YONGYE INTERNATIONAL (Nasdaq: YONG), a maker of widely popular organic plant and animal nutrients in China’s vast agricultural swaths, sees the possibility of 80% revenue growth this year as “very realistic,” the Beijing-based firm’s CFO told NextInsight on a recent site visit to a new factory in Inner Mongolia.

The ribbon cutting ceremony at the new plant outside the city of Hohhot was attended by over a thousand company executives, government officials, distributors, investors and journalists.

Being seated between Yongye Chairman and CEO Wu Zishen and CFO Sam Yu at the banquet hall of the Inner Mongolia Hotel in Hohhot, I was unable to make my questions heard over the lively conversation and ethnic Mongolian dance routines onstage, but after an endless procession of distributors parading past my gracious hosts and offering a toast to the table, I was able to sit down with the CFO.

NextInsight: Yongye seems very keen on a broadband approach to self-promotion, as all companies aspire to achieve. Let’s start with this weekend’s mega-gathering outside of Hohhot, Inner Mongolia. With the naked eye, it looked like perhaps as many as 1,000 people were there to witness your new factory opening. How accurate is my people count estimate? Who was in attendance (generally speaking, by rough breakdown), and what is the main benefit Yongye achieves by holding such a large and seemingly expensive event?

CFO Sam Yu: The attendants are from local governments, financial institutions, participants from our investor/analyst day, NASDAQ, local media and our distributors which account for the largest portion of attendants. We had a distributor meeting the next day.

About the new 30,000-ton facility outside of Hohhot, can you tell us a bit more about it? It was originally scheduled to begin production in October, but it began already. Why? It will obviously enhance your vertical integration. How will it supplement your existing facilities in the region, what are the expected investment costs for the entire plant, when will it enter full-scale production, and what products will it mainly produce?

CFO Sam Yu: The new factory has annual capacity of 20,000 tons for our plant nutrient product and 10,000 tons for our animal nutrient product. The investment is between 15-20 mln usd.

Moving onto other recent promotional events, can you tell us more about Yongye being featured on CCTV9, the English channel, in which your firm was highlighted in the television network’s 60th Anniversary Tribute to Chinese agriculture? How does this exposure help Yongye and does it target mainly distributors or end-users?

CFO Sam Yu: The CCTV9 program isn’t targeting a domestic audience. But we believe it is beneficial for our overseas investors to have a look.

Our group of fund managers and analysts were taken on a sidetrip to an open pit lignite coal mine. Is Yongye still awaiting formal government approval before full-scale mining of the coal can proceed? As humic acid from lignite coal accounts for 50% of your production costs (for a wide variety of organic nutrients for plants and animals in the PRC) will this upstream acquisition substantially reduce your production costs, and by how much?

CFO Sam Yu: We are still in the process of securing government approval. At the moment, we are not ready to share the specific cost reduction forecast yet until we run our business in the new model for one or two quarters.

Your new production facility has the capacity to produce humic acid onsite which you use to make your "Shengmingsu" brand products. Will you opt to produce the humic acid onsite, or outsource to dedicated humic acid producers for cost considerations, and if so when and what percentage will be outsourced?

CFO Sam Yu: We will manufacture internally.

When do you expect cost benefits from the lignite mine approval to begin material cost benefit contributions to your overall bottom line?

CFO Sam Yu: Probably in the second quarter of 2011, our first big quarter next year.

How does Yongye primarily intend to finance the new production facility?

CFO Sam Yu: With cash.

What is your average initial product development to full commercialization timeline? (in years)

CFO Sam Yu: Difficult to answer. Our current plant and animal products were already developed several years ago. We haven’t really launched additional products.

Research data has proven that crops treated with Shengmingsu (your main product line) grow faster, develop stronger roots and produce more fruits than those not treated with Shengmingsu. How are you promoting this valuable information and to whom?

CFO Sam Yu: We share this information with all stakeholders, e.g. farmers, distributors, branded stores, government agencies.

In China, a combination of limited arable land and the growing population has created a huge demand to increase fertilizer’s effectiveness and crop outputs. Meanwhile the overuse of chemical fertilizers is causing concerns about food safety among Chinese consumers. They have started turning to organic farming as a means of ensuring food safety. Farmers appreciate organic fertilizer for shortened growth periods and better quality fruits.

Which is a bigger driver of your sales – government measures to clean up the food supply, farmer demands for a cleaner, safer, healthier food supply, or end-consumer demands for a cleaner, safer, healthier food supply?

CFO Sam Yu: In our case, it is primarily the economic benefits of improved yields.

