SOMETIMES, ‘profit guidance’ from companies can be a positive surprise, instead of being yet another warning of a slump in earnings.

HLN Technologies (www.hlntech.com), which announced a ‘profit guidance’ yesterday evening (Jan 20), is a company we have had a brief encounter with.

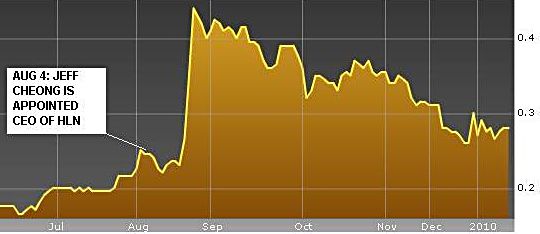

About five months ago, we met its new CEO – Jeff Cheong. He was just 28 years old.

And he was installed as CEO with the backing of HLN’s new 29.1% stake holder, China Infrastructures Global Investment Capital.

The previous CEO, Leslie Wa, was among those who sold some of their HLN shares to China Infrastrucutres Global Investment Capital.

Mr Wa, who sold 26.5 million shares at 23 cents apiece, and ceased to be a controlling shareholder, stepped down as CEO and became chief operating officer.

Interestingly, since then, he seems intent on buying back some shares (see table below) at about the same price.

Yesterday evening’s ‘profit guidance’ should come as a triumph of sorts for Jeff Cheong in his execution of his CEO role.

The company (stock price 28 cents, market cap $37 million) had announced a net loss attributable to shareholders of S$2,355,000 in its half year 2009 results announcement released on 13 August 2009.

HLN’s statement yesterday said the “Group is pleased to announce that it has turned around in the second half year and is expected to be profitable for the full financial year ended 31 December 2009.”

It said the turnaround was contributed by a favorable economic environment which resulted in a pick-up in the demand of HLN’s elastomeric, polymeric and aluminium products in the second half year.

By the way, this manufacturing business could be divested, according to Jeff Cheong in our interview last August. What he said he was keen on was for the company to become a financial services provider and an investment holding company.

|

A glimpse of that seems to be available now, as the ‘profit guidance’ statement said that the Group "had strengthened its financial position with cash and cash equivalents and investment in quoted securities of more than S$11.5 million as at 31 December 2009."

That’s about it, with further details of the Group's financial performance to be disclosed when it announces its un-audited financial results for FY2009 in February 2010.

For more on Jeff Cheong, read our August 09 interview: HLN TECHNOLOGIES: New dreams under new CEO, 28