FANTASIA HOLDINGS Group Co Ltd (HK: 1777) has taken full-service real estate operations to a new level, raising it to an art form of sorts.

The Hong Kong-listed firm’s management told a roomful of investors that mixed residential/commercial complexes, perhaps with a hotel thrown in, along with post-sale property management services have led to stellar first-half performance, even in a shaky marketplace.

Speaking at an Aries Consulting-organized Company of the Month event in Hong Kong, Fantasia’s Executive Director and Company Secretary Lam Kam Tong said that the mistake many peers in the property sector made was seeing the “end game” as making the sale.

“We believe it’s important to also provide a wide range of property services to the buyer.

“In other words, the close of the sale is not the be all and end all of the business relationship, but can be seen as the beginning in many cases,” Mr. Lam said.

Having just joined Fantasia this Spring, Mr. Lam has 14 years professional experience, having previously worked as executive director and CFO of fellow Hong Kong-listed developer China Aoyuan (HK: 3883), a major Guangzhou-based property play.

He also served as company secretary and qualified accountant at Hangzhou-based Greentown China Holdings (HK: 3900), one of the PRC’s top residential developers.

Therefore, Mr. Lam would certainly know what it takes to help make a full-service property developer thrive in the vast Chinese marketplace, having worked with so many peers.

In keeping with Mr. Lam’s stated recipe for success for a real estate play in today’s China, Fantasia Holdings describes itself as a leading property developer and property related services provider in China, committed to providing customers with a “full life cycle of housing products and services.”

Most of the company’s projects are located in fast-growing regions of the country, namely the Beijing-Tianjin metropolitan nexus, the Yangtze River Delta, the Pearl River Delta and in the southwestern boomtowns of Chengdu and Chongqing.

Fantasia specializes in Urban Complex Projects in the peripheral areas of existing CBDs within major cities (Tier I and II) or in developing business districts written into the city development plans of local governments.

Fantasia’s target customers are affluent middle-to upper-class individuals and families and high-growth small-to medium-sized enterprises.

Spring Forward

The strategy must be working, as Shenzhen-based Fantasia Holdings had a blockbuster Spring performance.

Contracted sales surged 164% month-on-month to 670 million yuan in March and another 15% m-o-m in April to 771 million.

“And I have an update to the most recent numbers. Our first half contracted sales reached 3.4 billion yuan, so we are well on our way of reaching our full year target of 7.2 billion,” Mr. Lam added.

He said that of the first half total, the Hong Kong-listed firm has already collected on over three billion yuan, which Mr. Lam called "a good cash collection rate.”

The company always keeps one ear close to the ground to get a sense of where macroeconomic policy is headed, as the property sector is one of the most credit-reliant industries and thrives amid a low borrowing-rate environment.

Having just cut interest rates twice in the space of a month, and reducing the reserve requirement ratio not long before, Beijing is making it easier for the country’s property developers to finance debt and add assets to their land banks.

“We were of course pleasantly surprised by these recent moves and expect at least one more credit-easing measure this half. Both RRR cuts and interest rate reductions are equally good news for us,” said Mr. Kenny Chan of Fantasia’s investor relations department.

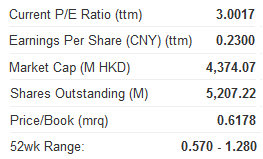

Investors have been attracted to the company’s recent market metrics.

With a BVPS of 1.37 hkd in 2011, the company is trading at FY11 PBR of around 0.60.

And with a 2012E NAV (Goldman Sachs’ estimate) of 3.33 hkd, Fantasia is trading at FY12 P/NAV Ratio of around 0.25.

As of the end of last year, Fantasia held cash totaling 1.336 billion yuan, while the net gearing ratio was 71.4%, maintaining a strong and stable financial position.

This is much healthier than one of the market “leaders” in the industry – Greentown China Holdings – whose current gearing ratio stands at a prohibitive 149%.

“Developers seldom pay out of pocket for new properties. If the asset cycle is relatively short, say 18 months from purchase to turnaround, then a relatively higher gearing ratio is not so dangerous and more manageable.

“In fact that’s the key. Effectively managing a company’s leveraging rate is very important for a healthy growth and expansion strategy,” Mr. Lam said.

He added that 60-70% was a “reasonable” gearing ratio.

“We also have to make use of leveraging to expand our business.”

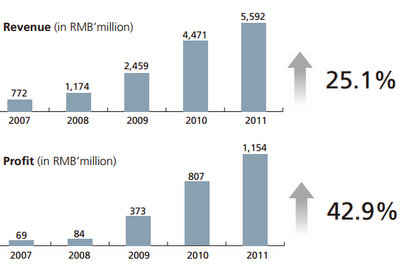

He went on to emphasize Fantasia’s main goal going forward would be to continue with the policies that brought is so much recent success – including a 43% jump in 2011 net profit to 1.2 billion yuan on a top line increase of over 25% to 5.6 billion.

“Our primary focus going forward will be on first and second tier complexes, with commercial/residential mixes and having quicker asset turnover timeframes."

As for the company’s reported plans to seek capital in additional markets, he said the possibility of raising funds in Taiwan was on hold for the moment.

“We haven’t put too much effort into the TDR plan because the market is not very stable at present. We will decide later this year whether to proceed with the plan,” Mr. Lam said.

Founded in the southern Chinese boomtown of Shenzhen in 1996 by Ms. Zeng Jie, the niece of former PRC Vice President Zeng Qinghong, Fantasia listed in Hong Kong in 2009 with an IPO price of 2.2 hkd per share.

See also:

Hong Kong CONDOS, China CARS: Latest Happenings...

THE HOUSE OF TRUTH: China Property Unstoppable?

THROUGH THE ROOF: China Housing Mkt Hits 17-Month High

HOT PROPERTY: PRC Real Estate Shares Up 20% This Year