CHINA KUNDA has shown up on the radar screen of a top hedge fund manager, Value Partners, which visited its operations in Shenzhen early this week.

Value Partners does a lot of legwork in its search for investments, so it does not necessarily follow that it would buy shares of China Kunda (www.chinakunda.com).

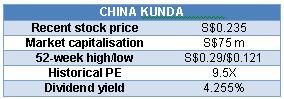

Listed on the Singapore Exchange last year, China Kunda is no ordinary Joe in an industry that is easy for people to think of as being low-margin and very competitive.

China Kunda has risen to the top of its industry through its advanced technology. Finansa Securities (HK) noted that the company either employs or has access to eight foreign technical experts, 16 professors and PhD holders, and other industry specialists.

The company’s Executive Chairman and CEO, Cai Kaoqun, has been a technical advisor to the National Key Laboratory of Material Forming and Mould Technology since 2007.

China Kunda supplies to manufacturers of components for brands such as Mercedes-Benz, BMW, Renault, Audi and Ford. About half of its revenue from auto moulds comes from exports.

Japan and the US are the top two producers of mould in the world, but a lot of work is being outsourced to China, now the No.3 producer. Cost is a key factor. In the US, the average manpower cost – for workers such as 3D CAD/CAM designers - is about 40X higher than that in China.

And this is how China Kunda hopes to ride the crest of the business, where it principally designs and manufactures moulds for automobile parts and consumer electronics gadgets such as laptops.

China Kunda has just announced that it won a contract, through a tender, to supply a mould directly to BYD, which has become well-known after Warren Buffett took a stake in it last year.

Now that mould is another example of China Kunda’s advanced technology for a component that is complicated to produce.

Hau Khee Wee, the CFO of China Kunda, told NextInsight that currently BYD manufactures that car component using two production lines as two different plastic resins are involved. A third production line is required to join the two parts together.

“What our ‘double-shot’ mould does is to produce the component in just one process,” he said. “The part will have a better quality because you don’t need subsequent processing to join two parts. The other advantage - you don’t need three production lines.”

The mould is a one-off piece of work (to be delivered by year-end) for BYD but China Kunda hopes to secure more contracts from BYD as its ‘double-shot’ mould technology can be applied to other car parts and various car models of BYD, said Mr Hau.

For a few years already, China Kunda has been making this type of mould for many car components in many other car brands.

In a sign of more business relationship to come with BYD, China Kunda has announced a MOU to acquire a controlling stake of at least 51% in a component supplier, SXD, which derives 60-70% of its revenue from BYD.

SXD, which designs moulds and produces metal stamped parts using the moulds, attracted China Kunda because it provides a ready opening for the latter to do more business with BYD.

“Getting accredited with BYD would take more than a year. SXD has strong technical ability,” said Mr Hau. "For a particular component, it is able to produce it using a single mould, while the previous supplier to BYD had to use 13 sets of mould."

And it gets the highest grading consistently from BYD every month, he added.

Beyond the sales achieved by SXD, China Kunda hopes to supply plastic components to BYD directly in future. Given its location in Shenzhen, China Kunda can easily supply to BYD’s factory in the same city.

Proximity is important as auto components are bulky and factories operate on a just-in-time basis.

Excerpts from Finansa Securities (HK) report dated 21 Sept 2009: |

Recent stories:

CHINA KUNDA: 'Worst is over, orders are picking up'

CHINA KUNDA breaks the mould with upgrades, expansion