Translated by Andrew Vanburen from 提升投資功力 首戒依賴傳媒 (中文翻譯,請看下面)

TO REALLY prosper in the capital markets, I think it is often necessary to take what the financial media says with a grain of salt.

Take the recent triple disaster in Japan, for example, which is still making headlines over a month later.

But after a few short days, sentiment suddenly picked up again – even as some areas were still inundated with tsunami-caused floodwaters.

Markets picked up and trading turnover returned to pre-quake levels on many regional bourses.

I recall a newspaper column written around a month ago which said: “In order to achieve objectivity in all things, it is best to avoid an overreliance on the mass multimedia, especially oversensationalism in the press. And when investing, it is wiser to make buying and selling decisions based on your everyday experiences and observations than on anything you hear on TV or read in the newspapers.”

I would agree.

I think the best way to hone your skills and efficiency as an investor is to exercise caution and scrutiny when consuming media reports, and do a bit more self-starter type research on companies, sectors and trends.

In other words, rely more on your own legwork and less on that of the media.

You will be surprised at how much you can learn by researching stocks on your own and coming to your custom-made conclusions.

Maintaining objectivity amid turmoil

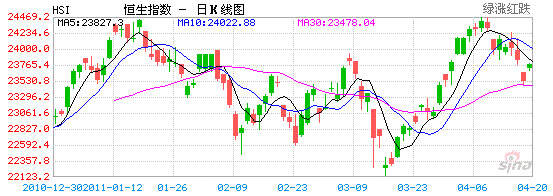

Hindsight is always 20:20, so let’s take a look at what happened to regional markets last month.

There were at least two somewhat absurd market reactions to the Japan earthquake.

First, when the earthquake first struck on the afternoon of Friday, March 11, the event ushered in broad selloffs on regional bourses for three consecutive trading days in an atmosphere of widespread panic.

Curiously, Hong Kong’s Hang Seng actually opened Monday, March 14 with an upward spike, but then fell back into panic mode trading as the day wore on.

It seemed that the Hong Kong market was even more frantic than Tokyo’s, even though people in Japan were the ones directly impacted by the temblor, with thousands made homeless and forced to line up for rice and water outside temporary shelters.

And regarding the ongoing anxiety over the radiation leaks at the Japanese reactors and the salt-hoarding phenomenon seen in the region... it all boils down to fear and the survival instinct, which people learn to rely on with exquisite perfection via the mass media's scare-tactic reporting.

There may have been a few cases of Mainland Chinese buying a “lifetime supply” of iodized salt, especially in the northeastern provinces closest to Japan, as it quickly became common knowledge that consuming such a commodity in copious amounts was a relatively effective way to ward off radiation poisoning.

But when the media began reporting on the low-level phenomenon, peer papers and channels needed to outdo the hype, and in order to boost ratings, reporters and cameramen would scour the supermarkets looking for empty shelves that normally were full of salt, and paint a picture of doom and gloom... and greed.

This of course had a positive stimulation effect on consumers of both salt and leafy vegetables who felt their neighbors were stocked up and they better do the same... and pronto.

It’s all about the ratings, you see. Daily broadsheets and TV news – especially in this IT era of free information 24-7 – feel tremendous pressure to scream out the headlines that will attract the most attention – and advertising revenue, while letting accuracy be damned.

“Tokyo paralyzed by nuke fears,” “Radiation sends people scrambling to the four winds” and “Eastern Japan a wash” were all headlines that screamed out for attention across the region shortly after the original earthquake. They may sell papers and glue eyes to TVs... but they are far removed from reality.

The same can be said for financial reporting.

When an outlet (or house) is just a bit too gung ho on a particular counter or sector... you know it’s time to add a pinch of salt.

Just don’t go hoarding it like the Chicken Littles in northeast China.

By diversifying your sources of information, and doing a bit of old-fashioned legwork when it comes to company research, you will be a better investor in the end and ultimately be able to determine on your own just when the sky might be falling... if at all.

See also: JAPAN TRAGEDY: How Will China Shares Respond?

提升投資功力 首戒依賴傳媒

(文: 黃國英, 豐盛融資資產管理部董事)

日本地震,倏忽逾月。

地獄變天堂,恐懼轉貪婪,財富大幅轉移。當時曾在報紙專欄寫過:「要做到客觀抽離,應盡量避免過份倚賴大眾視像傳媒…日常生活小習慣,同樣會左右投資決定。」

事實上,要提升投資力,審視自己接收、分析訊息的習慣,是乏人注意,卻功效甚高的一招。

大難當前客觀抽離

後見之明,當時市場反應,有兩大荒謬之處:首先,地震是三月十一日星期五發生;市場要到十五日,才忽然極度恐慌。更神奇的,是十四日恒指竟開低收高、倒升收市,完全唔驚。再者,後來港人卻比日本人更驚惶:日人深受其害,卻排隊買米;港人隔岸觀火,竟瘋狂搶鹽!

「盲搶鹽」現象,只要理解「獎勵機制」,就會明白傳媒是何等「功不可沒」。傳媒非善堂,賺錢求存,為重中之重:電視 求收視,報刊求賣紙,不難理解。而高收視的新聞,例必撻到爆燈,感情洋溢至極,才能引人注目。至於準確與否,對比收視銷量,只能盡量兼顧。當時本地報紙的 頭版標題:「核恐慌罩東京」、「輻射人四圍飛」、「東日本全毀」,何其扣人心弦,但偏離現實

回想去年歐債危機時,預言歐元滅亡,報導排山倒海;一年後,歐元兌美元,竟逼近1.5的歷史新高!金融海嘯時,眾大熊人評論員,每天出沒各大傳媒,預言大蕭條將至,誰知樓價反逼近97。01年911,電視每天重播飛機撞入世貿,多少人誓神劈願一輩子不再坐飛機,回教恐怖分子將稱霸地球?結果國泰(293)創了歷史新高。

當靠視像難知真相

由此推論,當「災難」發生,希望從傳媒報導,了解事實「真相」,評估事件的長遠影響,再作投資決定,等同財務自殺!災難當前,死、傷、慘、痛、哀、愁,基於獎勵機制,必定鋪天蓋地充斥傳媒。就算有看通看透的高人,告訴記者:「其實當年切爾諾比爾事件 (Chernobyl disaster),並沒令烏克蘭全滅。核電廠事故,跟核彈爆炸不同,是沒有蘑菇雲的。地球是圓的,而輻射線不懂以拋物線飛上大氣層,再射落嚟香港。輻射塵不會立即飛到香港,因為東京坐飛機來港,都要幾粒鐘,輻射塵應該快唔過飛機…」,基於獎勵機制,能出現在傳媒頭版顯眼位置,機會微乎其微。

無須盲目排斥傳媒報導。存在即合理,人總不能每件事件,都親身到現場理解,總得有記者赴湯蹈火,不畏艱辛,前往報導。只是凡有重大事件出現,要小心自己的分析,被排山倒海的報導,撻到完全被感性、感覺主導。正如自己寫過:「要做到客觀抽離,應盡量避免過份倚賴大眾視像傳媒,因為廣播時間有限,只會集中在少數大新聞,兼且畫面有感染力,令觀眾情緒容易去到極端。反而應主動上網,或者多看篇幅限制相對較少的文字傳媒。」 找性格冷靜抽離的朋友分析商量,亦是一法。

請看: HK SHARES: Japan, Global Recovery, Mideast Crisis, PRC Rate Action All At Play