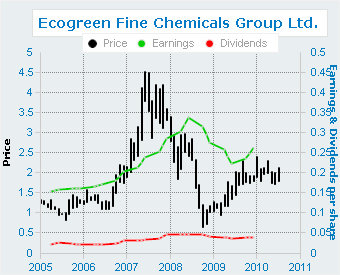

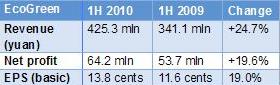

ECOGREEN FINE Chemicals Group Ltd (HK: 2341) is thriving on solid relationships up and down both its supply chain and organizational structure, helping lift first half revenue by 24.7% year-on-year to 425.3 mln yuan.

This enabled a bottom line growth of 19.6% to 64.2 mln yuan.

The leading Chinese producer of fine chemicals and a growing global presence in flavor and fragrance supply sector, EcoGreen’s Chairman told NextInsight that a major key to its success is maintaining strong ties with both suppliers and clients, and this meant valuing everyone equally, from the Chairman all the way to the pine tree forester in faraway provinces.

In a recent meeting which also included fund managers from Greater China and New York, EcoGreen’s Chairman and President Mr. Yang Yirong said that EcoGreen placed great importance on paying fair compensation and extending great respect to the laborers in China’s coniferous forestlands who work hard to deliver quality raw materials to the firm’s Xiamen-based factories.

“We have a very good supply network and excellent forestry resources. We must always strive to better understand what motivates our forestry workers and the pricing incentives that drive them. To do this effectively, we must have good cooperation and mutual respect from the Chairman all the way to the forester,” Mr. Yang said.

But this was not always as easy as it sounded, as many companies in the industry had to contend with upstarts looking to try their luck at collecting gum rosin and gum turpentine themselves for processing, an undertaking that requires much more technical expertise than one might imagine.

“Yes, a motivated group of foresters can strike off on their own and construct their own fragrance plant with a few million yuan pooled between them. But mid-stream operators and downstream refiners know the difference and will almost always opt for the higher quality product from the more experienced supplier, so we have not been negatively impacted by this phenomenon,” he added.

The existing laws on the books also kept most would-be competitors from becoming anything resembling tangible competition for EcoGreen.

“Local and provincial governments are regularly pressured by central authorities to crack down on these rural forester startups due to a lack of valid business licenses, their high power consumption and substandard output, so we are not affected by their operations. Most of the market demands increasingly high quality output in this sector.”

And this is exactly where EcoGreen excelled, and ran far ahead of the competition in China.

“We must be responsible to our downstream clients and consumers who demand and deserve the highest quality products, and we must therefore strive for excellence to maintain their loyalty and orders. We believe we here at EcoGreen can source, produce, and distribute and expand when necessary at best quality for best price in the world,” Mr. Yang said.

He added that this commitment to excellence, quality and profitability was in the best interests of both shareholders and clients, many of whom have been sourcing from EcoGreen for a very long time.

“We have a lot of long term orders so enjoy income stability. This is also proof of our commitment to excellence in quality sourcing as well as quality output. In fact, a lot of our big clients have been around for over 100 years, though not with us for that length of time,” he said with a smile.

EcoGreen was founded in 1994 and has been listed on the mainboard in Hong Kong since 2004.

The company also had a vested interest in keeping mutually beneficial relationships up and down the supply line because of the pricing nature of its chief raw material – turpentine.

EcoGreen currently uses botanical essential oils abundantly available in China. The nationwide procurement network built up by the firm early on and its related resources management strategies enabled it to secure a stable supply of raw materials amid sometimes violent fluctuations in raw materials markets, as was witnessed last year.

EcoGreen is heavily reliant on exports so the financial crisis adversely affected industry supply and demand in the world resulting a material change in the cost structure of the gum rosin and gum turpentine sectors.

Although its extensive applications allow it to enjoy an inelastic demand of sorts, turpentine supply can also be adversely affected by forces majeure, while caused its price to reach record highs in late 2009.

However, EcoGreen believes that its solid and improving relationships with foresters and its ability to pass higher raw material costs downstream through continuous quality enhancements and product diversification will lead to better returns down the road.

Launching new products with higher margins was key to this strategy, including sandalwood scent fragrances and leaf-based scents, production and sales of which are both increasing, management told us.

Just what did it take to know what the consumer wanted scent-wise, was a question posed to Chairman Yang.

Mr. Yang, who earned a degree in chemistry from Huaqiao University in 1982, a highly competitive science-oriented school in Quanzhou just up the road from the EcoGreen’s factory in Xiamen, gave a very insightful reply.

“Making scents is both a technological skill and an art form. To get the best scents and products it takes a fair amount of both qualities. We are very proud of our ability to create and maintain the best scents for the market, and we’ve created hundreds of them so far,” Mr. Yang said.

He added that one of the most developed and particular markets was also a bright spot for EcoGreen.

“Our North American market operations are growing well,” Mr. Yang added.

See also: ECOGREEN: Supplying 25% OF World's Supply Of Key Chemical