Main reference: Story in Securities Times

THE RISING CASUALTY figures from bird flu in Eastern China have taken a toll on listcos handling poultry, airlines serving a nervous flying public and even China’s most famous Peking Duck restaurant.

But thankfully so far, no signs of human-to-human transmission have been documented.

So which listco's are gettting hit hardest?

A chef carves up a Peking duck at a Quanjude restaurant in Beijing. Photo: Andrew VanburenFollowing the four-day Tomb Sweeping Festival market break, there were six confirmed fatalities from the latest outbreak of the disease with at least 20 victims total.

A chef carves up a Peking duck at a Quanjude restaurant in Beijing. Photo: Andrew VanburenFollowing the four-day Tomb Sweeping Festival market break, there were six confirmed fatalities from the latest outbreak of the disease with at least 20 victims total.

Restaurant chain Beijing Xiangeqing Co Ltd (SZA: 002306), already down 30% from three-month earlier levels, has fallen sharply of late due to the eatery’s chicken and duck-heavy menu.

Another clear victim amid a consumer sector worried about the potential wider spread of avian flu has been legendary Peking Duck chain Quanjude (SZA: 002186).

The famous brand with restaurants across Beijing and beyond has seen its Shenzhen-listed shares fall over 11% since late-March when news of the initial bird flu fatalities in Eastern China became known.

Closer to home, the Super Chicken chain of Taiwan-style fried chicken joints across Mainland China has been hit especially hard of late, with one company official saying sales have plummeted over 80% recently.

Upstream poultry plays have not avoided the carnage even as authorities begin mass-scale slaughter and disposal of chicken, duck and geese flocks considered at risk for an infection outbreak.

Shan Dong Yisheng Livestock & Poultry Breeding Co Ltd (SZA: 002458) saw its shares in Shenzhen fall their daily 10% limit on Monday as the updated flu casualty numbers were announced, while Fortune Ng Fung Food (Hebei) Co Ltd (SHA: 600965) lost over 8% of its share value in a single day.

Poultry processor Fujian Sunner Development Co Ltd (SZA: 002299) has been suspended from trading since February 27 as reports of the first bird flu casualties were first made public.

However, not all dining establishments are seeing their cooks idling away their time in kitchens.

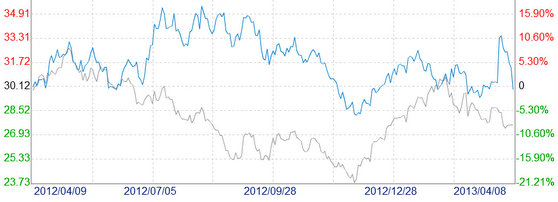

Quanjude's shares (blue line) have outperformed the Shanghai Composite (grey line) over the past year, but have fallen sharply lately due to bird flu fears. Source: Sinafinance

Quanjude's shares (blue line) have outperformed the Shanghai Composite (grey line) over the past year, but have fallen sharply lately due to bird flu fears. Source: Sinafinance

Xiao Nan Guo (HK: 3666) management said it will keep a close watch on inventory, but it said it hasn’t seen any flu-related downside so far as most of its menu offerings are beef, pork and mutton destined for the table-top grill.

Besides poultry-processors and fowl-friendly restauranteurs, other stocks taking a beating amid the avian flu scare have been travel firms and commercial airlines.

Lijiang Travel Co (SZA: 002033) and Guilin Travel Co (SZA: 000978), listcos named after prime tourist locations, both fell over heavily following heightened bird flu fears, with many opting to lay low and avoid crowded places for the time being.

Meanwhile, nearly all of China’s A-share listed commercial carriers and airports were down sharply early this week on the avian influenza anxiety.

Market watchers say that the disastrous PR event that was the official under-reporting of the extent of the SARS epidemic a decade ago means Beijing is certainly better prepared today -- both logistically and politically -- to handle any new localized or wider epidemics.

Therefore, shareholders can rest assured that a much better detection, control and containment regime is in place 10 years later to handle nearly any contagion contingency in Mainland China.

Furthermore, information on such matters is far more transparent and accessible.

That being said, until the infection rate figures start slowing, poultry processors and restaurants will likely continue to take a grilling while a resolution of the outbreak will go a long way toward putting more elevation into airline and travel stocks.

See also:

TSUI WAH RESTAURANT A 'Buy'