ANALYSTS CALLS to sell or buy a stock can be pretty stark – such as when Merrill Lynch chose to use the following terms in a Feb 13 report: “most preferred” and “least preferred”.

It has provided an updated stock list, “consistent with our fundamental 0-12-month opinions but intended to appeal to investors with a shorter-term time horizon, with potential short-term price catalysts.”

Painting its dismal outlook on Singapore, Merrill Lynch said that the economy remains vulnerable to external headwinds, earnings disappointment and fund raising.

However, with defensive stocks having delivered out-performance, the broker is increasing the beta of the portfolio but staying clear of pure cyclicals.

It included SembCorp Industries and CapitaMall Trust in place of ST Engineering and ComfortDelgro.

For the Least Preferred list, it removed Keppel Land and Suntec REIT and replaced them with DBS and CRCT. These stocks have ‘underperform’ ratings from Merrill.

Here are Merrill Lynch’s reasons:

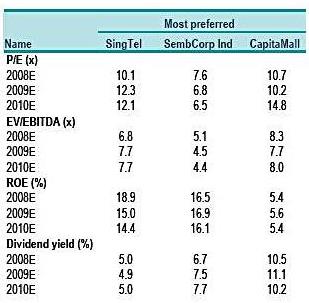

Most preferred

SingTel:

(1) Highly attractive defensive qualities,

(2) Forex risk biased to upside; and

(3) Potential to surprise on low expectations for dividend payout.

SembCorp Industries:

(1) Visibility of earnings from utilities business,

(2) Attractive yield with a comfortable 50% payout ratio and

(3) Opportunities created via strong balance sheet.

CapitaMall Trust:

(1) Equity overhang removed post rights issue

(2) Retail sub-segment more resilient and

(3) Defensive portfolio leveraged to mostly suburban malls.

Least preferred

DBS:

(1) 4Q08 results likely to disappoint as bank sets aside higher provisions (DBS has since announced that its Q4 net profit came in at $383 million, 5% below the previous quarter and 31% lower than a year ago.)

(2) Slowing reform momentum; and

(3) Net interest margin squeeze from falling SIBOR.

Cosco:

(1) Increased likelihood of order cancellations,

(2) Shipping segment also expected to take a hit; and

(3) Lower order book assumptions for Offshore & Marine segment.

CapitaRetail:

(1) Risk of breaching 35% gearing limit,

(2) Muted outlook on China property market; and

(3) Cost of capital prohibitive for acquisition growth.