Last year, China’s government announced a new land reform policy which allows leasing and transferring of farm lands. The new policy leads to higher requirements for long-term land fertility and has already changed farmers’ production methods. Together with the increasing rural income and growing demands for quality foods, Yongye has seen strong demands for its organic agriculture products. How important overall are these new land reforms and how?

CFO Sam Yu: Those reforms are very important in the long term, but have limited impact on our business in the near future. I believe the vast majority of Chinese farmland is and will continue to be cultivated by individual farmers for a long, long time.

Yongye has established a unique, award-winning business model to market Shengmingsu in China’s enormous rural market. Traditionally, Chinese agriculture commodity producers tend to use distributors but avoid costly advertising promotions. Yongye is focused on brand building and has invested in national advertising campaigns, as well as in showcasing successful results to farmers in remote villages.

As of June 30, 2010, Yongye had 18,700 independently-owned branded stores in its network, compared to 13,880 stores at the end of the first quarter and 9,110 stores at the end of 2009. How well has this promotion model worked for Yongye? How many stores do you expect to have by the end of 2010? By the end of 2011?

CFO Sam Yu: Not many companies in our sector are able to execute successful branding and distribution programs on a national level like we do. Our target is 23,000 stores by end-2010 and there is no plan for 2011 yet. But China has over 600,000 villages. There is plenty of room to grow in 2011 and beyond.

Yongye reported Q2 2010 revenue almost doubled compared to Q2 2009 to 89.4 min usd. From 2010 to 2012, Yongye expects to achieve at least a 50% annual growth rate in revenue and, for full year 2010, expects annual revenues of between 180-185 mln usd, representing an increase of between 83% and 89% over last year's revenue of 98.1 mln usd. On what fundamentals does Yongye base these full-year 2010 forecasts?

CFO Sam Yu: From the macro level, we believe the government will continue to support our sector. In our industry, we continue to see strong growth. Our product is only applied on 2-3% of arable land in China in 2009 at most. Also, our branded store growth is a good early indicator of future revenue growth. Our distributors are very bullish as well. Our annual growth rate for past years is always over 100%. We believe 80%+ for 2010 is very realistic.

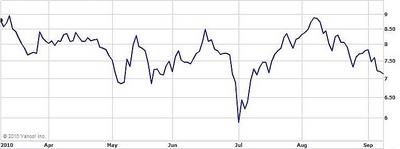

Why did Yongye choose to list on the Nasdaq board in 2008 and not sell A-shares, list in Hong Kong, list in Singapore, or elsewhere? Is Yongye happy with its decision to list on Nasdaq and its 2.5 year share performance? Any plans for an additional listing?

CFO Sam Yu: Getting listed in China is a time consuming process which lacks re-financing capability to a certain extent. Being a NASDAQ company in China also gives your product a premium image. From a capital market perspective, we do not think our stock price now fully reflects our potential and we are actively communicating to Wall Street. There is no plan for additional listings at this moment.

In June, Yongye entered into an agreement to acquire the Shengmingsu distribution network from its provincial level distributor in Hebei Province which is solely comprised of a customer list. You will pay 3 mln usd in cash and issue 3.6 mln shares of common stock to the seller to fund the transaction. How important are these arrangements for Yongye and will there be more to come?

CFO Sam Yu: Hebei brought in 30% of our business. There is a high risk of customer concentration. Also, the value of the distribution network will further increase in the future if we launch new products in the same channel. Hebei business grew 50% in 2009 and continues to grow significantly. We are spending 6 times 2010 earnings for the acquisition, which is a fair price. The deal will be positive for our revenue, gross margins and EPS starting from 2010. At this moment, there is no plan for additional acquisitions.

As for growth going forward, will it mostly be organic (no pun intended) or via M&A activity?

CFO Sam Yu: At this moment, there is no M&A plan. However, we will be open-minded as long as a good deal presents itself and is beneficial to shareholder value maximization in the long run.

Finally, the large group of Nasdaq investors that visited your firm earlier this year... how important are these visits and did anything concrete come from it yet?

CFO Sam Yu: Many of our investors are based in US. We wanted to provide an opportunity for them to look with their own eyes on our business by visiting farming villages, talking to farmers, touring branded stores, seeing the current and new factories as well as the coal resource project, and they also have interaction with management. If they walk away with a better understanding of their investment, we think we have achieved the purpose investor day.

Yongye International is a Beijing-based leading developer, manufacturer and distributor of Shengmingsu brand plant and animal nutrient products. Shengmingsu for plants dramatically improves the taste and nutritional value of crops while producing greater yields. Shengmingsu for animals improves the overall health of livestock. Yongye International was successfully listed on the OTCBB Market in the US in April 2008 and now trades on the Nasdaq Global Select Market under the ticker YONG.