Translated by Andrew Vanburen from 掌握财务分析 莫买股如买厨具

OLD MARKET HANDS will always tell you to see which way the wind is blowing before you set sail.

They also remind us that when shopping for good buys on the stock market, seeing is believing, a fool and his money are soon parted... and if something sounds too good to be true – it probably isn’t true.

Others advise investors to consider the bourse a big poker table, and the only ones who will walk away with the chips are those that not only know the rules of the game, but the strategies to win.

Street promoters and hawkers also have to know how to play the game, because they too have products to sell. And they can change their tactics mid-stream, chameleon-like, in response to the relative interest levels or crowd size of the audience at hand.

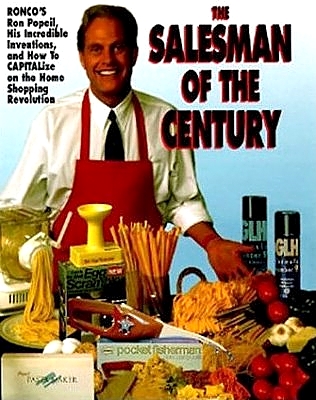

This brings me to the star of this somewhat lost art – Ron Popeil, the king of kings in the US when it comes to promotional sales pitches, a man who has been called “Salesman of the Century.”

Don’t need it? Don't buy it!

The Popeil dynasty specializes in kitchenware, and they make what they market, with their offerings being best known for their innovation and user-friendly characteristics.

Ron Popeil realized on that his biggest burden was not the competition, for there was little at the time that he roared onto the television ad scene.

But instead, the biggest hurdle Popeil had to overcome was customer skepticism.

People resist new ideas, and fear the unknown... including innovative products never seen before. They are afraid of getting duped by gimmicks and wasting their hard-earned money on products that will never be used and only serve as kitchen clutter.

But Popeil has been negotiating these barriers very successfully for three generations, and using his showmanship to get into people’s living rooms and trust-zones, and eventually their wallets, by first selling himself... and then whatever product he was featuring became a much easier sell, even a fait accompli.

He believed that to get customers whipped up into a buying frenzy, he first had to gain their trust, or barring that, he had to achieve a familiarity based on recognition, which was a kissing cousin to trust itself.

He gives the example of camcorders, which were selling quite well before the advent of the Internet when home movies were the best way to record a family’s video memories.

But sales were always faster and more furious when sold via a call-in hotline flashing below an animated salesperson demonstrating in moving imagery exactly how to use that particular model and what the video camera could accomplish.

This was far more enticing than a novice to video gadgetry walking up to a sometimes diffident sales clerk and being handed a pillow-sized instruction manual to “go figure out at home.”

Popeil was from the get-go cognizant of this demand in the market for more simplicity and “virtual POS” demonstrations. He knew that busy consumers had neither time nor patience to shop around town for different labor-saving devices, meticulously going through the owner's manual for each and deciding which was the best bet.

And in many ways, he was both the pioneer and king of direct sales, because he knew the power of both personality and live demonstration in helping nudge a potential consumer into paid-customer territory.

At the beginning of his sales pitches, or “performances,” he would first use feeling rather than logic to get the audience’s attention.

“Who out there wants to be able to slice tomatoes, thin as paper... with one hand?” he might ask, when hawking one of his knife sets.

“Look at what I’m doing, cutting up these tomatoes no thicker than a seed!”

By now his revved-up studio audience would be laughing and engrossed in the blur of Popeil’s knifemanship, and the TV cameras would be rolling as well. And by repeating these simple movements over and over, viewers back home would associate his products with ease-of-use and labor-saving qualities, and they may very well be prompted to jot down the number or address at the bottom of their TV screen.

For perhaps with the first slice, a skeptical viewing audience would still hold back. But after seeing the knives cut tomato after tomato into paper-thin slices with ease and without a growing puddle of tomato juice on the cutting board, they may glance at their own vegetable-stained countertops in their own kitchens and make the leap – I “need” these knives.

And that is how Ron Popeil, king of the TV sales pitch, "personally" came into your kitchen and hawked his wares.

And when one person made the plunge and bought the knife set (or rotisserie, blender, etc), then it became a positive-reinforcement chain reaction as the satisfied customer became a “volunteer salesperson” for Popeil’s products by telling his neighbors about his new purchase.

What begins as a trickle becomes a puddle, then a stream, then a river – of orders.

Actually, ordinary investors buy shares in the same way they flock to buy the latest and trendiest kitchenware. There really isn’t much of a difference.

The promotional materials for a product along with its user’s manual are like a company’s financial statements. For the garden variety investor, after five minutes of looking over a company’s annual report (or a product’s user’s manual), one’s eyes begin to glaze over and boredom sets in.

“All those figures, all those tables, all those numbers... and jargon that only the publisher can understand!” the prospective purchaser might lament to himself.

There are a limited number of professional investors – Warren Buffett’s partner Charlie Munger comes to mind – who consistently take the time to thoroughly research an opportunity before jumping in head first. As a matter of fact, these market whizzes relish the opportunity to fully investigate a stock before laying down their money.

These lucky ones are therefore equipped with the full knowledge of a stock’s full potential, and therefore understand its intrinsic value at the current valuation.

They are also less likely to call the number at the bottom of their TV screens and order a “Set It, Forget It” fully-automatic rotisserie after seeing one of Popeil’s on-air sales pitches.

Why? Because they haven’t read the owner’s manual, that’s why. And they take the same approach to investing in the stock market.

Expert investors like these are not swayed by hype or showmanship. Their only purchasing criterion is: “What is the stock all about and what is its true value?”

The lesson to be learned is that ordinary investors are most readily swayed by feeling and emotion.

Enter Mr. Popiel, stage left.

But extra-ordinary investors “seek truth from facts” and are won over only by logical arguments.

Before buying shares in an unknown company, they first take the time to read the owner’s manual.