Excerpts from latest analyst reports…

Nomura downgrades CONTAINER SHIPPERS to ‘bearish’, more downside to come

Nomura Equity Research says that despite the recent share price correction of Asian container stocks, it believes there is more downside to come, and now expects the sector to remain loss-making for the rest of the year.

Nomura believes the 3Q11 peak season will disappoint, preventing carriers from pushing through crucial freight rate increases (peak-season surcharges or general rate hikes).

“Thus, we expect the container sector to report full-year losses and signs are emerging that growth from the developed world could slow. Oil prices remain high and bunker surcharges would be insufficient to cover the bunker oil cost. We think 2012 is likely to see a return to profitability, but this is overshadowed by uncertainties in 2H11.”

Nomura said the container shipping sector recovery is taking longer than expected.

The house has a ‘reduce’ rating on CSCL (HK: 2866), and is cutting OOIL (HK: 316) to ‘neutral’.

CSCL margin pressure from high spot leverage and increasing costs

With Nomura’s forecasts showing a decline in freight rates (-7.3% overall in 2011F), it believes CSCL will register losses this year given higher spot exposure (40% spot in Trans-Pacific and 90% spot in Asia-Europe). Further, with fuel costs accounting for 27% of total operating costs, higher bunker costs are likely to lead to margins pressure as CSCL has not entered any hedging agreements this year due to growing bunker costs.

Maintain CSCL’s REDUCE with revised TP

Nomura is lowering its SOTP-based target price to 2.20 hkd from 3.40, valuing the shipping business at the mid-cycle P/BV minus 1SD (0.6x) to its FY11F book to reflect its expectation of losses this year (previously mid-cycle P/BV of 1.0x).

“For the port business, we continue to apply a target P/BV of 1.4x to 2010 book (assuming the same book in FY11F to be conservative). Upside risks include further asset injection, a return to profitability for the domestic China route, a sharp rebound in freight rates and faster than expected global economic recovery.”

OOIL cut to NEUTRAL from BUY

“Despite our expectation of lower average FY11F container freight rates (-7.3% y-y) coupled with higher bunker costs (37.5% y-y) in FY11F, we estimate OOIL will remain profitable in 2011 due to better cost control and it being a premium carrier,” Nomura said.

Nomura says it thinks OOIL was one of the only liners making profits during 1Q11, and furthermore, special dividends look unlikely.

“With only 1.6% potential upside to our new target price of 57.0 hkd (from 84.00), we downgrade our rating to NEUTRAL (from BUY),” Nomura said.

Its revised target price is based on a 1.1x mid-cycle P/B for non-property business and end-2010F property book value (unchanged).

Company-specific risks include aggressive fleet expansion. Upside risk includes effective cost control. Downside risk includes an aggressive new building/ordering spree.

See also: YANGZIJIANG Finally Gets Seaspan Contracts - What Do Analysts Say?

UOB Kay Hian: OVERWEIGHT on PRC CEMENT SECTOR

It’s time to review

The cement sector is one of the best performers ytd due to sustained pricing coordination and rising pricing power of cement makers. China National Building Materials (CNBM) and Anhui Conch outpaced the benchmark Hang Seng Index by 58.6% and 27.2% ytd, respectively. While UOB says it remains bullish in the long term, it sees increasing uncertainties in downstream sectors, which neutralizes its near-term outlook.

Negatives may arise in the coming two months: With the CPI rising strong this spring, UOB says China’s monetary tightening measures will continue in the near term, especially after May's CPI rose 5.5% y-o-y, a 34-month high.

"Fixed asset investment (FAI) – the number of newly-started projects – has dropped 9.4% y-o-y in 1Q11, meaning mass construction activities have cooled down. As newsflow on affordable housing projects and other demand drivers have yet to come, given the uncertainties ahead, a vacuum in fresh positive news is unfolding in the near term," said UOB.

Excellent performance to end: Building materials stocks outperformed the market in the last interest cycle in 2007. Anhui Conch advanced 118.2% from October 10 to end-May 2011, versus HSCEI’s 12.6% rise over the same period.

