TIGER AIRWAYS hasn’t had a flying start on its first day of trading today, in part because the overall market is in a sour mood.

The stock was up 2 cents from its IPO price of $1.50 at lunch break - and subsequently added another 6 cents to end the day at $1.58 as the overall market sentiment improved.

Market sentiment aside, many investors aren’t exactly inspired by its balance sheet, its earnings in the past and its prospects going forward.

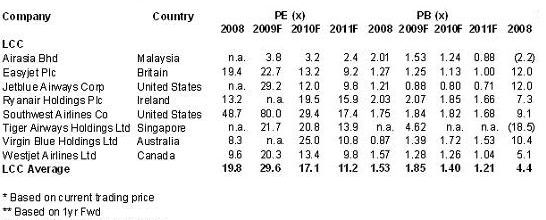

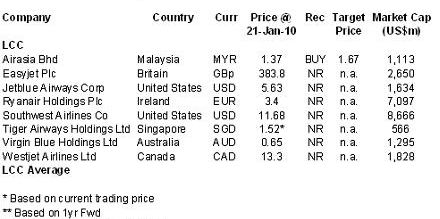

This morning, Esther Sim, an analyst at UOB Kay Hian Research, put together a peer comparison table for Low Cost Carriers.

She noted that Tiger Airways' closest listed competitor is Air Asia ( BUY/ Target:RM1.67), which trades at a substantially lower P/B multiple and EV/EBITDA multiple.

“Furthermore, the bulk of Air Asia's debt is in its books while Tiger Airways debt is mostly off-balance sheet.”

Note also that Air Asia has hardly budged. "Based on our preliminary estimates, Air Asia offers significantly better value," she wrote.