China Sanjiang is a manufacturer and supplier of consumer chemicals and their ingredients. Photo: SanjiangBocom: CHINA SANJIANG kept ‘Buy’

China Sanjiang is a manufacturer and supplier of consumer chemicals and their ingredients. Photo: SanjiangBocom: CHINA SANJIANG kept ‘Buy’Bocom International said it is maintaining its “Buy” recommendation on China Sanjiang Fine Chemicals Co Ltd (HK: 2198) due to a promising 2013 earnings growth outlook and capacity expansion for a key chemical.

Phase 4 of the company’s ethylene oxide (EO) project has been put into commercial operation, increasing its EO capacity to 330,000 tonnes.

The effective capacity in 2013 (on a daily basis, assuming 365 days-a-year operation) will reach 311,000 tonnes, representing a notable y-o-y growth of 65%.

Meanwhile, Phase 5 of the EO/glycol project is still under construction, and is expected to start operation at the end of 2014, and after that the company’s EO capacity will further increase by 200,000 tonnes, or 60.6%, to 530,000 tonnes in 2015.

Stable EO processing gross margin

“As EO is difficult to store and requires higher storage costs, EO manufacturers have a good degree of pricing power,” Bocom said.

Sanjiang’s historical gross margins for EO and surfactants are relatively stable.

Source: Bocom“With favorable supply and demand, gross profit per tonne is maintained at a reasonable level,” Bocom added.

Source: Bocom“With favorable supply and demand, gross profit per tonne is maintained at a reasonable level,” Bocom added.The MTO (methanol-to-olefin) project is essential to securing ethylene supply.

With phase 4 of the EO project having reached its target capacity, Sanjiang’s ethylene procurement volume has reached around 290,000 tonnes, most of which is imported.

This will rise to 420,000 tonnes upon the full operation of phase 5 of the EO/glycol project at the end of 2014.

“The designed capacity of the MTO project is 300,000 tonnes of ethylene and 390,000 tonnes of propylene per annum, and the full operation of this project will secure a majority of Sanjiang’s ethylene supply,” said Bocom.

Foresight demonstrated by recent acquisitions of downstream firms, ports

When the MTO project in Zhejiang achieves its target capacity, the company will need to purchase abundant methanol from abroad.

Sanjiang's shares have had a rather strong recent performance. Source: Yahoo Finance

Sanjiang's shares have had a rather strong recent performance. Source: Yahoo Finance“The acquisition of the biggest local port company there will secure methanol transportation and ensure better management of the arrival time of raw materials at the ports.

“In addition, the acquisition of companies engaged in relevant businesses such as Mei Fu Petrochemical (美福石化) will facilitate the company’s expansion into downstream businesses,” Bocom added.

Better-than-expected recent results

Sanjiang’s core net profit saw 60.7% growth in 1Q.

“Any interim earnings surprise could serve as a catalyst to propel its share price higher,” Bocom said.

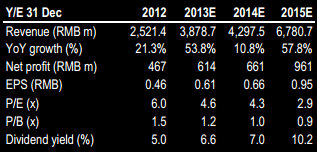

Sanjiang recently 3.77 hkdThe years 2013 and 2015 will be crucial for the company when its EO capacity will increase dramatically, propelling its leapfrog growth.

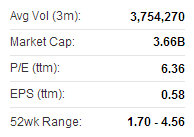

Sanjiang recently 3.77 hkdThe years 2013 and 2015 will be crucial for the company when its EO capacity will increase dramatically, propelling its leapfrog growth.“While we have seen higher market confidence on the company judging from the recent share price movement, its 2013 P/E still stands at 4.6x,” Bocom said.

The research house is raising its target price on Sanjiang to 5.38 hkd, equivalent to 7x 2013E P/E.

China Sanjiang is a manufacturer and supplier of consumer chemicals and their ingredients (i.e. EO and AEO surfactants). It also produces and supplies other surfactants. The company is also engaged in the provision of EO and surfactant processing services to its customers, as well as the production and supply of other chemical products (such as glycol) and industrial gases, namely oxygen, nitrogen and argon. In terms of production volume in recent years, the company is the third largest EO manufacturer and the largest privately-owned EO manufacturer in China, and is also the second largest AEO surfactant manufacturer and the largest private AEO surfactant manufacturer in China.

Deutsche: SINOPEC maintained at ‘Buy’

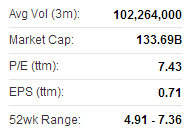

Deutsche Bank said it is maintaining its “Buy” recommendation on energy giant Sinopec Corporation (HK: 386).

Sinopec recently 5.34 hkdThe German research house projects that lower oil prices will reverse Sinopec's oil business losses from 2012.

Sinopec recently 5.34 hkdThe German research house projects that lower oil prices will reverse Sinopec's oil business losses from 2012.

It also said the new management team will add value to the Group.

Deutsche also expects that Sinopec will receive funds for oil exploration so as to boost its profit margin and return on equity.

The target price is reduced to 6.91 hkd from 7.5 previously.

See also:

HENGYANG PETROCHEMICAL: Macquarie Everbright Unit Injects S$54.25 Mln