Source: UOB Kayhian

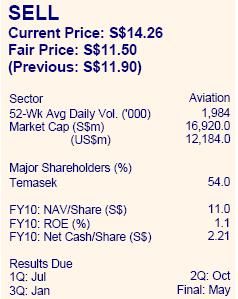

UOB Kayhian says ‘sell’ SIA, with fair price seen at $11.50

Analyst – K Ajith:

2QFY10’s results were worse than our expectation. We were expecting a marginal return to profitability on expectation of an improvement in passenger yields and lower spot fuel prices.

While it appears that results were within analysts’ estimates, we note that at 111x FY10F earnings, the market was certainly expecting a much better set of results.

Earnings Revision

We cut our FY10 net profit forecast by 70% to S$252.0m and FY11’s by10.6% to S$976.0m after lowering yield assumptions and raising fuel cost assumptions. SIA has hedged 20% of 2HFY10 fuel requirements at US$100/bbl. We also lower our dividend payout assumption to 10 cents/share(previously 30cents).

Valuation/Recommendation

Two quarters into an economic recovery, SIA has yet to return to profitability. Meanwhile, it has omitted to pay an interim dividend and we expect yield of just 0.7%.

We have valued SIA based on Gordon’s Growth Model (3-year average ROE: 7.3x, sustainable growth rate: 3.2x, COE: 7.3x). Pegging at a derived P/B of 1.01x on FY11’s book value, we value the stock at S$11.50 (previously S$11.90).

Maintain SELL and recommend that investors switch into SIA Engineering, which offers a yield of 5.0%.

Phillip Securities initiates coverage of OCEANUS with 48-ct target price

An abalone dish at Ah Yat Tian Xia.

Analyst – Brandon Ng:

Ah Yat Tian Xia is a joint venture with Ah Yat Group and the partner is responsible for the management and operations for the casual restaurants. Oceanus believes that the restaurant can be used as a sales platform to distribute the Group’s abalones.

To finance the expansion of the restaurants, Oceanus has submitted an application to the Taiwan Stock Exchange for the offering and listing of Taiwan Depository Receipts representing an aggregate of up to 200 million shares of the company on the TSE.

The TDR Shares shall comprise 100 million new shares and 100 mil vendor shares.The 100 mil new shares can potential raise an additional S$35 mil to the company.

We value Oceanus at S$0.480 based on two-stage discounted free cash flow to equity. Currently, Oceanus is experiencing high growth as the biological assets grow in size. Going forward, we expect Oceanus to experience stable growth beyond 2015 as it will consistently cage 150 mil abalones juveniles every year.

We initiate coverage with a BUY rating. Risks include loss of biological assets due to natural disasters, diseases, change in consumer preferences and potential dilution risk from the conversion of warrants.

Nomura Securities Malaysia pegs INDO-AGRI's target price to $1.80

Palm fruit

Analyst – Ken Arieff Wong:

� IndoAgri reported its 3Q09 results which were in line with both our and market estimates. On a PBT basis, 9M09 core profit (excluding biological and forex gains) came in at Rp1,485bn which forms 76.8% of our full year PBT forecasts of Rp1,932bn.

9M09 net profit came in at Rp1,239bn down 20% y-y due to both weaker CPO prices achieved of Rp6,467/kg (down 18%) as well as a shorter harvest period due to Eid-Ul Fitr holidays in Indonesia which lasted two weeks.

� 3Q09 saw CPO and FFB production grow 12% q-q, in line with our expectations of better yields in 2H09. Expect to see further production improvements in 4Q09, with management maintaining its full-year target CPO production of 760,000mT vs 539,000mT produced YTD 9M09. The effect of higher production could however be mitigated by slightly lower CPO prices in 4Q09.

� Sales value at its Cooking Oil and Fats division continued to be weak, falling 23.3% y-y mainly driven by a loss of cooking oil volumes (down 9% y-y), price competition, and some consumers moving back to unbranded cooking oils. Margarine sales however rose 6% y-y. The division currently contributes about 7.5% of group EBIT.

� Costs of production for its palm products declined to US$220/mT in 9M09 from US$250/mT in 9M08 on the back of lower fertilizer costs. The group expects cost of production to remain stable for the rest of the year. Selling and Distribution expenses and General and Administrative expenses also fell 42.5% and 8%, respectively, for 9M09 due to lower export taxes as well as reduced staff costs.

� With regards to plantings, management has reiterated its targets of planting 9,000-10,000 Ha in FY09, rising to 25,000-30,000ha in FY10, along with further 5,000ha of sugar plantings. On the El Nino front, so far there has been only slightly drier weather (a view shared by other planters), which leads us to believe that the El Nino is a non-event thus far.

Valuation: We derive our price target of S$1.80 by pegging our FY10F earnings forecast to a P/Eof 12x, which is a 20% discount to Malaysian planters. We believe that this is reasonable as it is already 33% above the group’s normalised P/E average since listing of around 9x (or 0.8 SD above the normalised mean).

The stock also traded at P/E levels of around 12x when the CPO price hovered close to RM2,500/mT in the previous upcycle. At current c. 12x FY10F P/E, valuations look fair especially taking into account our range-bound outlook for CPO prices. Maintain NEUTRAL.

Risks: Upside risks could stem from improved fundamentals lifting the CPO price above our assumption of RM2,500/mT and any improvement in outlook for its non-plantations businesses such as Oils and Fats as well as commodities.