UOB Kay Hian: Tiong Woon is an "undervalued service provider to the O&G industry"

Tiong Woon successfully completed the Roll-On-Roll-Off (RORO), haulage and lifting work for one of Asia’s tallest and largest xylene splitter columns at Jurong Aromatics Corporation’s complex in Jurong Island.

Tiong Woon successfully completed the Roll-On-Roll-Off (RORO), haulage and lifting work for one of Asia’s tallest and largest xylene splitter columns at Jurong Aromatics Corporation’s complex in Jurong Island. Photo: CompanyAnalyst: Loke Chunying

Providing a comprehensive set of project management services, from the planning and design of an integrated lifting and haulage service to the installation of dangerous Oil and Gas (O&G) structures (eg oil rigs), Tiong Woon plays an integral role in supporting its customers in the O&G industry.

• Serving a defensive niche. Deriving 70-80% of its revenue from the O&G industry, Tiong Woon’s earnings are relatively more resilient as these service contracts are longer term in nature and can be recurring.

Safety issues pertaining to the O&G industry also create high barriers to entry to the industry.

However, we note the recent price strengthening in its locally listed peers of between 16.7%-40.7%, suggesting a possible re-rating could be on the cards, as Tiong Woon plays catch up to its peers.

We initiate coverage on Tiong Woon with a BUY recommendation and a target price of S$0.455 pegged to its industry peers’ P/B average of 0.83x.

We initiate coverage on Tiong Woon with a BUY recommendation and a target price of S$0.455 pegged to its industry peers’ P/B average of 0.83x. Serving primarily the Oil & Gas (O&G) industry, Tiong Woon is an integral crane operator for oil majors in an industry that has high barriers to entry due to safety concerns.

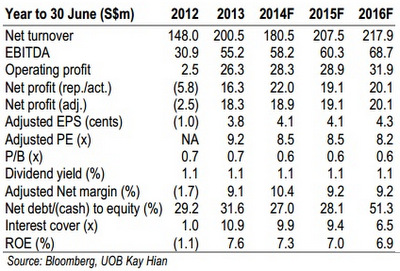

At 0.64x P/B, Tiong Woon is trading at a 23% discount to its local peers average P/B of 0.83x, offering value investors a huge margin of safety.

The ability to consistently record strong gains from disposal of equipment suggests a possible understatement in fair value of assets, making valuation even more compelling.

Recent story: YONGMAO, SIN HENG, TAT HONG: Which crane player to bet on?

|

OSK-DMG starts coverage of Gallant with 57-c target Inflection point on the horizon, landbank value may be unlocked. It has been a long wait as financial crises slowed Bintan’s development timeline but currently, our checks show that Lagoi Beach Village is complete and ready to open in 2H14. An ultimate resort tourism environment, Bintan Resort 3.0 seems ready. |