Last FY13 bumper dividend was largely due to the disposal of an investment property. Historically, Hafary paid 20-30% pre-tax profit as dividends.TO SOME investors, the first thing that comes to mind regarding Hafary Holdings is the generous dividends it has paid out in the past two financial years.

Last FY13 bumper dividend was largely due to the disposal of an investment property. Historically, Hafary paid 20-30% pre-tax profit as dividends.TO SOME investors, the first thing that comes to mind regarding Hafary Holdings is the generous dividends it has paid out in the past two financial years.For FY13 (ended June 2013), Hafary, the top Singapore-listed supplier of premium tiles, stone and other building materials, has paid 4 cents a share in interim dividend.

It will pay a final dividend of 2.5 cents a share. The payment date has not been announced yet but Hafary typically pays 6-8 weeks from the date of approval.

Since the final dividend was approved at the AGM on 25 Oct, it follows that the payment could be before Christmas, or sometime between Dec 6 and Dec 20.

The dividend aside (at a time when the stock trades at 22.5 cents), Hafary has a positive outlook, as its financial controller, Jackson Tay, described to analysts and fund managers this week. Several takeaways from the event:

Good turnout to hear the Hafary story. Photo by Tang Yibing1. Multi-sources of revenue: Most players in its industry are exclusively focused on a niche -- either retail or projects, and they tend to be limited in their product offerings. Hafary supplies a very wide range of products and has its hands in both retailing and projects.

Good turnout to hear the Hafary story. Photo by Tang Yibing1. Multi-sources of revenue: Most players in its industry are exclusively focused on a niche -- either retail or projects, and they tend to be limited in their product offerings. Hafary supplies a very wide range of products and has its hands in both retailing and projects. 2. Home-building boom: This will continue to be a major revenue source for Hafary over the next few years.

As at end-Sept 2013, about 85,000 private residential units are under construction or under planned development. "We feel comfortable about the outlook for the next two years as there are still a lot of project launches."

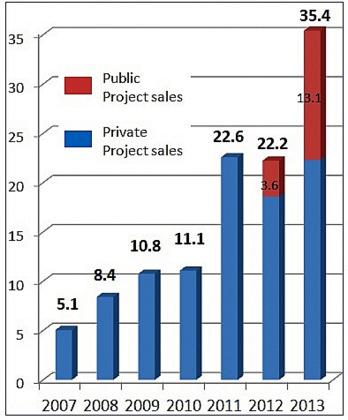

Revenue from public sector projects shot up to $13.1 million in FY13 (ended June 30) from $3.6 million in FY12.

Revenue from public sector projects shot up to $13.1 million in FY13 (ended June 30) from $3.6 million in FY12.Public and private projects made up 43% of revenue in FY13 -- the rest was accounted for by general customers (retail buyers and renovation contractors, etc).HDB's building boom will extend to 2016, with 100,000 HDB homes targeted to be built between 2012-2016.

HDB has identified certain manufacturers of tiles and specifications for use in its newbuilds. Hafary works with these manufacturers and has garnered exclusive distributorships for certain tile designs.

Hafary is already a major supplier of tiles to HDB newbuilds, deriving $13.1 million in revenue from public projects in FY13 compared to $3.6 million in FY12.

2. Renovation: As the number of homes expands and as homes age, the renovaton business thrives.

With people are getting more affluent and more sophisticated in their renovation choices, their spending on renovation is set to rise -- which spells good business opportunities for Hafary.

"Overall, the market is getting bigger by the day."

2. MRT projects: MRT stations need tiles too -- and after its initial foray into this business, Hafary is eyeing more MRT station contracts as new MRT construction projects are put up for tender by the government.

3. Competitive edge: Hafary holds a lot of inventory -- some S$35 million worth as at end-June 2013 -- which enables it to deliver promptly to customers.

Accounting-wise, any inventory that is more than 4 years off will be written off on its books -- but Hafary will still try to sell these. The obsolecence rate is very low at around 3%.

Hafary financial controller Jackson Tay (centre) chatting with Chan Wai Chee, CEO, Research - Special Opportunities, at Phillip Securities. Photo by Leong Chan TeikGiven its relatively large purchases from manufacturers, Hafary can obtain exclusive rights to certain products.

Hafary financial controller Jackson Tay (centre) chatting with Chan Wai Chee, CEO, Research - Special Opportunities, at Phillip Securities. Photo by Leong Chan TeikGiven its relatively large purchases from manufacturers, Hafary can obtain exclusive rights to certain products.In addition, as Jackson said, Hafary's after-sales support when any issues crop up is top-notch.

Overall, this business is a lot also about efficiencies that a player can squeeze out of its logistics, warehousing and manpower.

Hafary reckons it is doing well in these areas.

4. Barriers to entry: While the business might not seem to have high barriers to entry and could attract many entrants, Jackson disagreed.

"We see fewer competitors and zero new entrants as the capital investment is fairly large. Existing players are getting out and we are taking their market share."

He estimated that Hafary has about 50% of the general market and 15% of the projects market.

5. China losses: Hafary's investment in an associate in China which manufactures tiles has been fully impaired to the tune of $4 million in FY13.

Thus, there will not be any losses to be recognised going forward.

In FY2013, after excluding the one-time gain on property disposal and associates' loss, Hafary achieved net attributable profit of $9.3 million, compared to $4.7 million in FY2012.

Previous story: @ HAFARY's AGM: Rosy outlook for next 2-3 years on HDB building boom