"After the fifth interest rate increase in 2007, Anhui Conch dropped 8.4%, underperforming HSCEI’s -1% in terms of three-month performance. As the market expects further interest rate hikes going forward, the strong share price performance may not persist over the near term."

See also: MAN WAH: Sofamaker’s FY11 Sales Surge 30% To 3.8 Bln HKD, US Mkt Afire

AmFraser: PRC TEXTILE/APPAREL sector ‘bounced back with vengeance’

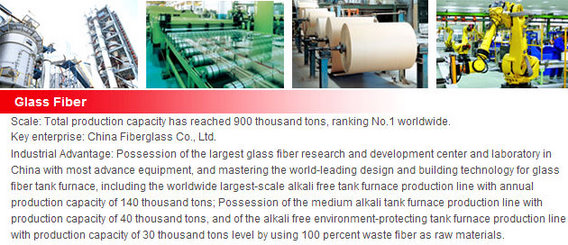

AmFraser says China’s fibre and textile industry remains an important pillar of China’s economy, last year amounting to RMB4.8 trillion, or 12.0% of China’s 2010 GDP.

“Furthermore, despite the oft-cited criticism that it is a ‘low-technology’ industry, it showed its resilience during the 2008 financial crisis -- China's textile exports fell 9% in 2009 from 2008, while the country’s overall exports declined by a hefty 16% during the period.

“With the global economic recovery, China’s textile and apparel industry has bounced back with a vengeance.”

China’s textile and apparel exports hit a record high of USD206.53 billion in 2010, a y-o-y rise of 23.6%. Textile exports amounted to USD77.05 billion (up 28.4%), while clothing and apparel exports made up the remaining USD129.5 billion (up 20.9%).

Industry Outlook

According to China’s National Textile and Apparel Council (“CNTAC”), fixed asset investment in the industry increased by 26.4% y-o-y to RMB222.98 billion.

Domestic consumption, export growth, structural changes due to government policies, rise in the cost of raw materials, increasing labour cost and labour shortages and an appreciating currency are all key factors worth monitoring.

"Within China’s textile and apparel industry, we believe that the companies operating in the niche ’performance fabric’ segment has the best outlook in the short- to medium-term," AmFraser said.

These companies would be able to differentiate their products through their technical capabilities and therefore, command better margins than more commoditized products like yarn and fibre. They would also be in-line with the PRC government’s aim to promote ‘technical fabrics’ and R&D within the industry.

AmFraser added that recent accounting and corporate governance issues have given S-chips (i.e. Chinese companies listed on the SGX) a bad name and have led to their general underrating by the market. However, from a risk/reward perspective, AmFraser believes this is a good time for investors to cherry-pick from the long list of severely-battered textile S-chips.

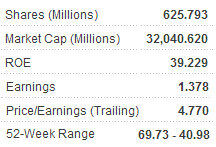

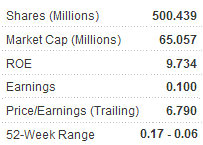

Foreland Fabrictech Holdings Ltd and China Taisan Technology Group Ltd are two S-chip textile plays that AmFraser believes are in the right segment at the right time to benefit from the potential robust growth in the industry.

"We visited Foreland at their Fujian factory and came away impressed. We highlight the stock with a BUY recommendation and fair value of S$0.215. After studying their listed peers on the SGX and HKEx, we peg a 5x P/E valuation on the Group’s FY2011E EPS of 4.3 SG cents to arrive at our FV."

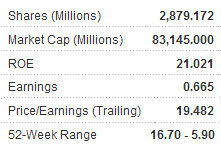

"We also visited China Taisan recently at their Fujian factory. We believe the Group is in the right segment at the right time with performance fabric manufacturing poised to benefit from robust demand.

"We herefore highlight the stock with a BUY recommendation and fair value of S$0.25. This represents a 78.6% premium over the last close price of S$0.14. After studying their listed peers on the SGX and HKEx, we peg a 7x P/E valuation on their FY2011E earnings of 3.6 SG cents to arrive at our fair value."

See also: CHINA TAISAN: On Track For A Strong Rebound In 2010 Profit