Executive chairman Wong Sheung Sze wants to grow sales of precision components in semi-con.

Executive chairman Wong Sheung Sze wants to grow sales of precision components in semi-con. Photo by Leong Chan Teik.

ANALYSTS FROM CIMB-GK, DBS Vickers and DMG recently reiterated their “Buy” and “Outperform” calls on Broadway Industrial Group, and upgraded the consensus price target to S$1.54.

That's 36% above yesterday’s closing price of S$1.13.

Things are looking up for Broadway, which is the world's No.2 hard disk drive (HDD) actuator-arm supplier with a 20% market share globally. Its two major HDD customers are Seagate and Hitachi, according to CIMB-GK analyst, Jonathan Ng.

1Q2010 revenues had grown 11.2% year-on-year to S$151.1 million, while net earnings more than doubled (up 121.4%) to S$11.9 million, thanks to margin improvement.

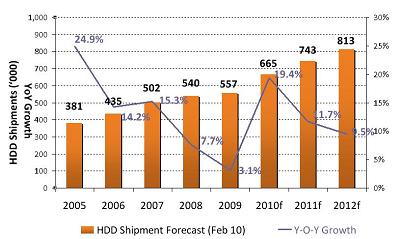

Broadway is riding on a boom in HDD sales, which have been projected by Trendfocus to grow 19.4% this year. HDD precision components contributed 75% to Broadway's 1Q2010 revenues.

A turnaround in its non-HDD precision components resulted in that segment's revenue leaping from S$3.6 million in 1Q2009 to S$12.6 million in 1Q2010. This segment comprises mainly of components for semi-conductors and automotives.

Trendfocus is bullish on this year's HDD demand growth, with a forecast of 19.4%.

Trendfocus is bullish on this year's HDD demand growth, with a forecast of 19.4%.

Other than the HDD industry, the company also supplies components to the semiconductor, automotive, oil & gas, and other industries.

Semi-con is the next big thing, with both iSuppli and Gartner recently increasing their 2010 forecasts for the sector’s revenue growth worldwide to 20% to 22%.

Broadway is increasing its HDD production capacity by more than 20% by the end 2010 as well as acquiring a new machining facility in Suzhou for non-HDD components.

DBS Vickers: 'Stupendous growth'

Analyst: Tan Ai Teng

At less than 5x FY10 PE, Ms Tan likes Broadway for being one of the cheapest proxies to the HDD recovery story.

”The quick semi-con precision components turnaround is a surprise, swinging from S$4 million in losses in 1Q09 to over S$1 million profit on rising demand.”

”However, strengthening RMB (35% of operating expenses is RMB denominated) and rising labor costs in China (expected to kick in sometime in June) could slightly offset this year’s stupendous growth.”

Broadway's 1Q10 group sales was S$151 million.

Broadway's 1Q10 group sales was S$151 million.

DBS Vickers upgraded FY10 earnings by 17.5% to S$44 million.

Based on a 20% payout target, dividend per share is projected to increase from FY2009’s 3 cents to 4 cents for FY2010, translating to a dividend yield of almost 4%.

CIMB-GK: "Possible upside surprises"

Analyst: Jonathan Ng

”We see further catalysts from (1) possible upside surprises in earnings, and (2) positive newsflow from the HDD and semiconductor industries.”

DMG & Partners: "Bottomline better than our forecasts"

Analyst: James Lim

“Presently valued at 5.0x FY10 P/E, we believe that Broadway should trade up to the industry average of 6.9x FY10 P/E.”

”Bottomline had turned out to be better than our forecasts due to higher margins in the semi-con division, which is currently in the midst of an upswing.

”IT market research firm Gartner had recently increased its expectations for global semiconductor equipment spending in 2010 to jump by 55.9% from its previous forecast of 45.3%.

“Its semiconductor components business could be the wild card in FY10 as it is now out of the red.

”Coupled with the recent move to acquire the Suzhou machining plant from Alantac Technology, we now estimate that this segment could account for about 10% to 18% of Broadway’s FY10 sales and net earnings respectively.”

Date |

Broker | Call | Price Target | Valuation |

| 28 Apr |

DBS Vickers |

Buy |

S$1.50 |

7x 2010PE |

| 28 Apr |

CIMB-GK |

Outperform |

S$1.67 |

8x 2011PE |

| 28 Apr |

DMG |

Buy |

S$1.46 |

6.9X 2010PE |

Related story: BROADWAY's lively Q&A with fund managers ...