The following comments were posted by Kevin Scully, executive chairman of NRA Capital, at his blog recently. Visit www.nracapital.com

OVER THE LAST few weeks three events have occured that in part have contributed to the steady rise in the price of China Animal over the last few days:

a) 20 October 2010 - Fidelity (a large and well regarded global fund manager) increased its stake in China Animal from 7.95% to 8.05%. China Animal already has three known insitutional investors - BlackStone, Fidelity and just below the 5% line Legg Mason.

b) on 25 October 2010 - China Animal's subsidiary Biwei Antai which was acquired in May 2010 received regulatory approval to commence commercial production of vaccines for Animal Foot and Mouth disease. This seems to be slightly delayed from earier guidance that such approval would be received in Q3-2010.

c) on 28 October 2010 - shareholders of China Animal approved its secondary listing in Hong Kong.

China Animal has been one of my Stock Picks for some time. While most investors are wary of S Chips - China Animal is one of the few exceptions as evidenced by its ability to attract strong institutional investors.

Because the company's main business is linked to domestic demand for drugs for farm animals - it is unlikely to be impacted by any outbreak of trade sanctions between the US and China following the passing of the Currency Manipulation Bill in the US in October.

All we are waiting for is its HK dual listing where I expect, its shares will be priced at S$0.40. This is likely to see its Singapore share price move beyond the S$0.40 level.

PER valuations are now no longer cheap - in the low to mid teens, ie the share has gradually been rerated so further price movement will have to be driven by earnings growth in 2011......

Bottom line....for existing investors who followed my recommendation.......just wait another one to two months (according to my sources) where I expect China Animal to receive regulatory approval.

Recent stories:

CHINA ANIMAL HEALTHCARE: An Animal to be Reckoned With

ERATAT LIFESTYLE, CHINA ANIMAL HEALTHCARE : What analysts now say....

'AEI remains undervalued'

In its first half 2010 results, AEI reported a loss of S$0.47mn despite a more than 40% increase in revenue. This loss was due to an impairment charge of S$4.07mn on a LME contract.....excluding this impairment, AEI would have made a net profit of S$3.6mn.

AEI announced that it had recently closed this LME position and fully recovered the impairment and also made a realisable gain of US$135,970. The net effect is that it will see a writeback of the S$4.07mn plus a recognition of the US$135,970 means a recovery of S$4.24mn.

At the operating level, the company is seeing some slowdown in demand from the harddisk sector.....more on this later. Outlook is uncertain given the volatility in the currency markets but AEI remains undervalued at 0.75 times price to book with net cash per share of S$0.085 and assuming the earnings momentum remains unchanged - the stock is trading in the mid single digit PERs.

The company is unlikely to pay the same dividend as 2009 but assuming a 1 cent dividend - we are looking at a running yield of 6.25%.

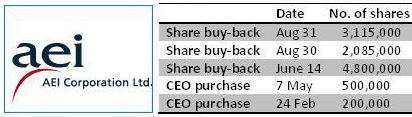

Recent story: AEI CORP: Sudden massive share buybacks