Musicwhiz's avatar

Musicwhiz's avatar

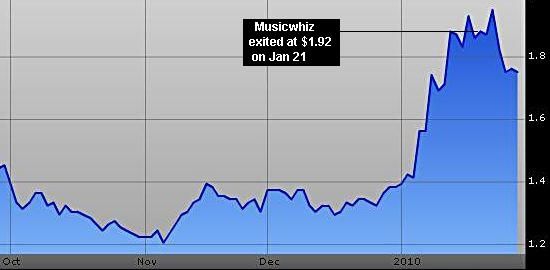

I GUESS THERE'S a time for everything, and the time had finally come for me to close the curtain on my investment in China Fishery. On the morning of January 21, 2010, I decided to divest my entire stake at about S$1.92, netting a gain of about 87% on my initial investment (excluding $220 in dividends).

This decision was not made lightly, and follows on the heels of a somewhat love-hate relationship I have with this company, and also the turmoil and conflicts within myself during my ownership of it. Taking into account my total holding period of about 2 years 2 months, the annual return was approximately 40% (non-compounded).

On the morning of January 21, China Fishery (“CFG”) announced its intention to dual-list (secondary offering of shares) on the Stock Exchange of Oslo Bors, located in Norway. The aim was to increase recognition of China Fishery as several fishing and fish processing companies were listed on Oslo Bors (there are currently three – Aker Seafoods, Leroy Seafood Group and Austevoll Seafood).

|

The listing would also raise the profile of CFG in Norway and Europe, where many of CFG’s customers and business partners are located. A third reason that was provided: the dual listing would attract institutional investors in Europe who would be able to trade CFG’s shares in two different time zones, thus improving the trading liquidity of the counter. Apparently, Management believed that going the dual-listing way would improve valuations and allow the counter to trade at a significantly higher valuation (and hence market price).

The arguments and rationale are indeed compelling, but once you scratch under the surface and reveal the underside of things, it started to get questionable. I will present the facts and logic of my reason for divestment, and though I do not classify this strictly as an investment mistake per se, let’s say that I did learn a lot of lessons and will, in future, be a lot more cautious and exercise more due diligence and prudence in conducting my investment affairs.

1) Weak Balance Sheet, High Capex

CFG’s Balance Sheet has always carried high debt, and this was a very uncomfortable aspect of the Company which precluded my original rationale for purchasing it (which was high barriers to entry, just to state the fact). In its most recent FY 2009 results (ended September 28, 2009), CFG stated that its net debt to equity had decreased from 92.2% to 84.3%, which was still uncomfortably high. Finance costs for 9M 2009 stood at US$20.7 million alone, and for 12M 2008 interest expenses went to as high as US$31.1 million, which was about 6.7% of revenues.

Debt continues to be a prominent feature of CFG as it took on additional bank loans in 2009 to finance its South Pacific expansion, and also previously issued Senior Notes due 2013 to finance its capex for additional reefer vessels/supertrawlers and to acquire fishmeal processing plans. The Group’s plans to expand further will probably result in more re-financing of their loans in future, and more additional debt taken on in addition to the Notes issued and existing banking lines. All these make this Company a high risk investment, as its gearing is a little too high for comfort.

2) Frequent Fund-Raising and presence of Scrip Dividend

It should become immediately apparent to the casual observer (and actually, to the astute investor, of which I am not), that the whole Pacific Andes Group has undergone frequent fund-raising. Pacific Andes Resources Development (PARD, formerly known as Pacific Andes Holdings Limited or PAH) recently concluded a 1-for-1 rights issue (announced May 22, 2009) of about 1.5 billion shares at S$0.15 per share, as well as 305 million detachable warrants at an exercise price of S$0.23 per share to raise a total of about S$300 million for working capital purposes.

Previously, PARD had also issued 4% Convertible Bonds due 2012. Both CFG and PARD also have scrip dividend policies in place for FY 2009 dividend, in order to conserve cash; and it is estimated that the majority shareholders will choose scrip instead of cash, thereby diluting existing retail shareholders even further (for those who choose cash over scrip).

Even in the previous year (i.e. FY 2008), CFG had a 1-for-10 bonus issue instead of a cash dividend, all in the name of further conserving cash. Thus, though the Cash Flow Statement of CFG shows an operating cash inflow of US$80 million for FY 2009, capex was US$119 million and new bank loans made up another US$178 million. This shows that the Group had consistently negative FREE CASH FLOWS, even though operating cash flows were mostly positive over the years.

3) Complex Group Structure

I’ve always wondered about this point, and it was one of the points brought up by concerned investors as well as readers of my blog. The relationship between PAIH (listed in Hong Kong), PARD and CFG is very complex, and involves a lot of cross-holdings using companies such as Golden Target for example. The Complex Group structure makes it hard to really compute the valuation and profits to be accrued from CFG to parent PARD, for instance, and also complicates matters when it comes to understanding the impact of Group decisions made and also how policies made at the parent level will cascade down to the subsidiaries. In short, complexity is NOT good for the investor as it makes matters more opaque and offers less clarity into the affairs of a Company. This inherently increases risk as well, as one’s understanding is compromised.

