Suntec Reit is a recommended 'buy' of DBS Vickers.

OVERWEIGHT S-Reits, said DBS Vickers Research in its Q3 Strategy report.

S-Reits have underperformed property developers and the broader market in 2Q09, rising 22% vs the sharper improvement of 59% and 31% for property developers and STI, respectively.

Visibility for developers was better, judging from robust response to residential launches compared to the lacklustre performance of office and retail rents, and that had helped boost investor sentiment and interest in the former.

“We ‘overweight’ the S-Reit sector. Going forward, the sector should experience some stability with most of the recapitalisation and debt refinancing activities completed,” said the research report authored by Janice Chua.

“We expect investors to refocus on the operating environment of S-Reits. In this regard, we expect the retail reits, particularly those with suburban malls, to be better supported owing to a more resilient household necessity spending pattern. We remain buyers of CapitaMall Trust, Frasers Centrepoint Trust and Suntec.”

Sources: Cambridge Industrial Trust, Phillip Securities.

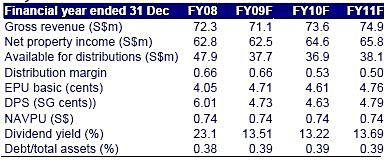

A S-Reit - Cambridge Industrial Trust - has been recommended as a ‘buy’ by Phillip Securities analyst Lee Kok Joo in his report yesterday (July 1) with a fair value estimate of 44 cents (compared to the recent traded price of 35 cents).

The Reit has no near term refinancing worries, as its single loan maturity of $390 million is due in 2012, he noted.

He forecasts a dividend yield of 13.5% based on a distribution of 4.73 cents per unit this year and a recent traded price of 35 cents.

On the overall market, DBS Vickers said that notwithstanding a stellar showing in 2Q, previous market cycles suggest that the current recovery trade has more room to run.

“All said, Singapore equities should generate decent returns over the next 12 months. The current consolidation provides an opportunity to reposition and refocus on sectors with earnings upgrade potential.”

Going forward, economic recovery following signs of bottoming out and earnings upgrades are required to sustain the uptrend. The first sign of upgrades in the last two months – Singapore’s GDP growth raised to –6.6% for 2009 and +4.2% for 2010, while DBSV research has raised corporate earnings by 5% and 6% for 2009 and 2010 respectively, leading to earnings growth of 12% for 2010.

DBS Vickers said: “We are overweight sectors where we see potential upside in earnings and valuation, primarily banks and property sectors, as proxies for cyclical recovery.”

Straits Asia Resources will benefit from rising coal prices, says DBSV.

Among finance stocks, the research house picked SGX as a proxy to its positive stance on the equities market, and UOB given its cheaper valuation and higher beta.

Among industrial stocks, DBSV likes SIA Engineering which will lead the eventual recovery of the aviation sector.

Fraser and Neave is its pick among property plays, given its exposure to the mass property market where Average Selling Prciess are resilient and rising.

SPH has yet to be rerated as a proxy to economic recovery, which is showing signs of bottoming out in Adex revenues. Straits Asia Resources will benefit from the recovery in coal prices.

Near term target 2400, 12-month target 2800

“If we apply a target PER of 16x, which is the historical average PER on FY09 earnings, our near term target for the STI is 2400. Applying a potential earnings growth of 15% for next year, the STI could reach 2,865 without stretching valuations to extreme levels,” said DBSV. Assuming the market’s equity risk premium continues to adjust towards its average mean of 3%, this will translate into a target of 2700 on the STI. Targeting average P/BV will bring the STI to 2,800.

Recent stories:

BNP Paribas: 10% more correction, then it's target 2,600 points

REITs and Shipping Trusts: More upside?

Post or read comments in our forum here.