Vivien Ho is a former analyst, and currently contributes stock analysis to a HK magazine, Capital Weekly, on a regular basis.

Translated from 勝獅業績強勁,前景仍不俗 by Andrew Vanburen

JAPAN’S TRIPLE TRAGEDY notwithstanding, the ongoing global economic recovery is raising prospects in the shipping sector.

And for Singamas Container Holdings Ltd (HK: 716), the resulting container shortage is providing even more revenue upside.

Because margins in the sector have traditionally been relatively low, the existence of a monopolistic situation by a handful of global players and the industry entry barrier being extremely high, the worldwide container manufacturing business more or less stood still in 2009.

But with the gradual and sometimes stuttering global financial recovery underway at present and the continued overperformance of the PRC economy – now the world’s No.2 – demand for shipping containers are likely to continue evincing a decidedly robust return to demand.

In 2009, annual global output was 500,000 units, with this number expected to skyrocket to 11 mln units by 2013.

And due to the rapidly rising demand, per-container selling prices are have already from around 2,155 usd in the first half of 2010 to 2,900 usd currently.

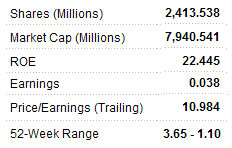

Singamas is primarily engaged in the manufacture of shipping containers and the provision of marine cargo logistics services, and is currently the world's 2nd largest container maker with a 2010 global market share of 23%.

Its 2010 revenue rose to 1.373 bln usd, up fourfold year-on-year.

Net profit was 92.541 mln usd or 3.84 cents per diluted share, swinging from a loss of 51.914 mln or 2.97 cents per diluted share a year earlier.

The group's strong performance in 2010, following a difficult spell in 2009, is primarily attributable to an across-the-board turnaround in global trade as the world worked its way out of the financial crisis that struck in 2008, as well as higher selling prices for shipping containers.

Last year witnessed a 688% increase in container sales to 612,000 units, with dry bulk containers accounting for 88.6% of these sales. In 2010, specialized containers including refrigerated units made up 19% of total container revenue.

Singamas management expects this proportion to rise to 40-50% over the next 3-5 years as they enjoy margins of around double those for traditional marine containers. This greater composition of higher-margin products is expected to bring tremendous financial benefit to Singamas going forward.

Average container selling prices last year rose 21% from a low of 2,403 usd to a high of 2,960. Thanks to continued strong demand, average selling prices (ASP) for containers is therefore quite likely to break through the psychologically significant 3,000 usd/unit level in the near future.

Even more reason to be sanguine on Singamas and the sector as a whole is the current order high-season – traditionally the second and third quarters – coupled with the actuality of strong incoming orders, that should produce another memorable year for the company.

Singamas’ order book for January-May 2011 currently stands at some 300,000 TEUs, and it is very likely the company will continue to boost capacity to meet these and other commitments.

During the global financial crisis which began in mid-2008, shipping sector firms significantly reduced new vessel and container manufacturing operations, and delayed replacement of aging vessels and containers.

Now with the global economic recovery apparently underway in most major markets, order recovery is also following suit.

In 2009, Singamas only produced 86,600 TEUs, a total which leapt to 636,000 in 2010.

This year, industry experts predict that the global demand will exceed three million units of 20-foot standard shipping containers.

And thanks to ongoing capacity expansion efforts, Singamas with its expected end-2011 capacity of 850,000 containers, is likely to be very well positioned to ride the wave of incoming orders for marine containers.

Analysts expect that over the next 60 days, there is a 60-70% chance that shares of Singamas will be trading higher than current levels.

Assuming market stability going forward, the target price should be 3.65 hkd.

See also:

PRC BANKS: Newly-Listed Chongqing Bank A Rising Star