Logistics Holdings has been securing increasingly large HDB contracts, auguring its upgrade to BCA A1 status. Company photo

Logistics Holdings has been securing increasingly large HDB contracts, auguring its upgrade to BCA A1 status. Company photoAT CATALIST stock Logistics Holdings' IPO in January last year, its management said that the A2 construction contractor is likely to become eligible for an upgrade to A1 status.

A main contractor with an A1 BCA license can tender for projects of unlimited value, while those with an A2 license can only tender for projects up to S$90 million in value with effect from 1 July 2014.

One criterion for eligibility for an upgrade to an A1 license is a track record of having completed building projects of S$150 million, with at least half of that in Singapore.

Given the growing size of contracts that Logistics has been awarded with, the leap to A1 status is likely to happen sooner than later.

In May, the Group announced that it won its first construction contract valued above S$70 million.

CEO Phua Lam Soon.

CEO Phua Lam Soon. NextInsight file photoWorth S$72 million, the contract was for a HDB project to construct a 432-unit 4-block precinct along Yishun Avenue 1.

The project also entails the construction of an electrical substation, minor sewer, a multi-storey car park and other community facilities such as eating houses, shops, a minimart, a childcare centre, pavilions, etc.

Work commenced on 29 May 2014 and is expected to be completed over 27 months (2.25 years).

The size of contracts that Logistics has been securing has been on an upward trajectory.

This is evidenced by the fact that its recent contract win bumped its order book up to S$329.8 million (as at 15 May), with projects lasting until its financial year ending 30 June 2017 (FY2017).

An order book of some S$330 million over 3 years translates into an average of about S$100 million worth of work a year.

Contracts secured during the first half of this calendar year alone have already amounted to S$113.65 million.

(Actually, about 20% to 25% of fees for each project is collected in the first year and another 70% to 80% by the third year.)

In April, it secured a contract worth S$9.95-million from Progen Holdings for the construction of an 8-storey single-user industrial building.

In January, it secured a contract worth S$31.7-million from HDB for the design and build of upgrading projects and contingency works in three HDB precincts.

Logistics' stock price has risen 30% to 40% over the past 12 months. Bloomberg data

Logistics' stock price has risen 30% to 40% over the past 12 months. Bloomberg dataBut it's not a bed of roses.

Like other construction players, Logistics has been challenged by the rising cost of labor as well as the rising cost of raw materials.

As four out of five of its construction workers are foreigners, the Group has been challenged by the rise in foreign worker levies and the decreasing foreign worker quota in Singapore.

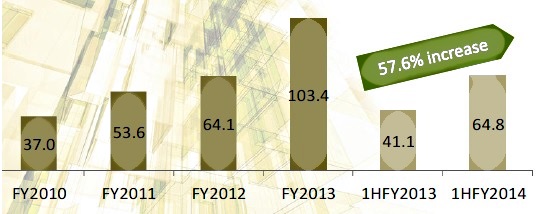

Its 1HFY2014 revenue had surged 57.6% year-on-year to S$64.8 million but net profit attributable to shareholders was only up 17.0% at S$2.6 million, partly due to an increase in headcount and salaries.

It was also affected by a hike in the prices of granite after the Indonesian government banned a wide range of minerals from being exported globally in January.

This had triggered a cessation in the shipment of granite aggregates to Singapore from Indonesia leading to a shortage in the construction raw material.

Logistics' revenue has grown at a CAGR of 40.86% over the past 3 financial years.

Logistics' revenue has grown at a CAGR of 40.86% over the past 3 financial years.(S$ million)

Diversification into vertically integrated player

To mitigate the challenges that it faces in the construction business, the Group has diversified into property development.

On 28 January, it took possession of a piece of freehold property at Paya Lebar that it acquired en bloc last year.

It intends to redevelop the land parcel into high-end cluster houses.

To deal with the rising cost of labor, it has also constructed a pre-cast plant in Johor.

The newly completed plant is expected to increase the Group’s productivity by decreasing its reliance on manpower.

Previous story: LOGISTICS HOLDINGS: Q&A With Analysts @ First IPO Briefing Of 2013