WARREN BUFFETT eschews diversification, seeking to buy lots of a stock only when prices are very attractive.

WARREN BUFFETT eschews diversification, seeking to buy lots of a stock only when prices are very attractive.What works for him could work for many lesser investors too. Similarly, a very diversified portfolio could make good sense, especially if one seeks lower volatility in one's portfolio.

Different strokes for different folks, as one might say.

The Yeoman 3-Rights Value Asia Fund has done well for its investors and an excellent article by Genevieve Cua in Business Times (Nov 27, right) highlighted that.

And the fund is big on diversification -- not unlike Aggregate Asset Management which we highlighted recently in AGGREGATE ASSET MGT: 'Why we invest in more than 100 stocks'

The Yeoman fund invests in around 70 stocks and has S$117 million of assets under management as at end-Oct 2013.

Here's more:

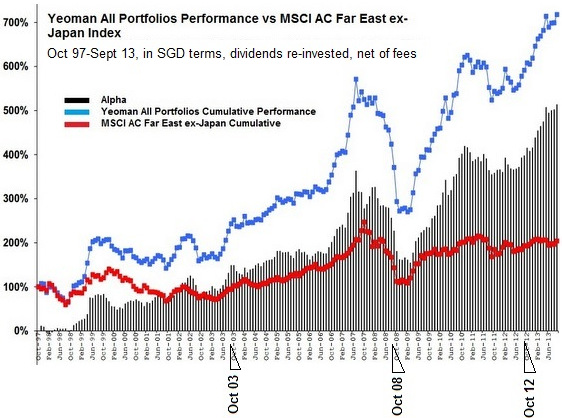

Performance: In the current year to end-October, the Yeoman fund has gained 19.34 per cent, compared with the MSCI Far East ex Japan index return of 3.45 per cent.

Since its inception in October 1997, the fund has achieved cumulative returns of more than 638 per cent, compared with the index return of 110 per cent.

This translates to a compounded annual return of 13.3 per cent.

Every $100,000 invested at inception have transformed into more than $738,000!

Methodology: On Yeoman's website, the explanation is: "We call our investment process the "3-Rights" (Right Business, Right Price and Right Management). Subject to the 3-Rights criteria being met, we are usually fully invested holding little or no cash. For us, performance attribution is from securities selection and portfolio construction, not market timing."

BT quoted Yeo Seng Chong, Yeoman's founder and chief executive, saying undervaluation is the "prime and only motivation for investing''.

Yeo Seng Chong, 59, founder and CEO of Yeoman Capital Management. Screengrab from http://www.youtube.com/watch?v=err1lNGSQ94"If we can't get undervaluation, we don't participate. The undervaluation is measured in terms of PE (price earnings multiple), dividend yield, free cash flow and discount to balance sheet book value. We also look at return on equity to make sure our stocks have capital efficiency."

Yeo Seng Chong, 59, founder and CEO of Yeoman Capital Management. Screengrab from http://www.youtube.com/watch?v=err1lNGSQ94"If we can't get undervaluation, we don't participate. The undervaluation is measured in terms of PE (price earnings multiple), dividend yield, free cash flow and discount to balance sheet book value. We also look at return on equity to make sure our stocks have capital efficiency."From Yeoman's website: "If we have the comfort of time on our side and the stocks that we own are backed by real businesses generating adequate earnings relative to our price at entry and the cost of the company's capital employed, then we are getting richer by the day, no matter where the market goes.

"If we get the '3-Rights' right, time is our friend. In the short term, price and value may not converge but over the longer term they surely must.''

It adds: "We do not sell just because other people are selling (or buy just because others are doing so)."

|

Diversification is key: The maximum exposure to a single stock is about 1.4 per cent. And it has tremendous defensiveness.

As Mr Yeo told BT: "If something doesn't work out in one stock and we suffer permanent and total impairment, we would have lost 1.4 per cent. But if the remaining stocks work out, and typically we pay 50 cents on the dollar - that is, we assess that the stock is worth $1 and we pay 50 cents - ... the loss would be more than covered.

|