Prada is Bocom's top sector pick. Photo: PradaBocom: Tough Past Year for RETAIL

Prada is Bocom's top sector pick. Photo: PradaBocom: Tough Past Year for RETAILBocom Research said China’s Hong Kong-listed discretionary consumer retail plays performed worse than expected in 2012.

“Last year ended with more disappointing results with average net profit (ex-sportswear) declining 2%, a significant deceleration from 30% growth in FY11,” Bocom said.

Moreover, based on its tracking of 34 retail stocks, stocks with earnings below its expectations rose to 43% of the total in FY12 from 25% in FY11, while those above expectations decreased sharply to 11% in FY12 from over 20% in FY11.

Among the key segments, menswear and sportswear were below expectations, while footwear, department stores, luxury and supermarkets were in line.

“The key sector drawbacks were SSS slowdown and a margin squeeze, due to more cautious consumer spending amid the weakened macro climate and the knock-on impact with bigger sales markdowns and destocking pressure.”

Bocom added that unsurprisingly, the results season has seen more frequent ratings and earnings downgrades.

Bocom added that unsurprisingly, the results season has seen more frequent ratings and earnings downgrades.“In our stock universe, we downgraded CRE (HK: 291) to ‘Sell’ from ‘Neutral’ and Lifestyle (HK: 1212) to ‘Neutral’ from ‘Buy’, and made forecast cuts on Belle, Golden Eagle, Trinity, Parkson, and Springland.”

In view of the latest 1Q13 sales statistics and the continued sluggish consumer sentiment, Bocom says signs of a sector recovery remain weak.

“Furthermore, with rising cannibalization risk due to aggressive store expansion of most retailers over the past few years and rapidly intensifying market competition, we believe the sector will continue to see de-stocking pressure and aggressive promotional activities, at least into 2Q13E.”

The current consensus estimate of the sector’s FY13E net profit growth is 16%, and Bocom expects surprise on the downside.

“As such, we are more selective in stock picking and continue to prefer names with strong pricing power and brand recognition due to their better resilience.”

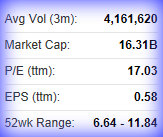

Prada's Hong Kong-listed shares are recently trading at 71.85 hkd. Source: Yahoo Finance

Prada's Hong Kong-listed shares are recently trading at 71.85 hkd. Source: Yahoo FinanceIt is reiterating its key “Buys” on Prada (HK: 1913) (its top sector pick), Intime, Springland, Daphne, Bosideng and Sa Sa.

“Key issues to watch in 2013 continue to be (1) SSS and ASP trends; (2) discounting activities; (3) cost control execution; (4) inventory levels; and (5) expansion pace.”

Yuanta: DAPHNE Preferred Choice

Yuanta Research said that footwear retailer Daphne (HK: 210) is its "preferred choice" in China's consumer sector, and is reiterating its "Buy" recommendation with a target price of 12.30 hkd (recent share price hkd).

“Unlike Belle, Daphne recorded strong SSS growth of 22% y-o-y in 1Q12 for its core brands (Daphne/Shoebox). We anticipate flat y-o-y SSS growth for Daphne’s core footwear brands in 1Q13, which should be well expected by the market based on management guidance from its 2012 results release,” Yuanta said.

Daphne recently 9.89 hkdThe research house forecasts Daphne’s SSS to grow 6% this year, with growth accelerating in 2Q-4Q13.

Daphne recently 9.89 hkdThe research house forecasts Daphne’s SSS to grow 6% this year, with growth accelerating in 2Q-4Q13.“At present, investor sentiment is affected by concerns of potential human-to-human transmission of bird flu in China. However, we argue that the concern will be short-lived.”

Yuanta added that not only is footwear a basic necessity, but Daphne is not facing any inventory issues, and therefore the company is under no pressure to clear inventory in the event of a short-term drop in demand.

It added that just 16% of Daphne’s China retail network is located in bird flu-affected areas such as Anhui, Jiangsu, Shanghai and Zhejiang.

See also:

HK-listed Sportswear Plays: Big Dividends, Small Profits?