Translated by Andrew Vanburen from

全國網絡完備 中金再生佔盡地利 (中文翻譯,請看下面)

“IF YOU gain a foothold, and so does your opponent, sometimes it’s better to take a defensive position so you don’t lose the advantage you already have,” says one of the many analects from Sun Tzu’s masterpiece: The Art of War, written in the sixth century BC amid the tumult of the late Spring and Autumn period.

Sun Tzu, the most famous of Imperial China’s war strategists, has seen his highly treasured tome translated into numerous tongues and used by not only armies for good and evil alike, but also by businesspersons and investors looking to stay a step ahead of the competition and the Street.

What does this all have to do with China Metal Recycling (Holdings) Ltd (HK: 773), China’s No.1 scrap metal recycler?

Alot, actually.

It is hard to separate the recent fluctuation on the Hong Kong Stock Exchange from the foreboding sentiment associated with the financial, natural and political upheavals afflicting the western democracies, Japan and the Arab world, respectively.

In fact, I think it is more mood than fundamentals that is driving the market these days.

Last month, Japan’s biggest earthquake ever was enough to shake the world’s financial markets, given how close it was to the capital Tokyo.

But then shortly after, we all watched in terror the footage of the ocean moving across the Japanese countryside, seemingly in slow motion, but with enough power to move entire villages several kilometers inland and destroy nearly everything in the waves’ path.

And just as the world was coming to grips with the enormity of the twin natural disasters to strike the world’s No.3 economy, we began getting wind of a looming nuclear crisis which to this day we still do not know the extent of, and perhaps never will.

Uncertainty is the biggest enemy of the equity markets, and what could be more uncertain than an unresolved nuclear emergency involving several reactors just 250 kilometers from Japan’s most populated metropolis?

This produced an exodus of epic proportions on the Nikkei with valuations plummeting and turnover slowing to a crawl in the days after the initial quake.

Despite the rise of China, Asia’s second biggest economy’s importance in the financial world was demonstrated when regional bourses in Hong Kong and the PRC all took major hits following the initial meltdown of the Nikkei.

However, a short two weeks after the temblor, cooler heads suddenly prevailed in Hong Kong and the Hang Seng quickly rose to 23,850 from just 22,000.

The markets acted very much like a schizophrenic patient, with as divergent a personality one day to the next as diversity among characters in the famous Chinese novel Journey to the West.

And this herd mentality characterized by panicked selling, then re-buying, is also the meticulously spelled-out recipe for disaster – the strategy for slaughter – that Sun Tze often warned of in his renowned novel The Art of War.

What goes up...

If emotion-based trade is dictating short-term market behavior, then business performance is doing the same for the longer term investors. Emotions, after all, can only impact a listed firm’s valuation, but have little raw effect on its value.

Bandwagon buying and selling is behind a lot of the volatility these days, with global crises and conflicts fueling the fire.

For many companies, whether directly affected or not by the myriad problems plaguing the world, the only thing keeping them grounded in reality is the critical mass of long-term investors willing to ride out the emotional rollercoaster until the amusement park ride is over and the attendant raises the safety bar.

Surely these are the individuals (or institutions) who will benefit most from the ride, both emotionally and monetarily.

For they know the structure of the rollercoaster is sound and that the speed and seeming instability of the car as it careens though the loop-de-loops is all part of the owner’s plan and included in the game, and at the end of the day, the car has only a miniscule possibility of derailing at any particular moment.

Daring riders know the risks, and the rewards, and even get a certain thrill out of the idea of the institution of risk itself, although it is managed meticulously by regulators and engineers of the park thanks to regular inspections.

Yet some carnival goers still bail out just before sitting down in the cold metal bucket seats of the fast-moving attraction, and jump to the back of the line in a vain attempt to reinvigorate a battered semblance of courage.

But by the time they finally get their ride in, some revelers have been on the attraction two, three times, and the gates to the theme park are about to close as darkness falls.

China Metal Recycling

China Metal Recycling (Holdings) Ltd (HK: 773; CMR), listed these last two years on the HKSE mainboard, has not been immune to the valuation rollercoaster over the period.

But I believe that the Guangzhou-based firm, China’s largest recycler of scrap metal in terms of revenue, is one amusement park attraction worthy of waiting in long lines to ride.

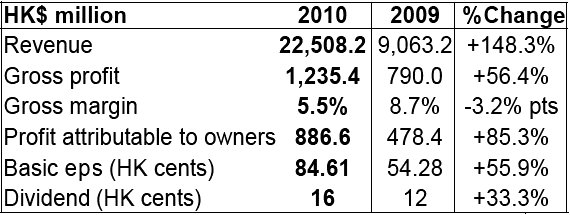

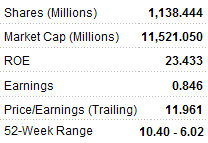

It has just announced that its top line in 2010 shot up 148.3% year-on-year to 22.51 bln hkd producing an 85.3% rise in net profit to 886.6 mln.

