flow generative operations

According to management, the business model and strategy offer a short payback period of 5-6 months. Once the oil wells start producing, it generates cash flow immediately. Capex is low as these are simple onshore wells. Management estimates the capex for each well to be US$120,000-160,000. Part of the drilling capex can be funded by its existing production.

Highly scaleable model – likely growth in the next couple of years

In an announcement on 22 Sep 14, Giken stated that it has increased its production from its Dandingilo-Wonocolo (“D&W”) and Tungkul fields by 31% --- from (14 wells) 670 barrels of crude oil per day (“bopd”) in June 2014 to (15 wells) 880 bopd in Sep 2014. There are two noteworthy points on the above figures.

a) The update only pertains to 15 wells from D&W and Tungkul fields. D&W and Tungkul fields have a total of 139 wells.

b) The update pertains to D&W and Tungkul fields. Giken has a total of five fields now with a combined 300 wells. Even without new expansion, there is likely to be enough work for Giken for several years.

Going forward, management expects to drill three to four wells each month. This should speed up production and, subsequently, profitability. Management added that they may consider building tank farms once production hits a significant level.

Selling price to Pertamina fixed yearly

Pertamina fixes the selling price of the oil at approximately 70% of ICP. According to management, this price is reset annually.

Naturally, there are both positive and negative aspects to such an arrangement. My personal view is that with this arrangement, there is some stability to Giken’s business operations, unlike other oil & gas plays which may be extremely vulnerable to short term swings in oil prices.

Senergy commissioned to prepare reserve report on Kawengan, Trembul and Gabus fields

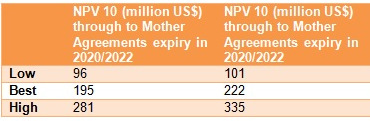

Table 1: Projected net present value of D&W and Tungkul fields using a 10% discount rate.

Table 1: Projected net present value of D&W and Tungkul fields using a 10% discount rate.

Source: Senergy report dated 26 May 14A valuation report has been prepared by Senergy Oil & Gas (Singapore) Pte Ltd (“Senergy”) which valued the D&W and Tungkul fields at (best scenario) net present value of US$195m based on a 10% discount rate (See Table 1 on the right).

Giken has commissioned Senergy to prepare a reserve report on Kawengan, Trembul and Gabus fields. It is noteworthy that these three fields have a total of 161 wells vs the 131 wells at the D&W and Tungkul fields. Furthermore, according to management, their data showed that Trembul and Gabus fields have deeper oil wells than the other fields, providing greater potential for the production of oil.

Thus, based on my (purely) layman perspective, the Senergy reserve report on Kawengan, Trembul and Gabus fields may likely yield a figure comparable to US$195m, similar to that of D&W and Tungkul fields. This is likely to (at least) add some assurance to Giken’s shareholders and may raise the overall valuation of Giken.

Indonesia – committed to increase domestic oil production

Indonesia, a former OPEC member, was a net exporter of oil till 2008 where it became a net importer. Falling oil production has hit Indonesia hard. Thus, the country is likely to continue its push towards increasing domestic oil production which should bode well for Giken. Indonesia has more than 10,000 old wells, thus the growth opportunity for Giken is significant.

Existing contract manufacturing business likely to do better

Giken’s 1HFY14 revenue and net profit from contract manufacturing were S$38.5m and S$708K, respectively. Although the contract manufacturing business environment is likely to continue to be competitive, management expects its results to gradually improve in the next two years.

Jokowi to suspend operations at Pertamina unit à no impact to Giken

Business Times on 24 Sep reported that Mr Joko Widodo plans to halt operations at Pertamina's energy trading unit Petral. However, according to management, this has no impact on Giken as the latter does not deal with Petral. Giken sells oil directly to Pertamina and not its subsidiaries.

|

Investment risks ♦ Customer concentration risk Giken can only sell its oil to Pertamina which has the right to set the selling price and the exchange rate. Although there seems to be a large customer concentration risk, I will like to draw readers’ attention to the following points which may alleviate the risk: a) Pertamina is buying a minuscule portion of the oil it requires from Giken. Even if Pertamina prices the oil at 70% discount to ICP, it is unlikely to result in meaningful cost savings for Pertamina. b) Giken is the only player in this old wells programme for the whole of Indonesia. Furthermore, Indonesia has more than 10,000 old wells, and as Indonesia is looking to increase its domestic production, it is likely that Pertamina wants a cordial working relationship with Giken. ♦ Ability to extend agreements The ability of Giken to extend the Cooperative Agreement with the local co-operatives and to sign new Cooperative Agreements are key factors for Giken’s long term growth. Furthermore, the renewal of the Mother Agreement between Pertamina and the local co-operatives is important too. Giken is currently producing oil from 15 wells out of their 300 wells.Even without new Cooperative Agreements, there is likely to be enough work for Giken for several years. ♦ Limited track record in producing oil Based on limited published figures, Giken’s oil production has risen from 300 bopd to880 bopd in less than six months. However, there is limited data (we need more data over time) to ascertain management’s track record in oil production. ♦ Foreign country risk Giken’s onshore oil business operates in Indonesia hence it is subject to Indonesia’s politics, laws and regulations. |

Figure 1: Giken’s corporate structure.

Figure 1: Giken’s corporate structure.

Senergy report

Based on Table 1 above, although Senergy estimated that D&W and Tungkul fields are worth a (best scenario) net present value of US$195m based on a 10% discount rate, the actual stakes Giken has in the fields are likely to be worth less than US$195m. See Figure 1 on the right for the corporate structure.

Limited analyst coverage

Only Voyage Research covers Giken with a potential price of $0.450 -- i.e. there is limited analyst coverage. It is reasonable to say that the investment community is still not familiar with Giken, especially its foray into the onshore oilfields in Indonesia. Management is cognizant of that and is doing their best to raise the awareness of the investment community on Giken.

Giken’s chart analysis

Giken has been trading within the range of $0.315 - $0.360 since 9 Jun 14. It seems to be testing the support of $0.315-0.320. A sustained break below $0.315 points to a measured technical target price of around $0.275. However, there are multiple levels of support from $0.300 – 0.310 due to the placement price at $0.300, Fibonacci level and 100D EMA. Resistances are at $0.330 – 0.335 / $0.350 – 0.360. A break above $0.360 negates the slight negative bias of the chart.

Conclusion – This is just an introduction

In short, Giken seems to be a budding Indonesia onshore oil play. Short payback periods, cash flow generative operations, a guaranteed customer and favourable Indonesia dynamics etc. are points which interest me. However, customer concentration risk, ability to extend agreements and limited track record are some factors which readers should be aware of.

Readers who are interested should take a look at http://www.giken.com.sg/ for more information. You can also email me at

Recent stories:

GIKEN SAKATA gets new group CEO; SIIC ENVIRONMENT is a buy

GIKEN SAKATA: Up 512% this year ahead of oil venture in Indonesia