UOB: PRC PROP ‘top picks’ COLI, AGILE, CRL, SOHO CHINA; GLORIOUS ‘dark horse’

UOB KAY HIAN says “natural selection” is helping weed out weaker real estate firms in China, and is ‘overweight’ on the often volatile sector.

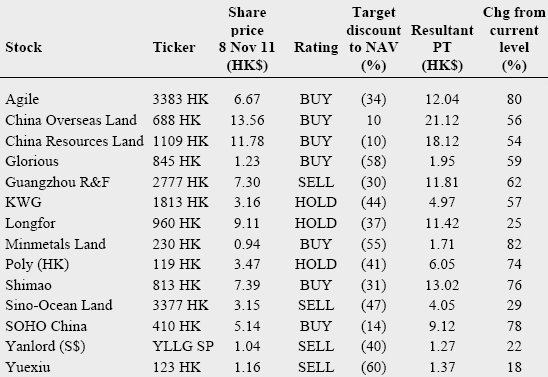

Top picks include China Overseas Land, Agile Property, China Resources Land and SOHO China, with Glorious Property as its “dark horse.”

Borrowing the natural selecton idea from naturalist Charles Darwin, UOB said: "A challenging operating environment allows well-managed companies to grab market share and expand at the expense of the weaker ones."

The brokerage assessed companies based on 16 parameters in the categories of financial management, landbank quality and growth potential.

It found that Longfor Properties, China Overseas Land, China Resources Land, SOHO China and Country Garden all had characteristics needed to succeed in an often topsy-turvy market.

"In contrast, Yanlord Land, KWG Property, Guangzhou R&F Properties, Sino-Ocean Land and Yuexiu Property could lose out in the race."

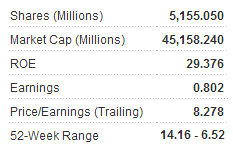

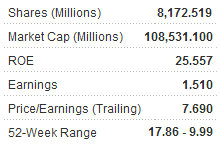

UOB added that despite several valuation recoveries among Mainland China’s Hong Kong-listed property developers, valuations are “still distressed.”

The sector as a whole is trading at a 46% discount to NAV, below the historical mean discount to NAV.

“The key risk to our outperform call on PRC’s property sector is if the overseas crisis drags the world into a recession again,” UOB said.

But Mainland Chinese real estate firms were not just hostage to events overseas.

“The rapidly-changing and often hostile (due to government policies) Chinese property market is immensely challenging for developers. But such an operating environment allows well-managed companies to grab market share at the expense of their weaker counterparts which will be forced to downsize.”

UOB added that a “successful” developer needs to be “led by an insightful, effective and ambitious” team of managers.

“Currently, the stock market focuses mainly on financial management and how well a developer can sell its products. Here, we conduct a more vigorous exercise to assess developers using 16 parameters under four broad categories. This exercise will also allow us to know more about these companies, most of which have a listing history of less than five years.”

Financial management – Cash flow prospects in 2H11 and 2012, current gearing, near-term liquidity position and funding costs.

Landbank quality – Timing of acquisitions (ie whether landbank is cheap or expensive), exposure to lower-tier cities (smaller cities will become the future growth drivers, and early birds will enjoy a head start) and landbank duration (too big a land reserve is a balance sheet burden).

Growth potential – Contract sales growth in the last four years (a good track record provides confidence in future prospects); gross margin (a high margin leaves more room for price cuts in a slow market); 2012 ROE, ROA and asset turnover (near-term growth outlook); 2012 revenue lock-in (assuring for investors as uncertainty on the sector outlook looms); setting the right targets (shows how well management knows the industry and the company), and weathering adversity (management quality is best reflected during tough times).

Other factors – Parental backing (state-owned enterprises will continue to attract a premium rating in this policy-driven sector) and market capitalisation (large companies generally have more resources to allow them to grow bigger still).

“We covered 16 companies in this exercise. Longfor Properties has emerged as the stock with the highest ranking in our exercise, followed by SOHO China, China Overseas Land and Investment (COLI), China Resources Land (CRL) and Country Garden. These are the more all-rounded companies and possess the quality of being a market leader,” UOB said.

On the other hand, the brokerage said Yanlord Land, KWG Property (KWG), Guangzhou R&F Properties, Sino-Ocean Land and Yuexiu Property rank the lowest in its league table.

“While they have different shortcomings, they generally are lagging behind in terms of sales, which could be a long-term issue given that China’s property development operates on a volume-driven model. Slow sales also directly affect their liquidity outlook.”

See also:

BAOFENG: Aiming To Crystallize New Orders With Swarovski

FOCUS MEDIA: Capturing Captive Audiences In Singapore, Hong Kong