Getting the Green Light: China and Argentina inked a record rail deal

A NEARLY 12 bln usd rail project agreement between China and Argentina sent listed railway stocks soaring on the news.

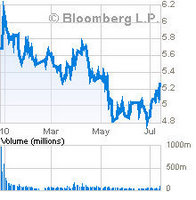

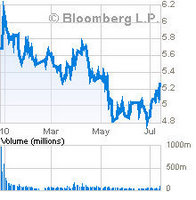

Hong Kong-listed China South Locomotive & Rolling Stock (HK: 1766: SHA: 601766), which has reportedly attracted portfolio attention from the likes of Warren Buffett and Bill Gates, saw its A shares close up 4.6% Wednesday while China North Vehicle (SHA: 601299) rose 3.1%.

Yesterday, China South gave back 2.28% to close at 5.20 while China North added another 0.19% to finish at 5.24.

The deal is likely to put to rest a trade spat between the two countries that had disrupted shipments of soybean oil to China from its biggest supplier earlier this year.

China Railway Group Ltd (SHA: 601390) and Jinxi Axle Company Ltd (SHA: 600495) also chugged into slightly higher territory Wednesday on news of the massive deal. China Railway gained again yesterday, up 1.4% to 4.26 while Jinxi shed 0.3% to close at 7.89.

The agreement allows Chinese firms to contribute to rail projects in South America’s No.2 economy, namely a 10 bln usd upgrading of the network of Belgrano Cargas, a company which operates a 10,841 km freight rail network in Argentina.

Also included in the deal is a 1.85 bln usd project to refurbish the Ferrocarril Belgrano line.

China CNR Corp's market cap is 43.8 bln yuan, 52-wk range: 4.6-6.3 yuan; P/E: 23x; current price: 5.3 yuan

In addition, a unit of China Railway Group signed a preliminary 1.8 bln usd deal to build a subway in Cordoba and also a 1.5 bln usd project for a rail line serving Ezeiza Airport outside the Argentine capital.

Argentine President Cristina Fernandez de Kirchner is currently leading a trade delegation in China.

The broad agreement covers 10 separate projects with contracts running from between two to five years, including the sale of Chinese railway technology and the electrification of railways in the South American country.

The signing is one of a growing list of megadeals that Beijing has been inking with resource-rich but infrastructure-poor (or infrastructure-outdated) countries, especially in Africa and South America.

The Argentine side said in a statement that China National Machinery & Equipment Import & Export Corporation won a contract to refurbish the Belgrano Cargas, while a group of Chinese firms with notables such as Shaanxi Coal Group will initiate another.

In a related deal, China Citic Bank and China Development Bank yesterday agreed to extend 273 mln usd in credit to finance the South American nation’s plan to purchase high-speed trains from Shanghai-listed China North Vehicle (CNR).

China Citic Bank reportedly said that CNR is targeting the export of 20 high-speed locomotives and 220 passenger carriages to Argentina as well as services and parts support.

Concurrent with the flurry of transport and financing deals, the two sides also unveiled an agreement to build a swine flu vaccine research lab in Argentina.

Final Destination: China is hoping its rail deals in Argentina will expedite soybean oil shipments back home

Chilly trade ties have characterized bilateral relations between the two countries of late. Earlier this year Beijing placed major burdens on soybean oil exports from Argentina, the world’s top exporter of the commodity.

Analysts have speculated that the move was a direct response to earlier efforts by Buenos Aires to reduce the flood of Chinese consumer goods entering Argentina, an especially sensitive political issue at a time of economic uncertainty.

Two-way trade rose to 14 bln usd in 2008 from just four bln in 2004, making China Argentina’s No.2 trading partner after Brazil.

The Argentine president said earlier this week in China that Argentina -- which has a population of 40 mln -- can feed half a billion people, and this productivity could help guarantee China's food security.

The deal follows a pattern of business relationships between Beijing and Argentina’s northern neighbor – Brazil.

Brazil has been one of the top two suppliers of another crucial commodity to China for many years – iron ore.

Chinese companies have not only been investing in projects by Brazilian miners such as Vale, but also helping to build the infrastructure to bring the ore to port before it is sent over vast expanses of water to Chinese steel mills.

Related story: HK-LISTED HENG TAI chasing fatter margins at crop cultivation level

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors