Grace Cheng, founder of www.dailymarkets.com

I RECENTLY attended the Indexing & ETF (Exchange Traded Fund) Investments conference in Singapore. It was organized by Terrapinn and there were speakers representing many of the major ETF providers including Deutsche Bank, Barclays, Lyxor (Soc Gen’s ETF arm) and CASAM.

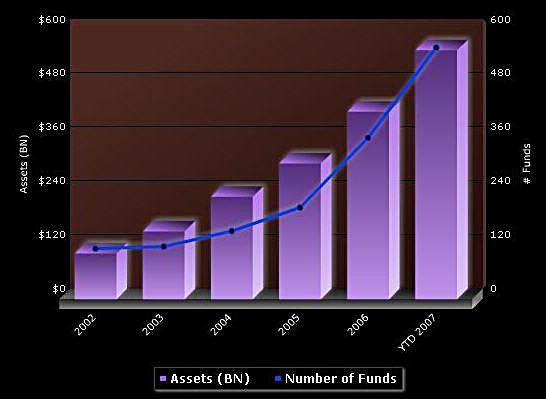

Most of the presenters mentioned at least once that while most of the financial industry is suffering from the economic downturn, the ETF industry is actually benefiting from it. Why is that so? Because investors are realizing that many actively managed funds are under-performing indexes and charging higher management fees than most ETFs.

In the aftermath of high profile Ponzi schemes, namely those of Madoff, Stanford and others, many investors are also looking for transparency in their investment managers, and since ETFs are supposed to hold some or all of the assets of the index they are tracking, they are more transparent than some actively managed funds.

With more than 1500 ETFs available across many exchanges, how can an investor choose which one to invest in? Well, the first thing would be to decide which sector (commodities, stocks, bonds, currency etc), region, or index they want to invest in.

But let’s say you want to invest in a certain sector and see there are several ETFs and ETNs (Exchange Traded Notes) available for that sector. Which would be best for you?

There are risks but the rewards are ample.

There are several things to look at:

Risk

ETNs hold huge counterparty risk. If the issuer fails, you could lose up to your entire investment as you are simply buying a note (debt) from the issuer. This problem became very apparent by the failure of Lehman and what happened to the ETNs Lehman had issued. Why would anyone buy an ETN then? Well, an ETN tends to track the underlying index better and have less “tracking errors” - something which we’ll get to later.

Swap-based ETFs give some of the advantages of ETNs by reducing the “tracking errors” and making their price more closely follow the index they track, while at the same time being an ETF and limiting their counterparty risk to a maximum of 10% of the fund.

They do have a risk that sometimes they are not holding the assets of the underlying index they are supposed to be tracking and if the counter-party were to default, this could affect the liquidation value. Also, it seems they are currently not available in the US but only in Europe and Asia.

ETFs generally try to hold either all the components of the index they track or a representative number of the components that closely track the index. Because they have to readjust their holdings as the index changes, it can result in “tracking errors”.

Apart from that though, they have lower counter-party risk; in the event that the ETF provider goes down, the underlying assets held by the ETF should closely resemble the underlying index.

ETFs have been popular in the US as they offer the diversification of unit trusts but not high management fees. Source: Internet

How Closely They Follow The Index - “Tracking Error”

When an investor buys an ETF, the prospectus should show how much of a ratio of “tracking error” exists. This “tracking error” indicates how far above or below the index price the ETF price swings. These variations can be caused by additional costs incurred in buying/selling the underlying assets, lack of liquidity in the underlying assets, or issues relating to dividend payment as calculated by the index versus what and when it is paid out to the ETF.

“Normal” ETFs can generally have the most tracking error as they hold the underlying assets and can incur additional costs as mentioned above.Swap-based ETFs try to significantly reduce that tracking error by holding the underlying asset and a swap contract that makes up the difference between the assets held and the index value.

This means that if the assets held by the swap-based ETF are worth 14.5 and the index is at 16, the swap contract should pay 1.5 and bring the total value in line with the index. If the swap value goes above 10% of the total net asset value (NAV), the swap is reset and the money used to purchase underlying assets. This limits the counter-party risk to 10% of the index.

ETNs can manage their assets however they want since in essence, you are just buying a debt obligation with the ETN provider that requires them to pay off the index value at a given date. Of the 3 options, this has the largest counter-party risk but also tends to follow the underlying index very closely and with little tracking-error. Several of the speakers though thought that Swap-based ETFs are a better option as they have lower risk and similar tracking-errors to ETNs.

Management Fees

Apart from risk and tracking errors, the next most important factor to most investors is probably what the management-fees are. ETFs tend to have low management fees overall and in some cases, the management fee is somewhat offset by tax benefits on dividends received that are not accounted for in the underlying index. Thus apart from management fees, it is important to compare the performance of similar ETFs relative to the index.

Previous contribution: Grace Cheng interviews Jim Rogers

Article reproduced with permission of Grace Cheng (www.dailymarkets.com), who is a Singaporean who splits her time between Singapore and New York.