Excerpts from analysts' reports

OSK-DMG reiterates buy call on RH Petrogas

Source: OSK-DMG

Source: OSK-DMG

Analysts: Lee Yue Jer & Jason Saw

RHP’s share price fell by almost 20% on news that the Zircon-1 well did not flow. This is equivalent to a SGD99m loss in market value due to a well costing SGD8m, and whose cost is recoverable.

Meanwhile, the stock is trading at a 44% discount to its production assets alone, ascribing zero value to 1,074mmboe of 2C and prospective resources in appraisal, development and exploration assets.

Reiterate BUY, with SGD1.38 TP.

OSK-DMG reiterates buy call on RH Petrogas

Source: OSK-DMG

Source: OSK-DMGAnalysts: Lee Yue Jer & Jason Saw

RHP’s share price fell by almost 20% on news that the Zircon-1 well did not flow. This is equivalent to a SGD99m loss in market value due to a well costing SGD8m, and whose cost is recoverable.

Meanwhile, the stock is trading at a 44% discount to its production assets alone, ascribing zero value to 1,074mmboe of 2C and prospective resources in appraisal, development and exploration assets.

Reiterate BUY, with SGD1.38 TP.

Yesterday, Devon Energy (DVN US, NR) purchased GeoSouthern Energy’s 400mmboe of reserves in Eagle Ford for USD6bn in cash, equivalent to USD15 per barrel.

Note that Eagle Ford is an unconventional shale field producing light oil, which should have a lower NPV/bbl value compared to RHP’s conventional fields.

This supports our USD14.6-16.1/bbl NPV valuation for RHP’s conventional light-oil assets and our USD10/bbl NPV for the unconventional heavy Fuyu oil.

RHP’s production assets are worth SGD0.90 per share, based on our conservative assumptions.

Note that Eagle Ford is an unconventional shale field producing light oil, which should have a lower NPV/bbl value compared to RHP’s conventional fields.

This supports our USD14.6-16.1/bbl NPV valuation for RHP’s conventional light-oil assets and our USD10/bbl NPV for the unconventional heavy Fuyu oil.

RHP’s production assets are worth SGD0.90 per share, based on our conservative assumptions.

Recent story: RH PETROGAS 'attractively valued', SPH offers 5.1% yield, Sell Ascendas REIT

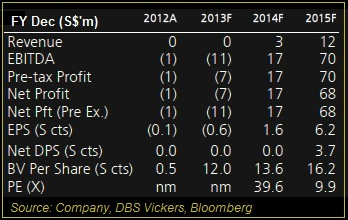

DBS Vickers highlights catalysts for stock price of Rex International

Analyst: Suvro Sarkar

Rex will be investing US$20m for a 67% stake in Rexonic, which will own a proprietary environmentally-friendly, high-power ultrasound technology for commercial oil well stimulation developed by Swiss partner Ogsonic AG.

Rex will be investing US$20m for a 67% stake in Rexonic, which will own a proprietary environmentally-friendly, high-power ultrasound technology for commercial oil well stimulation developed by Swiss partner Ogsonic AG. This technology is intended to replace traditional chemical methods and has been shown to increase oil production from 30% to 380%, both onshore and offshore, according to management.

This JV will target the oil & gas production phase, and being complementary to Rex’s existing offerings in the exploration phase, offers cross-sell opportunities.

Mans Lidgren, CEO of Rex International.

Mans Lidgren, CEO of Rex International. NextInsight file photoRexonic has already signed contracts with three major NOCs and could contribute a recurrent earnings stream within the next few years.

Drill campaigns all on track. Drill results from the first well in Oman can be expected around end-December 2013, and the second well around 40 days later.

While the developments in Oman are likely to be of much interest to the market, Rex is also aiming to drill another 5-7 offshore wells in various areas in 2014, and looking to grow its portfolio from the current 15 licences to 30 licences over the next 18-24 months, potentially providing a constant stream of newsflow and catalysts.

Maintain BUY for 85% upside potential. Our TP for Rex is adjusted down to S$1.15, as we factor in a bigger share base arising from the recent share placement, as well as consideration shares issued to fund the acquisition of the Rexonic stake and an additional stake in Rex Caribbean.

However, we believe the story for Rex remains intact, as highlighted above, and the recent sell down thus presents a good buying opportunity.

Recent story: REX: Recurring income from JV in oil production service