Excerpts from latest analyst reports…..

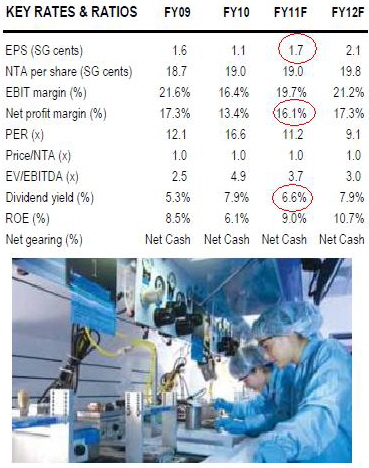

OCBC Investment Research: ‘We like Avi-Tech for its growth potential, strong financial position and attractive dividend yield’

Analyst: Kevin Tan

While gross margin eased to 25.6% from 32.7% in 4QFY09 due to less repair works (which typically command higher margins), the higher revenue and good control of operating expenses were sufficient to offset the negative impact of margin erosion.

As such, PATMI stood at S$1.0m (-10.2% YoY, -0.9% QoQ), also exceeding our expectation of $0.9m slightly. For FY10, we note that revenue amounted to S$29.6m, down 5.5%, while PATMI stood at S$4.0m, down 27.0%, due to difficult conditions in 1HFY10.

Nevertheless, Avi-Tech proposed a final dividend of 0.25 SG cent/share and special dividend of 1 cent/share, translating to a FY10 yield of 7.9%.

Segmental analysis. Only the Engineering Services (ES) segment reported a decline in revenue (-64.7%) for FY10, due to slower pick-up in capital expenditure by its customers. The rest of the operations, namely BM and BS segments, registered strong growth in FY10 (up 107.2% and 23.8% respectively), and partially offset the ES weakness.

In fact, BM segment overtook the other two segments to become the largest revenue contributor (42.5% of FY10 revenue), driven by recovery in the semiconductor industry, increased product offerings, and successful penetration into the US market.

We view this positively as it clearly displayed management's timely efforts and strong execution to mitigate the negative performance from its ES segment.

Expecting improvements in business operations. Going forward, Avi-Tech is cautiously optimistic that the demand for semiconductor chips will continue its recovery due to increased demand from a broad range of end markets.

While its ES segment was impacted by low levels of capex from its customers, the group revealed that it is beginning to receive healthy orders and enquiries for its ES and repair services. Within its BS segment, Avi-Tech is also expecting several new customers to contribute positively to its sales.

In addition, its groundwork into the medical and life sciences industry is starting to bear fruits, with orders for new equipment likely to pick up with the recovery in the macro economy.

Maintain BUY. We continue to like Avi-Tech for its growth potential, strong financial position and attractive dividend yield. We raise our FY11 forecasts by 0.9-1.3% as we re-jig our opex and finance costs assumptions. Maintain BUY and S$0.24 fair value, still based on 1.2x FY11F NTA.

Recent story: SEMICONDUCTOR BOOM: Beneficiaries include Avi-Tech, Serial, Hisaka

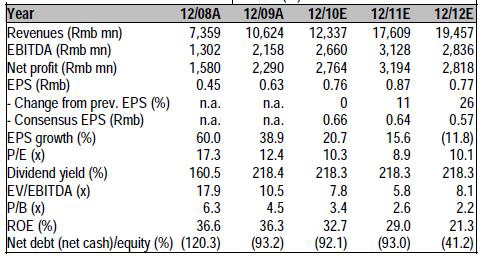

Credit Suisse maintains 'outperform' rating on YANGZIJIANG after US$915 m orderbook win

Analysts: Gerald Wong, Bhuvnesh Singh & Christopher Chang

● Yangzijiang announced that it has entered into 28 shipbuilding contracts with a total value of US$915 mn since 1 July 2010. This represents the largest newbuild order announced in a quarter since 4Q07, effectively exceeding our US$800 mn order forecast for the full year.

● These contracts include an order for eight 2,500 TEU containerships, the first such order Yangzijiang has won since March 2008. We believe this supports our increasingly positive view on the containership newbuild segment, where the current backlog to fleet ratio of 30% is below its historical average.

● Yangzijiang is best positioned among the Chinese shipyards to benefit from a rebound in containership orders with 12% of the Chinese containership market. 53% of Yangzijiang’s current orderbook is for containerships when measured by value.

Quality at attractive valuation

We have increased our EPS forecasts for 2011 and 2012 by 11% and 26%, respectively, by assuming that the construction of vessels will take place between January 2011 to December 2013. We do not include the eight options worth US$298 mn in our numbers, leaving further room for earnings upgrades.

We reiterate our OUTPERFORM rating on Yangzijiang and increase our target price to S$1.90 (from S$1.80) to reflect higher BVPS. At our target price, Yangzijiang would be trading at 2011E P/B of 3.1x, in line with its historical average.