Main reference: Story in Securities Daily

SEVERAL A-SHARE listed firms are set to take off thanks to a very promising future for a particular sector.

Which are they and what's the energized sector suddenly in demand?

Not just hot air

Over the past few years, there has been an unprecedented expansion of drilling and output for natural gas worldwide, most notably in the United States.

Taxi drivers line up in Guangzhou to fill up their tanks with natural gas. NextInsight file photo

Taxi drivers line up in Guangzhou to fill up their tanks with natural gas. NextInsight file photo

At the same time, the recently-retired national leadership in Beijing along with the incoming administration have continuously trumpeted the need to find a more clean-burning energy feedstock to fuel the world’s most populous country’s juggernaut of an economy.

Frequent negative global press portraying choking air pollution in the PRC capital has also helped to light a fire under energy policymakers in Mainland China to help find a way to wean the country’s power producers off the heavily polluting brown coal which is responsible for so much of the smog today.

And it’s not just China’s countless power plants that are gradually starting to jump aboard the natural gas pipeline.

Several major metropolitan areas across the country have this year already begun trial runs for natural gas refueling networks to power city buses and taxis.

China is increasingly promoting natural gas as a cleaner feedstock. Aries Consulting file photo

China is increasingly promoting natural gas as a cleaner feedstock. Aries Consulting file photo

Bustling urban centers including Beijing and the Guangdong industrial city of Dongguan have made preliminary moves to make this far less polluting fuel its main source of energy for city mass transit networks.

Compressed natural gas (CNG) is also an increasingly common fuel in China’s millions of private automobiles plying their way across city streets and highways in the world’s biggest car market.

The “Garden City” of Hangzhou plans to have between 5-8 working natural gas refueling stations per 1,000 vehicles by year end.

Finally, more and more homes are being retrofitted or originally-fitted for natural gas consumption.

Analysts say A-shares with exposure to natural gas supply technology are likely to take off sooner rather than later thanks to unmet demand, strong government support and an expanding supply infrastructure across the country and region.

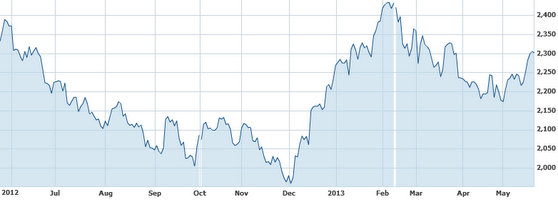

Recent China shares trends. Source: Yahoo Finance

Their consensus forecast is that of the 23 natural-gas related domestic listcos with direct exposure to second tier city markets in China, at least 15 of these stocks will outperform the benchmark Shanghai Composite Index over the remainder of the year.

Zhangjiagang Furui Special Equipment (SZA: 300228) makes the canisters that hold natural gas.

Late last month its Shenzhen-listed shares had already surged 112% year-on-year on strong demand growth assumptions and over 30% since May.

Zhejiang Jiuli HiTech (SZA: 002318) provides stainless steel seamless pipes that transfer gas from tanks to cars and other applications.

Its A-shares have also surged nearly 30% since the beginning of May.

Sichuan Guangan AAA Public Co (SHA: 600979) is a vital cog in the CNG supply chain, providing natural gas as well as electricity and water to end users, and its shares have surged over 28% in the past month.

Xinjiang Haoyuan Gas (SZA: 002700), based in China’s energy-rich Xinjiang region, builds and operates long-distance natural gas pipelines that deliver natural gas to municipal gas companies and direct users.

Haoyuan has seen its share price add over 22% over the past month.

Other beneficiaries of China’s “gas rush” that have shown strong share price gains since May are likely to include: Xinjiang Tianfu Thermoelectric (SHA: 600509; +21%), Oriental Energy (SZA: 002221; +20%) and Shaanxi Provincial Natural Gas (SZA: 002267; +15%).

“Natural gas is the fastest-growing energy theme in China’s stock markets,” said Changjiang Securities.

“We expect domestic consumption of the commodity to increase by over 20% per year over the next five years.”

See also:

What Are Growth Themes In China Shares?