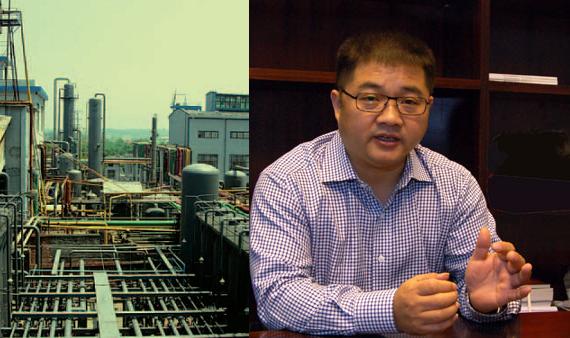

Changjiang Fertilizer executive chairman Zhu Cheng Bao (above) has sold 13.98% of his Changjiang shareholdings to an investment vehicle of tycoon investor Goh Geok Khim.

Changjiang Fertilizer executive chairman Zhu Cheng Bao (above) has sold 13.98% of his Changjiang shareholdings to an investment vehicle of tycoon investor Goh Geok Khim.

NextInsight file photo

JUST TWO months after China's newly sworn-in government rolled out policies to support its agriculture industry, an investment vehicle of GK Goh founder and executive chairman, Mr Goh Geok Khim, has taken a stake in SGX-listed fertilizer manufacturer, Changjiang Fertilizer.

This was via a married deal on 10 April 2013, when Changjiang executive chairman Zhu Cheng Bao sold 50 million Changjiang shares, or a 13.98% stake, to Equinox Investments.

Goh Geok KhimEquinox is 26.8%-owned by GKG Investment Holdings Pte Ltd, which is controlled by the founder of SGX-listed stockbroking house GK Goh, Mr Goh Geok Khim, and his son, Mr Goh Yew Lin.

Goh Geok KhimEquinox is 26.8%-owned by GKG Investment Holdings Pte Ltd, which is controlled by the founder of SGX-listed stockbroking house GK Goh, Mr Goh Geok Khim, and his son, Mr Goh Yew Lin.

Mr Goh Geok Khim remains the executive chairman of GK Goh after he sold the broking business in 2005 to CIMB.

The tycoon is taking a stake in Changjiang at a time when its stock price has recovered significantly despite two consecutive quarters of net losses.

From a trough of around 10 cents during the 4th quarter of last year, its stock price has recovered by a significant 50% to about 15 cents recently -- until it was sold down to 13.8 cents last Friday on light volume of 110,000 shares.

Its stock price has held up this year despite the company announcing on 28 February that its FY2012 net profit attributable to shareholders was down 64.6% at Rmb 33.9 million.

The company is an established producer of nitrogenous fertilizer in Hunan, China.

It had embarked on an aggressive capacity expansion plan that multiplied production capacity by 5.6 times from 2002 to 2011, increasing it to 195,000 tons of anhydrous ammonia a year.

Profits started falling short of expectations in early 2012 after it began suffering double whammies of poor fertilizer demand due to adverse weather conditions and a margin squeeze as a result of China’s inflation.

Mr Zhu's share sale to Equinox was the second major paring down of his shareholdings.

On 14 January, he disposed of 67.4 million Changjiang shares for S$10.4 millon, or 15.5 cents apiece, to a Cai Jian Hua.

This was at a 2012 PE ratio of about 8X and zero dividend yield. The company has not paid out dividends since its listing on the SGX in 2009.

In terms of book value, the stock sale-and-purchase was at just 0.5X.

Cai, who is neither a member of the board of directors nor senior management, has raised his stake from 6.54% to 25.26%, making him the No.2 largest shareholder in the company.

Changjiang's stock price plunged in 2012 after earnings fell short of expectations.

Changjiang's stock price plunged in 2012 after earnings fell short of expectations.

Bloomberg data

Related stories:

SGX Stocks To Reap Harvest From China’s Agri Support

CHANGJIANG FERTILIZER, UNITED ENVIROTECH, BROADWAY: What Analysts Now Say.....