Translated by Andrew Vanburen from: 避免投資視盲 設定到價響鬧裝置 (中文翻譯, 請閱讀下面)

HOW OFTEN do we watch our money disappear through the cracks during a catchy but crackpot craze?

And how many of us have safeguards like “internal price clocks” in place to protect our investments? Not enough of us.

Photo: iamkoream.com

One night not too long ago, in a city that will remain unnamed, four armed thugs shot a cop dead, which set off a citywide dragnet to find the suspects.

A plainclothes police detective named Miguel happened across the suspects and promptly gave chase.

However, the unlucky sleuth managed to get tangled in a coil of barbed wire installed by the police to cordon off the area.

Not long after, several uniformed policemen arrived on the scene.

But they suddenly cut short their chase of the fleeing suspects, surrounded the ensnared detective, and began flailing at him with their nightsticks.

For in fact they had mistaken Miguel, their brother in arms, as one of those accused of killing their fellow officer.

All of their anger and pent-up rage was taken out on Miguel via a savage revenge-fueled assault.

At the same time, another plainclothes officer named Kenny saw the true suspects across the coils of barbed wire, leapt over the barrier, and quickly apprehended the intended target.

Meanwhile, Miguel lay seriously injured. The officers present suddenly realized their mistake, and were devastated by their overkill.

You may be asking yourselves at this point... What does this crimefighting miscue of catastrophic proportions have to do with the price of tea in China?

Or better yet, how on earth can it inform more intelligent and profit-oriented decisions in the chaotic capital markets of today?

Simple. Before jumping on a “sure bet” recommendation, make sure to initially identify its intrinsic value and redeeming qualities.

In other words, it is highly advisable to first establish a positive ID of the destination of your hard-earned money before committing it to the “beatdown” basket.

Because once you are locked into a certain “sure bet,” you can bet your bottom dollar that if you hitched your wagon to the wrong target, you will have more than your reputation to answer for.

Just ask the short-sighted policemen who bloodied their batons pummeling the wrong killer.

We can learn alot about scouting out fat bottom lines from the the thin blue line.

That is, seasoned and smart policemen will always act with due diligence and extreme caution before pulling out their billy clubs -- let alone their sidearms.

Likewise, in the world of share investing, nothing prevents rash action like a well-established "internal price clock" to keep us from succumbing to mob-rules behavior.

Good companies lecture on the need for due diligence. This should also describe successful investors.

See also:

ALEX WONG: Keyhole Investors Seldom Succeed

ALEX WONG: Don’t Blame The Shorts

避免投資視盲 設定到價響鬧裝置

某夜,某城市。

四名匪徒,槍擊警員,周遭警力全城搜捕。便衣探員米高,發現其中一匪,隨即追捕。匪徒跳過鐵絲網,米高卻被鈎住。數名軍裝掩至,他們沒去追賊,卻將米高拖下,就地圍毆。原來是誤認米高為打傷同袍的疑犯,火遮眼下有仇報仇。同一時間、同一地點,另一便衣肯尼,就在米高被打現場,飛身越過鐵絲網,追捕該匪。打了半响,米高重傷,眾軍裝方才發現殺錯良民,立即一哄而散。

非關鍵者視而不見

最後肯尼捉到匪徒,卻差點一齊收監。因為在米高被打案的聆訊中,肯尼供稱不見軍裝打人,甚至無見到米高。肯尼被認定作偽證扯貓尾,雖然最終不用坐牢,仍被革職。無人相信一個警察,會完全不見身旁發生的事,除了兩個大學教授:Chabris和Simons。兩人進行「選擇性注意」實驗,已有十年時間。大家也可一試,Youtube關鍵詞:selective attention test。在此先不談實驗情節,方便大家進行。實驗結果,是一半人會對明顯、但沒預期會出現的事物,全然視而不見。

直覺上,凡是相當突出的事項,應能引起注意。但注意力是有限額的,當我們聚焦在某一項目,另一項得到的關注便會減少。注意力集中下,可以更準確地見到預期會出現的事物;相反,對任何非目標的物體,很容易錯失。在進行關鍵事項的時候,情況尤為明顯。肯尼身負追捕任務,心中對「獵物」早有印象,一經鎖定,便能全力集中,窮追不捨;而同場出現自己人打自己人,對局外人是很明顯,例如被肯尼逮捕的犯人,就供稱跳過鐵絲網後,回頭望見米高被打一幕(大概因為犯人要留意的,是所有追捕自己的警察),但肯尼事前難以想像有此「奇景」,所以沒看到,也不出奇。

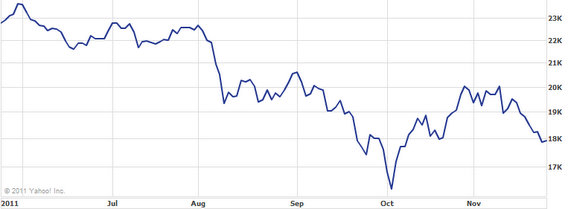

在波動的市況下,我們同樣容易出現「不注意視盲」。新近的宏觀消息,最令人注意,相當於對講機中,傳來疑兇形容:歐債危機?鎖定目標:指數期貨、金融股、外匯,大加鞭韃,至死方休。到殺完一圈,走勢反轉,甚至回升至原地,才會驚覺:之前誓神劈願,一見洗倉就撈的股份,也已先跌後升,但大市爆炸途中,似乎並不覺它們下跌。例如恒隆(101)轉眼間已完成幅度三成的V形,股價回升至八月份水平。領匯(823)上落兩成,也是在兩周內完成。

心水股每日睇圖

每天望着同一版股價跳動,卻錯失低吸機會,是因為太集中追鞭風眼類別,看不見很少出現、沒有預期的個股大瀉。警察捉賊,是性命相搏,見不到自己人,也無可厚非。我們卻可設定路徑,去改善這個問題:可在想撈目標股份的價位,設定響鬧裝置;或準備一張心水清單,每日收市後,逐隻睇圖(睇圖比只睇價好,較形象化,容易知道跌成點)。由此逼令注意力,從狂鞭的沽空行動中暫時抽離,才有望發現筍價。

請閱讀:

Shareholders Blast NEW WORLD DEVELOPMENT Share Offer

Out Of This World: ARMARDA Involved In Huge Mobile Satellite Deal