Excerpts from latest analyst reports….

CIMB initiates coverage of TSH Corp with 25.5-cent target price

Analyst: Leong Wei Hao

The network effect. Given the established reputation of Singapore companies in respecting intellectual rights, TSH is a natural choice for foreign customers to work with. Being an ODM player. TSH is able to work with customers to tailor products to their requirements and since the Group is known to respect patents/copy rights and royalties, its customers have little to worry on infringement of such matters in dealing with TSH.

Going forward, the Group will develop mobile internet devices to capture the rising popularity of the mobile networked generation. E-book readers will be a key driver this year, but there are already plans to launch mobile PCs and other products.

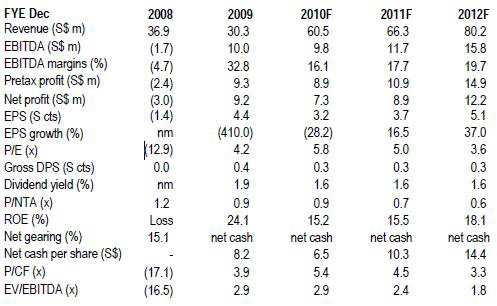

Initiate with BUY and target price of S$0.255. We initiate coverage with a BUY recommendation and target price of S$0.255 based on parity to CY11 BVPS. Interestingly, ex cash P/E for CY11 is a mere 2.2x or an earnings yield of 45.5%.

Two growth engines. Whereas TSH was just relying on the Homeland Security business to drive earnings in the past, going forward, the Company will develop its ODM consumer electronics business. We have factored in revenue from new products in these segments for the next three years. The Company already has photo scanners, e-book reader and mobile internet devices as immediately available to market products.

Strong balance sheet. TSH has a strong balance sheet with net cash at S$15.9m or 6.6cts as at 1H10. This represents 37% of its current market cap. Going forward, given the asset light nature of its business as the Group focuses on ODM, we believe net cash will continue to rise. TSH will continue to look for growth opportunities and cash will be deployed for this purpose first. However, we believe the rising cash horde could afford the Company room to raise DPS. We have conservatively assumed DPS to match that declared in FY09 (ie 0.3cts).

Risks

Dependent on major customers. The Homeland security services segment of TSH’s business is highly dependant on a few government related Companies. According to management, contracts are awarded on a contract basis, should TSH fail to secure contracts from either of their major customers, revenue and profitability will be impacted significantly.

Margin squeeze. Consumer electronics products are characterized by fast moving technology and relatively low barriers to entry. As barriers of entry are low, the firm has to compete on quality and price, while differentiating itself for competitors offering similar products. Moreover, costs of manufacturing are dependant on cost of raw materials and labour. The Group’s manufacturing operations are centred in the coastal regions of China, in Shenzhen and Hangzhou, which have been affected by rising cost of labour. Inability for the firm to differentiate itself from competitors and command better prices for goods, while managing input costs will lead to margin squeeze.

Recent stories:

KEVIN SCULLY: 'What to do after TSH has run up on strong volume...'

TSH wins US$8.72 m contract from Taiwan defence ministry

KEVIN SAYS: 'Can TSH Corp be a 4-bagger?'

CIMB rates NOL and Berlian Laju as ‘outperform’

• We are OVERWEIGHT on containers but NEUTRAL on dry bulk and UNDERWEIGHT on tanker shipping. Our Outperform recommendations include NOL (NOL SP; Outperform; TP S$2.25) and Berlian Laju Tanker (BLTA SP; Outperform; TP $0.09).

• For the container shipping sector, we expect Neptune Oriental Lines (NOL) to benefit from high locked-in transpacific contract rates until next year May/June, despite the currently falling spot rates to the US. This will underpin its strong financial performance in 2H09 and at least into 1H10.

• For the tanker shipping sector, our top pick remains as BLTA. We like the chemical tanker for attractive valuations (0.4x P/B despite having a relatively strong expected ROE of 9.2%). BLTA has also achieved a small core net profit of US$1.1m in 2Q10, and we expect results to improve from stronger investment income in 2H10.