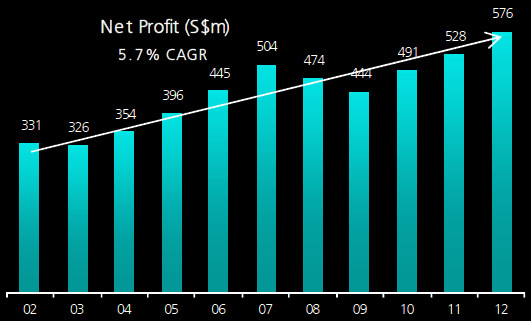

Excerpts from DBS Vickers' report this morning ST Engineering's steady profit track record. Chart: DBS Vickers

ST Engineering's steady profit track record. Chart: DBS Vickers

Analysts: Suvro SARKAR and Janice CHUA

Enviable track record. We recently met up with 35 fund managers on a roadshow in the US with STE’s management team. Investors are generally impressed with the group’s track record over the past 10 years, chalking up revenue CAGR of 9.3%, net profit CAGR of 5.7% and EVA of 8.7%.

Current shareholders have done well to enjoy the ride on ST Engineering’s sterling share price performance over the past 12 months, the stock generating total return of 32% (including dividend yield) notwithstanding the recent pullback.

Strategic growth drivers in place. Key discussion topics during the roadshow revolved around the group’s strategy for growth and possible changes in revenue mix in the next 5 years. Near term growth will come from acquisitions in Aerospace (PTF conversions in Europe), new hangar facilities in Guangzhou and engine workshop in Xiamen, and expansion into the shiprepair business in the US.

Armed with a net cash chest of more than S$500m, the group is well positioned to source for M&A for longer term growth.  Management’s key concern would be to negotiate an environment of rising cost pressure in Singapore due to the curbs on foreign labour, to ensure the group’s competitiveness in the global arena.

Management’s key concern would be to negotiate an environment of rising cost pressure in Singapore due to the curbs on foreign labour, to ensure the group’s competitiveness in the global arena.

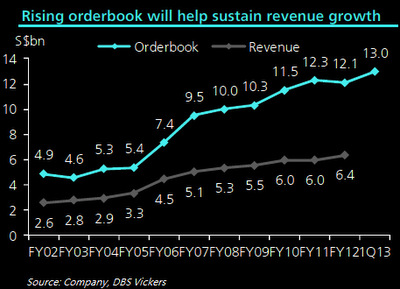

Maintain BUY, TP of $4.80. STE has no exposure to a potentially rising interest rate environment globally, and hence STE remains our preferred pick, offering strong earnings visibility from its record order book of S$13bn, steady earnings growth of 6% and dividend yield of 4.6%.

The stock is a proxy to recovery in the US economy with 27% of sales from the US.

Appreciation of the US$, if sustained, will provide earnings upside. Catalyst for stock performance will come from sustained order win momentum, going forward.