which is available on the news-stands

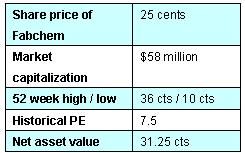

FABCHEM is an S-chip that is not covered by analysts despite it having been listed on the Singapore Exchange since 2006.

It’s an unusual business – that of manufacturing explosive devices such as boosters, seismic charges and tube charges.

It also produces:

* industrial fuse and initiating explosive devices such as detonating cords and non-electric tubes;

* industrial detonators such as non-electric detonators and piston non-electric detonators; and

* ammonium nitrate.

A story on the company in the current edition of the popular weekly, The Edge Singapore, caught our eye as the angle was on the potential earnings kick that the massive infrastructure projects in China could give the business.

“As Beijing pours billions of dollars into infrastructure projects, demand for explosives, used in the construction industry and tunneling of railways, could give Fabchem an added boost to its revenue,” said the article written by Angeline Cheong.

In addition to the infrastructure projects, China is seeing a pickup in mining operations. That's actually where most (60%) of Fabchem's revenue comes from. About 20% comes from infrastructure.

The Group’s 1Q2010 (ended June 2009) results were sparkling.

Net profit after tax soared 69.5% year-on-year to RMB 19.6 million. Revenue grew strongly to RMB 83.2 million in 1Q2010, a jump of 73.1% year-on-year.

During its Q1 results announcement, Fabchem also said it would adopt a dividend policy starting in the current financial year of paying out dividends of at least 10% of its net profits to shareholders.

In FY09, it didn't pay any dividend.