ANALYSTS MAINTAINED their ‘Buy’ and ‘Outperform’ calls on leading HDD actuator arm maker, Broadway, after it doubled its interim dividend to 2 cents a share.

The analysts maintained their earnings forecasts and target prices after the HDD component manufacturer generated 2Q10 net earnings of S$10.3 million, up 34.9% year-on-year.

Excluding unrealized forex losses, net earnings were above analyst forecasts, who maintained consensus target price at S$1.61, or 36% above today’s close price of S$1.18.

”There is more upside for the non HDD business segments,” said executive chairman, Mr Wong Sheung Sze, during the company’s results briefing last week.

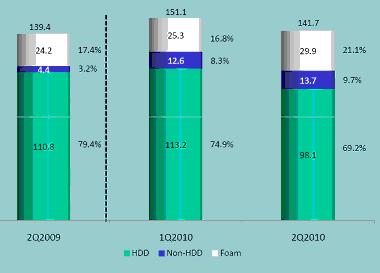

HDD components contributed 69.2% to group top line while components for semi-conductors and the remaining 30.8% came from automotive industry, as well as foam plastics.

|

Including foam products, its non-HDD business segments have grown in revenue contribution to group top line, up from 20.6% a year ago.

During 2Q10, the component maker acquired equipment to expand the annual capacity of this segment by 7.5%, in line with its target to raise capacity by 20% by end 2010.

It is also acquiring a new manufacturing facility in Suzhou, in expectation of higher orders from the semiconductor equipment market.

The planned acquisition is expected to be completed in 3Q2010 and contribute to top-line growth in 4Q2010.

It will also begin producing paper pulp packaging products this during 3Q10.

What the analysts say

DMG

Analyst: James Lim

Mr Lim has a 'Buy' call on Broadway and target price of S$1.46.

Discounting a forex loss of S$2.5m arising from a sudden spike in the Chinese RMB after the government decided to allow it to appreciate, Broadway’s operational results has met the DMG analyst’s expectations.

Mr Lim likes the bullish macro outlook for the HDD and semicon equipment sectors and expects the two segments to grow respectively by about 23% and 110% in 2010.

The analyst expects higher labour costs in China to impact 3Q10, but believes sequentially higher contributions from all of its businesses should more than mitigate this negative aspect.

The analyst thus anticipates that net profitability in 3Q10 will be no lower than 2Q10.

DBS Vickers

Analyst: Tan Ai Teng

DBS analyst Tan Ai Teng maintained her ‘Buy’ call and target price of S$1.50 on Broadway.

Despite sales being below forecasts, but 2Q10 net earnings of S$10.3m was above her expectations. She is positive on the following:

1) Expansion of gross margins to 16.6% from 15% in 1Q10 and 13.8% in 4Q09, thanks to effective cost control and better product mix.

2) Non-HDD sales expanded 9% q-o-q while foam packaging grew 18% q-o-q.

CIMB

Analyst: Jonathan Ng

CIMB analyst Jonathan Ng maintained his ‘Outperform’ and aggressive target price of S$1.86.

Excluding S$2.5 million of marked-to-market forex losses (mostly unrealised), 2Q10 core net profit of S$12.8m (+81% yoy) was 42% above consensus and 38% above CIMB estimates.

Related story: BROADWAY's lively Q&A with fund managers