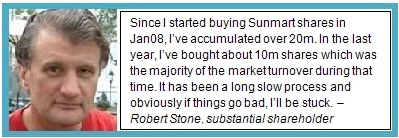

On Mar 19, Sunmart Holdings filed an announcement to the Singapore Exchange that Robert Stone’s shareholding in the company had crossed the 5% level and he had become a substantial shareholder. We subsequently asked him for his insights into the business, and he obliged with the following write-up.

SUNMART HOLDINGS is one of China’s largest producers of plastic spray pumps used for all kinds of consumer and pharmaceutical products such as cosmetics, deodorant and detergents.

Based near Wuxi, Jiangsu province, it was listed on the Singapore Exchange in August 2007 when it sold 102m shares at 25c each.

This turned out to be bad timing for subscribers as the price only briefly rose above the listing price. Since then the price and volume have been low as interest in the company has been minimal. The stock recently traded at 13 cents, giving the company a market capitalisation of S$52 million.

The company’s purpose in raising the cash was to fund the expansion of its production capacity.

This entailed completing the construction of new factories on a 10 hectare site and the construction of a new office building.

After meeting the CFO, Ho Soo Hui, in Singapore, I visited the company in January 2008. At that time both the office building and the first stage of the new factory were under construction.

The downturn in sales the company experienced after the financial crisis broke in September 2008 was sharp and for a while the situation looked serious as the company was short of funds to pay for the ongoing expansion.

Fortunately a local bank helped out with a loan in January 2009. Since then the company’s financial situation has improved. I visited the company again in July 2009 and was surprised by the amount of building that had been completed since my previous visit.

Photo by Robert Stone

The whole 10-hectare site was fully built out with new large double storey buildings.

There was a large amount of space for new machines to be installed. At this time the company was facing a mismatch between the products required by their customers and the machines they had that could meet that demand.

Since then the situation has improved as Sunmart has been continuously buying and installing new machines. The company has been constrained in this by the amount of funds available and also by its own reluctance to expand too quickly in case demand should again collapse.

The management is keen to raise funds by issuing equity and is also looking at a secondary market listing. Normally as a minority shareholder, I am concerned when a placement is being contemplated as the dilution usually occurs at a significant discount to the market price.

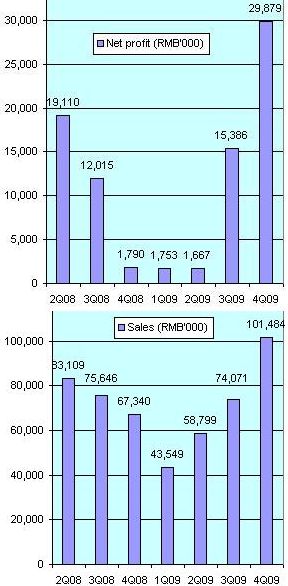

Record sales, profit in 4Q09

With Sunmart I’m confident that if fund raising goes ahead, it will not be detrimental to minority shareholders. This is due to the reluctance of the CEO, who holds about 70%, to issue shares below the IPO price.

With the market price at about half the IPO price, if he is able to pull it off, it will be an unusual situation for a Singapore listed company.

Quarterly sales and earnings are in an uptrend. Q4 sales and net profit were the highest ever experienced in the company’s history.

Sales in China, which now comprise nearly half of sales, are growing strongly as the company is well leveraged to the future growth in Chinese consumption.

I don’t expect earnings to keep growing at the same rate as in the last two quarters but my guess is that as long as the economy in China keeps growing without major hiccups, it’s reasonable to expect significantly higher earnings for 2010.

A feature of the company that I think is attractive compared to some other S-Chips is that Sunmart has a huge number of customers (2,000) so its receivables risk is minimal.

The company also has very effective domestic and international marketing capability. It sells its products to 80 countries. The downside is it is in a competitive industry.

However, the capacity of the new plant and the latest equipment it is continually adding allow the company a greater degree of flexibility in meeting customer demand than many of its smaller competitors.

The company did not pay a dividend last year due to capital commitments and I will be surprised if a dividend is paid this year for the same reason. I am confident though that the management is keen to pay a dividend as soon as possible.

Since I started buying shares in January 2008 I’ve accumulated over 20m. In the last year I’ve bought about 10m shares which was the majority of the market turnover during that time.

It has been a long slow process and obviously if things go bad I’ll be stuck. However, my investment strategy is to try and pick good companies and hold the shares for many years.

As long as the company grows at a decent rate and is committed to paying dividends to its shareholders, eventually the returns will be very good.

Related stories:

ANWELL: "My take on its solar biz prospects"

ROBERT STONE reaping the rewards of 3 decades of investing