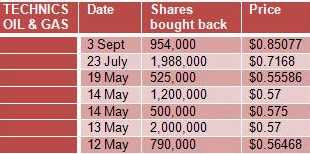

On that day, the company made yet another significant share buyback, amounting to 954,000 shares at around 85 cents a share.

That brings the total number of shares it has bought back to about 10.4 million, or 7.26% of the issued share capital, since December 2008.

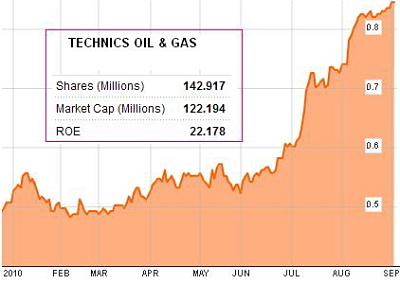

Supporting the buyback and the uptrend in stock price of Technics - which designs, concept engineers and fabricates process modules and equipment for use in oil and gas exploration and production - are:

* Profit growth: Technics reported S$12.2 million in net profit for Jan-Sept 2010 period, compared to S$4.5 million in the previous year. Gross profit margin jumped 14 percentage points to 37% in 9M2010.

* Bumper dividend: Best of all, during its recent 3Q results announcement, it surprised by declaring a whopper of an interim dividend of 10.5 cents a share. Book closure date has yet to be fixed.

Technics’ warrants expire in November this year and can be converted one for one into the mother share at an exercise price of 40 cents apiece.

The conversion of the warrants will pour a big bucketful of cash (about S$28.6 million) into the company, as will a TDR listing of its shares in Taiwan, which Technics is pursuing.

And, of course, this is where the share buybacks could make eminent money sense: Technics could list as TDRs the 10.4 million shares it has bought back (plus any new shares that it may issue or any vendor shares that may be offered for sale).

Technics can be expected to sell such shares at a higher price to Taiwanese investors, who typically pay a premium for Singapore shares, as well as enjoy savings from not having to pay out the bumper 10.5-cent dividend on the shares it has bought back.

Recent stories:

INSIDER BUYING: Fuxing, Technics, Venture, BreadTalk, etc

INSIDER BUYING in an uncertain market last week....