On the macro front, it said the Singapore property cycle is in an upward phase that should last through 2011/12.

Property developers’ shares would move on RNAV upgrades. The share prices tend to close the gap (and may even trade at a premium) to RNAV estimates during market up-turns on the expectation of sustained increases in underlying property prices, said JP Morgan.

It expected the Singapore property developers to deliver a blended 13% price return in 2010.

”Our preferred property developer pick is City Developments, while in the mid-cap space we like Wing Tai (upgraded from Neutral to Overweight). In the CapitaLand group of listed entities our preference is for the parent CapitaLand.”

Excerpts from the report on City Developments (closed at $11.00 yesterday):

City Developments is, in our view, the most liquid play on the Singapore residential property sector, especially the high-end segment which forms 30% of our estimate of the group's RNAV.

Notwithstanding its recent outperformance, we expect City Developments’ share price to continue to reflect an uptrend in high-end residential property prices and to trade towards and possibly beyond our updated end Dec 2010E target price of S$13.20/share (S$12.60 previously).

• 4Q09 results likely to beat consensus estimates: We expect CityDevelopments' net earnings for 4Q09 at S$195 million, up 0.6% Q/Q and almost double the previous corresponding quarter in 2008. Our estimate is significantly higher than consensus estimates, and we are expecting consensus estimates to move higher over the next month, onthe back of the continued recognition of high-margin projects such asThe Solitaire, One Shenton and Cliveden@Grange.

• Upside bias to valuations and price target: during market up-cycles, the stock tends to trade ahead of RNAV upgrades and there is upside bias to our end Dec 2010E target price which is based on our end Dec10E RNAV estimate of S$13.17 for the stock. Key risks include a prolonged period of demand weakness in the Singapore residential property market, and a re-acceleration in the declines in the global hospitality business.

Key risks to our rating and price target include: 1) A prolonged weakness in the Singapore residential property market; 2) A further substantial decline in the Singapore commercial property price; 3) A worse than expected deterioration in global business and leisure travel.

Recent story:

ROXY-PACIFIC: Replenished landbank, now gearing up for sale, sale

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

CITYDEV: JP Morgan's top property pick

- Details

- The NextInsight team

One Shenton, a project of City Developments. Photo: CDL website

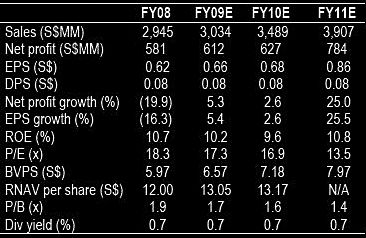

Figures in S$ millions. Source: JP Morgan, Jan 21.