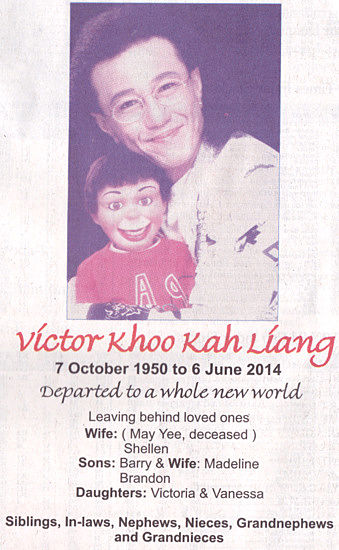

The sad news this morning is of the passing of Victor Khoo at 63 from cancer. I met him some 15 years ago for an interview for an investment-related story for The Straits Times. I would like to share it here.

The sad news this morning is of the passing of Victor Khoo at 63 from cancer. I met him some 15 years ago for an interview for an investment-related story for The Straits Times. I would like to share it here. WAKING UP every morning, Mr Victor Khoo, 48, asks himself: "What am I here for?" He soon arrives at an answer: "I'm here to be happy."

Then he asks the next question: "What makes me happy?" And the answer, he realises, is : "My family and my work."

Reassured that he has got the vital, basic things right for the day, he goes out and is happy enough at work entertaining people with his jokes, magic tricks and ventriloquism and earning an international reputation for being an all-round show host.

He values family life in a certain poignant way that must have come from his having experienced a wrenching personal loss. His first wife, May Yee, died in 1995 after a 12-year battle with breast cancer.

Given the circumstances, it is not surprising that when asked to talk about how he manages his money, the answers invariably lead back to his family. Basically, he has been investing in property so he can eventually give a house each to his children and wife.

He has four children and is remarried to Shellen, 36. "I buy with one sole objective: It is to give each of my children a roof. That would be my parting gift."

His track record so far, and it is a happy one:

1991: Bought a 2,300-sq ft apartment in Yong An Park in the prime district of River Valley. His family lives there now.

1993: Bought a 2,200-sq ft apartment in Regency Park in River Valley. It is rented out.

1994: Bought a 1,000-sq ft office in Henderson, a 10-minute drive from River Valley, and made it his office.

Property No.4, which is a condominium in River Valley, is close to being clinched, he says.

He has chosen properties in River Valley for a simple reason: He hopes to have all his children living near him when he is old. The purchased properties are freehold and are almost fully - if not fully - paid for.

Mr Khoo fights shy of talking about their present values and how much they have appreciated by. A check of advertised prices for similar properties in The Straits Times Classifieds suggests that they are worth a total of $6 million.

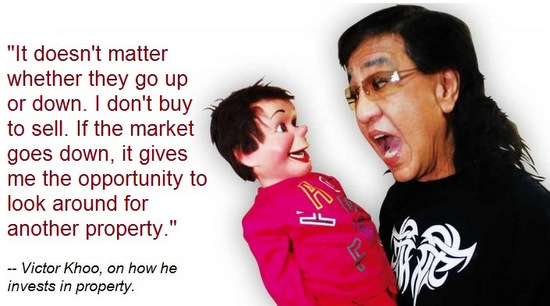

"It doesn't matter whether they go up or down. I don't buy to sell," he says. "If the market goes down, it gives me the opportunity to look around for another property."

Photo: http://is.asia-city.com/

Photo: http://is.asia-city.com/During the recent recession, he found a semi-detached house that he liked very much. But the owner wanted $500,000 more than the valuation figure of $2.3 million and Mr Khoo declined to pay the premium.

He never tires of saying he values every dollar he earns because he got it through hard work.

The only landed property he has ever owned was a terrace house in Jalan Mutiara, in River Valley, which he bought in 1994. He never moved into it although he had planned to do so. After buying it, he did not feel "comfortable" living in it. He does not offer more by way of reason except to say: "I live my life by gut feel." He sold the house for a profit in 1996.

In not moving to the terrace house, he also remembered the words of a monk whom he had brought along to check out Yong An Park before he bought a unit there.

The monk had said: "This is the right place for you." Mr Khoo agrees to this day. His apartment on the third floor opens out to a view of the condominium's swimming pool and a shady tree.

Before that, home was a five-room Housing Board flat in Bedok North which he bought for around $40,000 in 1979 after he got married. He sold that for about three times as much when he upgraded to Yong An Park.

Now, by most accounts, Mr Khoo is doing all right where money is concerned. But this was something he did not have when he was growing up as a kid. He had 10 siblings and they all lived on the cramped upper floor of a shophouse in Bras Basah Road.

"It was a luxury to have a packet of char kuay teow to be shared by 11 of us," he recalls.

His experience of the tough times has led him to avoid spoiling his children. So, on family outings they often eat at food courts or hawker centres. And when they holiday, they fly economy.

He has made it a point not to announce to his children his aspiration to give each of them a property. Neither do they know of the insurance policies that he and his wife have bought to cover their education and health. Some of the policies will yield cash at maturity.

"I don't want them to just sit around and not work hard for whatever they want in life," he says.

But when it comes to their education, he does not hesitate to spend money. "I know the importance of education now. I had gone through life the hard way. I went straight into the entertainment line after my A levels. I was the only child in my family who didn't go to university, which sort of disappointed my father."

His two daughters aged four and five go for extra classes in phonics, music and Chinese at up-market agencies. His twin sons -- who are aged 21 and have just finished their national services -- are planning to go for further studies overseas.

Despite being clear about his goal of leaving each of them a property, he says he sometimes experiences doubts over whether he is making smart investments. "When I play golf with CEOs and friends, they talk about the money the made in various schemes, especially share investments. I wonder if I have been right in my investment approach."

But rational thinking eventually gains the upper hand, and he tells himself firmly that stocks are not for him. He has no clue about how stocks behave and he has no time to track their price movements. He would rather focus on coming up with creative ideas for his shows, he says.

Given his high profile, it is not surprising that he gets the occasional call from representatives of fund managers or bankers offering to manage his money. But he declines.

"I have to be on top of the situation. I can't just thrust my hard-earned money into their hands," he explains.