4) Not fully in tune with the Group’s business

I’ve realized over time that CFG’s business was not as simple to understand as I had previously thought. In the first place, there are the (Vessel Operating Agreements) VOA signed which are carried in the books as deferred expenses and deferred charter hire, and even the structure of the 4th VOA is not easily explained. Considering I am accounting trained and I don’t really understand the accounting treatment for these items says volumes about how ordinary retail investors must be able to understand these issues! There are also aspects such as pledging of inventory for loans, tracking of fishmeal prices, El Nino effects on the availability of fish and other aspects which are pretty hard to track and follow unless you have a good grasp of the industry and intimate knowledge of the operational aspects of the Group.

he halibut fish is among a key catch of China Fishery. Internet photo.

he halibut fish is among a key catch of China Fishery. Internet photo.

Suffice to say I probably did not have the appropriate level of interest or inclination to dig out the facts to track the Company, and did not do enough detailed reading on the species of fish they caught (CJM and Peruvian Anchovy). Thus, I felt that this lack of understanding compromised my investment position and I was better off divesting my position since I did not truly understand the forces which affected the business.

5) Potential Dilution from Secondary Listing

In case most investors out there have not realized, the proposed secondary listing for CFG actually involves the issuance of NEW shares to institutions and retail investors in Norway; and will cause dilution equivalent to a private placement of shares (assuming it had been done in Singapore). As at the time of the announcement, it was still not known of the issue size and pricing for the secondary listing, or whether or not Oslo Bors would approve the listing (there is a high chance they will, though). But what is immediately apparent is that CFG has to raise funds once again, and they are doing it through equity issuance this time instead of turning to debt (e.g. loans and senior notes).

The FC of Pacific Andes Group acknowledged that this move would “dilute earnings” but will ultimately benefit the Company because of the working capital raised. This does imply that the Group has insufficient recurring cash to work on and always needs to turn to capital markets to raise funds. This share issuance will dilute not just earnings, but also future dividends as well as there will be an enlarged share capital base!

6) Peer Valuations on Oslo Bors

According to a Lim and Tan Daily Review report, the other 3 seafood and fishing companies on Oslo Bors trade at around 8x-10x FY 2010 PER, and have a P/B of about 1.3x on average. CFG, on the other hand, is priced expensively at about 16x FY 2009 PER and 12x FY 2010 PER, and has a P/B of 3.4x. This seems to suggest that CFG is trading at elevated prices with respect to the other listed fishing companies in Norway, so I am not sure what kind of “improved valuations” the CEO was talking about.

In fact, the P/B alone would probably signal that CFG may be trading at a premium price currently, with a lot of positives already factored in. For me, that’s my feel of the situation – a lot of the positives have been included in the share price, such as expansion into South Pacific, completion of their new mega-vessel The Lafayette, as well as implementation of the ITQ system.

7) Environmental Issues and Concerns about Over-fishing

This was kindly highlighted to me by a fellow blogger called Donmihaihai, who also pointed out certain aspects of Ezra to me in his blog; and he has been a very astute and helpful investor who deeply analyzes the numbers and facts. He did mention on the sustainability of fishing resources, and highlighted the fact that such supertrawlers actually destroy many natural habitats and are not environmentally friendly. The environmentalists are fervently lobbying against stricter regulations against over-fishing, but the vessel Lafayette would probably put a spanner in their works as it is able to fish all year round, without having to re-fuel.

Separately, I also had misgivings about being vested in China Fishery even though of course the Directors proclaim that they are adhering to international standards on over-fishing; but one has to take note that the South Pacific is a relatively new fishing ground and there are still inadequate legal controls over the fishing environment there. Therefore, one can argue that CFG would be left alone to do what it has to in order to “maximize shareholder value”. This was a nagging thought which stayed with me for quite some time, and I was unable to shake it off; and was a minor contributing factor to my decision to divest.

The case of CFG may be classified as an investment thesis which was partially flawed, since I first purchased my shares in late 2007 when I had just switched to the value investing methodology. During that time, I did not do much in-depth research into my purchases as I do now, and it was also a bit of luck that I averaged down on my purchase subsequently during the 2008-2009 bear market; and the Company had managed to stay afloat during this trying period.

I recall being very nervous and being unable to sleep well because of the high debt which the Group was holding; and also seeing many companies like Ferrochina, Celestial and Fibrechem encountering problems and being suspended from trading. I had told myself, after learning the harsh lessons of the previous bear market, that I would never again over-expose myself in this way through the ownership of a Company with such high gearing.

Fortunately for me, the dual listing news came at an opportune time, as it raised a minor euphoria as had been expected from the recent announcements of dual listings from companies such as Z-Obee, Oceanus, Epure and Novo Group. I made use of the heightened expectations to sell and even though in the interim, the share price may scale new heights, there are no regrets as I had to move on to companies with better structures and with a less risky value proposition. Suffice to say that I now have the unenviable task of deciding how to allocate the monies freed up from this divestment; and I shall have to actively seek out investment opportunities in a climate of rising valuations.

Overall, this has been a positive learning experience, and the profits and resulting cash inflow will bolster my cash reserves and allow me to scout around for more investment opportunities. The realized profits from the divestment of CFG will be reflected in my January 2010 portfolio review. The total dividends I had received from CFG over my entire holding period amounted to S$220, so the bulk of the gains came from capital gains. Moving forward, I hope to achieve a more balanced mix of dividends and capital gains from future investments. More time and effort will be spent researching such opportunities to avoid the mistakes made for CFG.

This article was first published in Musicwhiz's blog (http://sgmusicwhiz.blogspot.com/) and is reproduced here with permission.

Recent stories:

BREAKING NEWS: China Fishery seeks dual listing in Oslo

MUSICWHIZ: How I'm dealing with market woes