Basic earnings per share increased 55.9% to 84.61 HK cents, and the board recommends the payment of a final dividend of 16 HK cents per ordinary share for 2010.

Sales volume of ferrous metals and non-ferrous metals were approximately 1.57 mln tons and 360,000 tons, respectively, accounting for 22.6% and 77.4% of CMR’s total revenue during the year, with both categories roughly doubling on the year.

And looking ahead to full-year 2011, management said it expects turnover to increase by around 40%.

Another major plus for the firm is its highly integrated procurement, sales and distribution network.

Its Guangzhou and Zhongshan bases give it a solid beachhead in China’s south, near to the manufacturing core and with excellent rail, highway and sea transport links.

Its facilities in Jingying and Ningbo give it a coveted foothead in prosperous Jiangsu province, with its numerous clients and metal processing plants.

And its presence in the sprawling northern Chinese municipality of Tianjin allows it to expand to further serve the region, both logistically and in terms of capacity growth.

Therefore, the company has enough of a strategic geographic advantage to keep its hold on top spot in the country’s metal recycling market, and CMR would do well to take Sun Tzu’s advice to heart:

“If you gain a foothold, and so does your opponent, sometimes it’s better to take a defensive position so you don’t lose the advantage you already have.”

These factors are certainly enough to get the attention of most investors, recent global market trepidation notwithstanding.

See also: BRIGHT WORLD, TECHCOMP: What The Edge S'pore Reported...

全國網絡完備 中金再生佔盡地利

(文: 黃國英, 豐盛融資資產管理部董事)

「我得則利,彼得亦利者,為爭地。爭地則無攻。」-《孫子兵法》

股價短線波動,幾近全由情緒主導。日本核電廠爆炸,人人嚇得肝膽碎裂,棄股斬倉者,不計其數,人如潮湧,馬似山崩,自相踐踏,亦恐慌至極。兩週後,眾又忽然恐懼變貪婪,恒指由22000點邊,挾到23850有多。市場人格分裂,原理就像電影《西遊記》,至尊寶明明見到同一個人,一時會係紫霞,一時會係青霞;一時呵你,一時鞭你,好難觸摸。

升勿喜跌勿亂

短線看情緒,長線看經營。情緒只能影響價格,對價值的影響,卻微乎其微。對家明明只懂睇圖,人多擠逼拼死買,再作個淒美動人的FA古仔壯膽,何不笑而不語,「你嘅」,貴出如糞土,捨得沽貨。到對家一手都係,價跌、圖表惡劣,心情沮喪,先怨、後罵、神「瘋」大成而終自宮,滿腦子世界末日時,賤取如珠玉,唔駛卸佢。口訣:升勿興奮狂喜,跌勿自亂陣腳,財上平如水,心平如鏡。拙新作《決勝在期權》已詳述,不贅。

感受市場情緒細微變化,左穿右插,以快打慢,非人人所能。手腳慢,則可以價值為本,聚焦公司經營,以極慢打極快,以耐心換公司成長,懶理當中市價起伏、流言蜚語,業績如對辦,續持,以注碼控制風險。道理如此簡單,執行卻是如此困難。

中金再生(733),上市近兩年,股價起起落落,淘盡多少suckers?多少往事,已盡付笑談中。剛公佈了去年全年業績,營業額由2009年的90億,升至2010年的225億。產量由09年的76萬噸,倍增至193萬噸。去年賺近9億,按年升近九成,增長令人滿意。

展望2011年,管理層預期營業額增長四成。預期毛利率亦會低位反彈,如能由2010年的5.5%,上升一個百分點,連同營業額上升,毛利可望由12億升至20億(假設廢鋼及廢銅的價格變化不大)。由於公司為輕資產模式,只要固定成本控制得宜,盈利增長的動力,應能維持。

更重要的是,公司全國的採購及銷售網絡已成形。廣州、中山,是為南方基地;江陰、寧波,靠近江浙客戶;天津基地擴產,劍指河北、內蒙各大鋼廠;武漢廠房一旦落成,全國網絡基本完備。廣東、江浙、天津、武漢,皆為全國鋼廠群聚之地,屬兵法中的「爭地」。所謂「爭地」,梅堯臣曰:「形勝之地,先據乎利。」曹操注曰:「當先至為利也。」先發而佔,其利大矣。

負債急增毋需過慮

人們較關注的問題,不外是應收帳款上升,及銀行貸款增加。其實兩者均毋需過慮:應收帳款及票據,分別上升191%和189%,看似嚇人,但與營業額增幅148%相比,實屬合理。銀行短債增加約25.1億、長債3.5億,全數可在存貨、現金及銀行存款中反映:存貨增加10億、現金及已質押銀行存款增加21.4億,當然存貨的增加,有部份是由於金屬價格上升。

請看: XINREN (PE 5.5) To Ride On Aluminum Demand Boom And Expanded Capacity