Excerpts of latest analyst reports….

Kim Eng Securities highlights that HOCK LIAN SENG has net cash higher than market cap

Analyst: James Koh

Industry outlook: The Singapore government’s commitment to improving infrastructure in the country is part of its larger aim to increase the population to 6.5m by 2030. Hence, the plan to double the existing MRT network to 278km and to add a North‐South Expressway by 2020. The Building Construction Authority (BCA) has also estimated annual public construction demand at $18‐25b in 2011 and 2012.

One of only two major local players. Unlike residential developments, local infrastructure construction projects are dominated by foreign companies. Most local players participate through JVs with their foreign counterparts or as sub‐contractors. HLS and Lum Chang are the only two local players that tender for projects as main contractors.

Potential MRT works could boost orderbook. HLS currently has a comfortable net orderbook of about $500m till 2015, which are locked in at healthy margins. The company has participated in both the MRT Downtown Line 1 and 2 projects. We believe this track record would give it an edge in winning work for the upcoming Downtown Line 3 project as well.

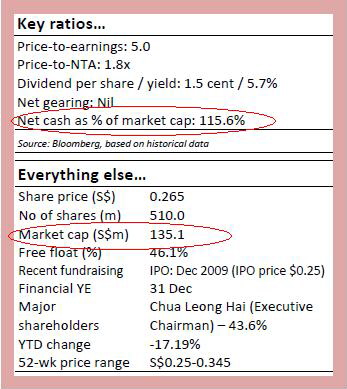

Strong cash position could lead to other aspirations. The company is sitting on net cash of $156.2m (higher than current market cap), which we expect will be used for business diversification to enhance earnings outlook. Potential related areas include property development, acquiring building equipment and/or overseas expansion.

Recent story: KEVIN SCULLY'S take on HOCK LIAN SENG, INNOTEK

Macquarie Equities Research sets $1.50 target for OSIM

Analysts: Patrick Yau and Somesh Kumar Agarwal

Event

OSIM reported stellar 2QCY10 numbers with 141% YoY earnings growth vs our 39% estimate driven by new product innovation and improved productivity per store, reflective of the change in management’s focus. We raise our TP by 8% to S$1.5 and reiterate our strong Outperform call on the stock.

Impact

New products and same store sales improvement lead to stellar growth: Driven by new products such as “UMama warm” and a focus on improving productivity per store (EBITDA per store up to S$25,047 vs 15,898 last year),OSIM continued with its strong gross margin improvement (+500 bps YoY in1HCY10), which led to an astounding 141% YOY earnings growth in 2QCY10.

China expansion is ahead of expectations: Belying concerns on its execution capabilities, OSIM added 20 new OSIM stores and 7 new Richlife stores in China. Management confirmed that at least additional 42 new OSIM and 30-50 new Richlife stores would be opened in China in 2HCY10.

Remains cash rich driven by well managed working capital and high FCF: OSIM’s net cash increased to S$43m (net debt / equity at -40% now) driven by well managed working capital (inventory days down to 38 days from 40). OSIM also announced an interim dividend of 1 cent per share.

Earnings and target price revision We increase our CY10 and CY11 earnings estimates by 16% and 9% respectively on better margin forecasts. We increase our TP to s$1.50.

Price catalyst

12-month price target: S$1.50 based on a Sum of Parts methodology.

Catalyst: Store expansion at higher than expected rate of 9% over CY09-12

Action and recommendation

Change in management focus towards profitability and execution is evident: OSIM continues to improve productivity in all its markets in Asia,while expanding only in China. Management remains entirely focused on both these counts, with CEO Ron Sim spending more time on day-to-day activities and in China while Brookstone is managed by a new CEO in US.

Accumulate as company continues to execute: China expansion could rollout sooner and larger than expected. We now estimate 33% earnings CAGR for OSIM over the next five years (CY09-14) and ROICs of 50-55%. We expect OSIM to remain a strong structural growth story for the next five years.

Stock at large discount to last 5 years median P/E; Brookstone being ignored: Stock is at 10x CY11 earnings (ex-Brookstone) vs 16x median P/E over the last 5 years. We expect the stock to re-rate to 16x levels as it continues to deliver on execution. Investors are also ignoring the upside from Brookstone, which has all its 312 stores operative; we expect it to deliver EBITDA of US$55-60m by CY12 vs US$23m reported in CY09.

Recent story: OSIM, OCEANUS: What analysts now say....