Recently appointed StarHub CEO Mr. Tan Tong Hai addresses investors in Shenzhen.

Recently appointed StarHub CEO Mr. Tan Tong Hai addresses investors in Shenzhen.

Photo: Aries Consulting

MR. TAN TONG HAI, CEO of Singapore telecom giant StarHub (SGX: STH) said there is still plenty of room for expansion in the mobile, broadband and pay TV provider’s home market.

“Our mobile client numbers in particular have seen continuous rises since 2008 and there’s no saturation effect seen in Singapore,” Mr. Tan told investors in Shenzhen on Friday at the Aries Consulting-organized “Scaling New Heights Investor Conference 2013.”

Key to the company’s successfully becoming Singapore’s No.2 broadband provider and mobile telecom play has been StarHub’s ability to offer premier services in package deals in a strategy called "hubbing."

“Our Internet and pay TV products are part of a single package. This has allowed us to build up the highest ARPU (average revenue per user) in our sector, and we pay great attention to this metric,” he said.

Founded in 1998, StarHub was licensed at the time to provide fixed network and mobile services when the Singapore government announced the city state’s telecommunications industry would be completely liberalized by 2002.

Founded in 1998, StarHub was licensed at the time to provide fixed network and mobile services when the Singapore government announced the city state’s telecommunications industry would be completely liberalized by 2002.

StarHub was officially launched in early 2000 with ST Telemedia, Singapore Power, BT Group and Nippon Telegraph & Telephone (NTT) being major shareholders.

“We have a diverse international ownership structure which helps spread risk,” Mr. Tan said of the firm’s current shareholding arrangement.

Four years ago, StarHub reached a major milestone as an internet services provider (ISP) when Singapore’s Infocommunications Development Authority announced that StarHub’s wholly-owned unit Nucleus Connect was chosen to design, build and operate the active infrastructure of the Next Generation Nationwide Broadband Network.

StarHub now offers a comprehensive range of information, communications and entertainment services for both consumer and corporate markets in Singapore, operating a mobile network that provides 4G, 3G and 2G services.

StarHub Senior Vice President Ms. Jeannie Ong (right) meets and greets attendees at the 'Scaling New Heights Investor Conference 2013' in Shenzhen. Photo: Aries Consulting

StarHub Senior Vice President Ms. Jeannie Ong (right) meets and greets attendees at the 'Scaling New Heights Investor Conference 2013' in Shenzhen. Photo: Aries Consulting

It also manages an island-wide HFC network that delivers multi-channel pay TV services, ultra-high speed residential broadband as well as fixed network services.

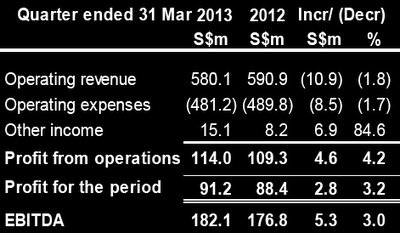

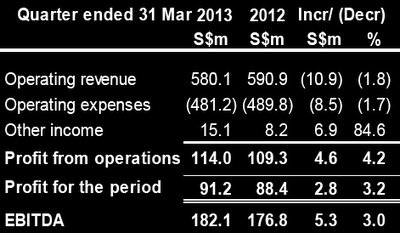

For the January-March quarter, operating revenue shrunk 2% year-on-year to 580 million sgd while pre-tax profit rose 3% to 110 million.

Overall service revenue for the quarter was 0.2% lower at 547.3 million sgd , with mobile services revenue down 1.5% at 301.9 million, pay TV services revenue 1.1% lower at 94.7 million, fixed network services revenue up 3.9% at 88.3 million, and broadband services revenue at 62.4 million -- up 1.7% due to a larger subscriber base and better plan mix.

Mr. Tan Tong Hai became StarHub's CEO this spring.

Mr. Tan Tong Hai became StarHub's CEO this spring.

Photo: StarHubThe company also managed to reduce its net debt nearly 23% to 290 million sgd.

Mobile services contributed 55% to the top line in the first quarter, pay TV 17%, fixed network 16% and residential broadband 12%.

In early February of this year, Mr. Neil Montefiore retired as CEO and by the end of the month StarHub's then Chief Operating Officer Mr. Tan Tong Hai was appointed the next CEO.

“As for our pay TV segment, both StarHub and the Singapore government have a high respect for IPR compliance. Therefore, to date we have never been asked to shut down any channels or services (over piracy issues),” Mr. Tan said.

He added that StarHub customers tended to be more quality-conscious than those using other telecom service providers – a factor which helped solidify ARPUs for StarHub.

“Some 38% of our clients are 4G users,” he said, referring to the speediest, most advanced, feature-rich protocol.

“At an average pay TV ARPU of 52 sgd in the first quarter (up a dollar y-o-y), we’re the highest in Asia in that category.”

In November of last year, StarHub announced new content additions to make contracts “stickier,” and stop customers from moving to rivals like Singapore Telecom (ST).

Mr. Tan said StarHub was bullish on its pay TV business, which allows users to catch their favorite Bollywood or Mandarin-centric shows at home or on their mobile devices, thus making long commutes more bearable.

StarHub recently 4.16 sgdSingapore, with its culturally-diverse population, has four official languages: English, Mandarin, Malay and Tamil.

StarHub recently 4.16 sgdSingapore, with its culturally-diverse population, has four official languages: English, Mandarin, Malay and Tamil.

However, the large and growing Indian population on the island was creating a greater demand for Hindi-language content, and StarHub was keen to tap this sector as well.

To this end, StarHub recently added Song Max, its ninth Hindi channel featuring a steady stream of Bollywood offerings.

Regardless of whether customers preferred English, Mandarin, Cantonese, Hindi, Malay or Tamil content, international visitors to the city state get an early taste of StarHub’s service quality.

“In 2008 we were awarded a contract to install Wi-Fi in Changi International Airport,” he said.

Despite its technical nature and need for R&D reinvestment, StarHub was committed to rewarding shareholders on a regular basis.

“We offer dividends every quarter,” Mr. Tan added.

In 2012, StarHub offered a dividend of 0.20 sgd per share, with a yield of 5%.

See also:

STARHUB: High Dividends To Beat Inflation Blues

Recently appointed StarHub CEO Mr. Tan Tong Hai addresses investors in Shenzhen.

Recently appointed StarHub CEO Mr. Tan Tong Hai addresses investors in Shenzhen. Founded in 1998, StarHub was licensed at the time to provide fixed network and mobile services when the Singapore government announced the city state’s telecommunications industry would be completely liberalized by 2002.

Founded in 1998, StarHub was licensed at the time to provide fixed network and mobile services when the Singapore government announced the city state’s telecommunications industry would be completely liberalized by 2002. StarHub Senior Vice President Ms. Jeannie Ong (right) meets and greets attendees at the 'Scaling New Heights Investor Conference 2013' in Shenzhen. Photo: Aries Consulting

StarHub Senior Vice President Ms. Jeannie Ong (right) meets and greets attendees at the 'Scaling New Heights Investor Conference 2013' in Shenzhen. Photo: Aries Consulting Mr. Tan Tong Hai became StarHub's CEO this spring.

Mr. Tan Tong Hai became StarHub's CEO this spring. StarHub recently 4.16 sgdSingapore, with its culturally-diverse population, has four official languages: English, Mandarin, Malay and Tamil.

StarHub recently 4.16 sgdSingapore, with its culturally-diverse population, has four official languages: English, Mandarin, Malay and Tamil. NextInsight

a hub for serious investors

NextInsight

a hub for serious investors